Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are comparing financial statements of two relatively new companies in different industries. Neither company has any debt (liabilities) on its balance sheet, and both

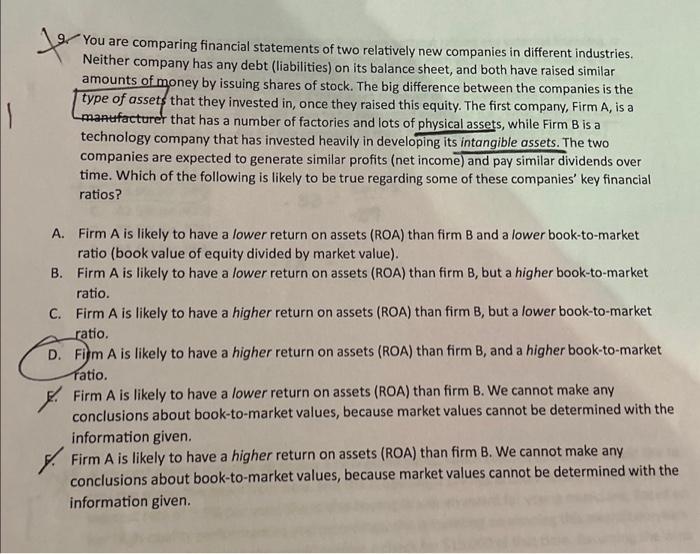

You are comparing financial statements of two relatively new companies in different industries. Neither company has any debt (liabilities) on its balance sheet, and both have raised similar amounts of money by issuing shares of stock. The big difference between the companies is the type of assets that they invested in, once they raised this equity. The first company, Firm A, is a manufacturer that has a number of factories and lots of physical assets, while Firm B is a technology company that has invested heavily in developing its intangible assets. The two companies are expected to generate similar profits (net income) and pay similar dividends over time. Which of the following is likely to be true regarding some of these companies' key financial ratios? A. Firm A is likely to have a lower return on assets (ROA) than firm B and a lower book-to-market ratio (book value of equity divided by market value). B. Firm A is likely to have a lower return on assets (ROA) than firm B, but a higher book-to-market ratio. C. Firm A is likely to have a higher return on assets (ROA) than firm B, but a lower book-to-market ratio. D. Firm A is likely to have a higher return on assets (ROA) than firm B, and a higher book-to-market ratio. Firm A is likely to have a lower return on assets (ROA) than firm B. We cannot make any conclusions about book-to-market values, because market values cannot be determined with the information given. Firm A is likely to have a higher return on assets (ROA) than firm B. We cannot make any conclusions about book-to-market values, because market values cannot be determined with the information given.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started