Question

You are choosing one of the three portfolios by considering the Sharpe Ratio, Treynor Ration and Jensen-Alpha. Briefly discuss which one you would choose to

You are choosing one of the three portfolios by considering the Sharpe Ratio, Treynor Ration and Jensen-Alpha. Briefly discuss which one you would choose to optimise risk-adjusted return. Justify your choice by providing evidence using suitable performance measurement.

Briefly discuss two limitations of your choice.

In light of your answer in provide a better alternative portfolio evaluation index. Provide justifications for your choice.

You are going to combine portfolio AAA and portfolio BBB to form a portfolio CCC. Without doing any calculation, do you expect there will be any improvement in portfolio CCC in Sharpe Ratio, Treynor Ratio and Jensen-Alpha?

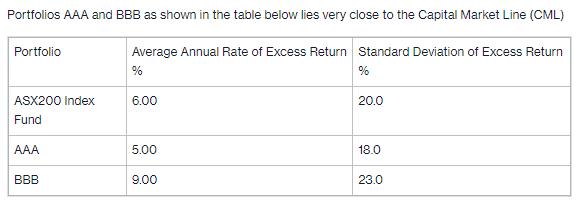

Portfolios AAA and BBB as shown in the table below lies very close to the Capital Market Line (CML) Portfolio ASX200 Index Fund AAA BBB Average Annual Rate of Excess Return Standard Deviation of Excess Return % % 6.00 5.00 9.00 20.0 18.0 23.0

Step by Step Solution

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To optimize riskadjusted return among the given portfolios we can evaluate them using the Sharpe Ratio Treynor Ratio and Jensens Alpha 1 Sharpe Ratio ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started