Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are concerned about the market volatility but have found stocks that are attractively priced. You want to set up a 100% beta-neutral trade on

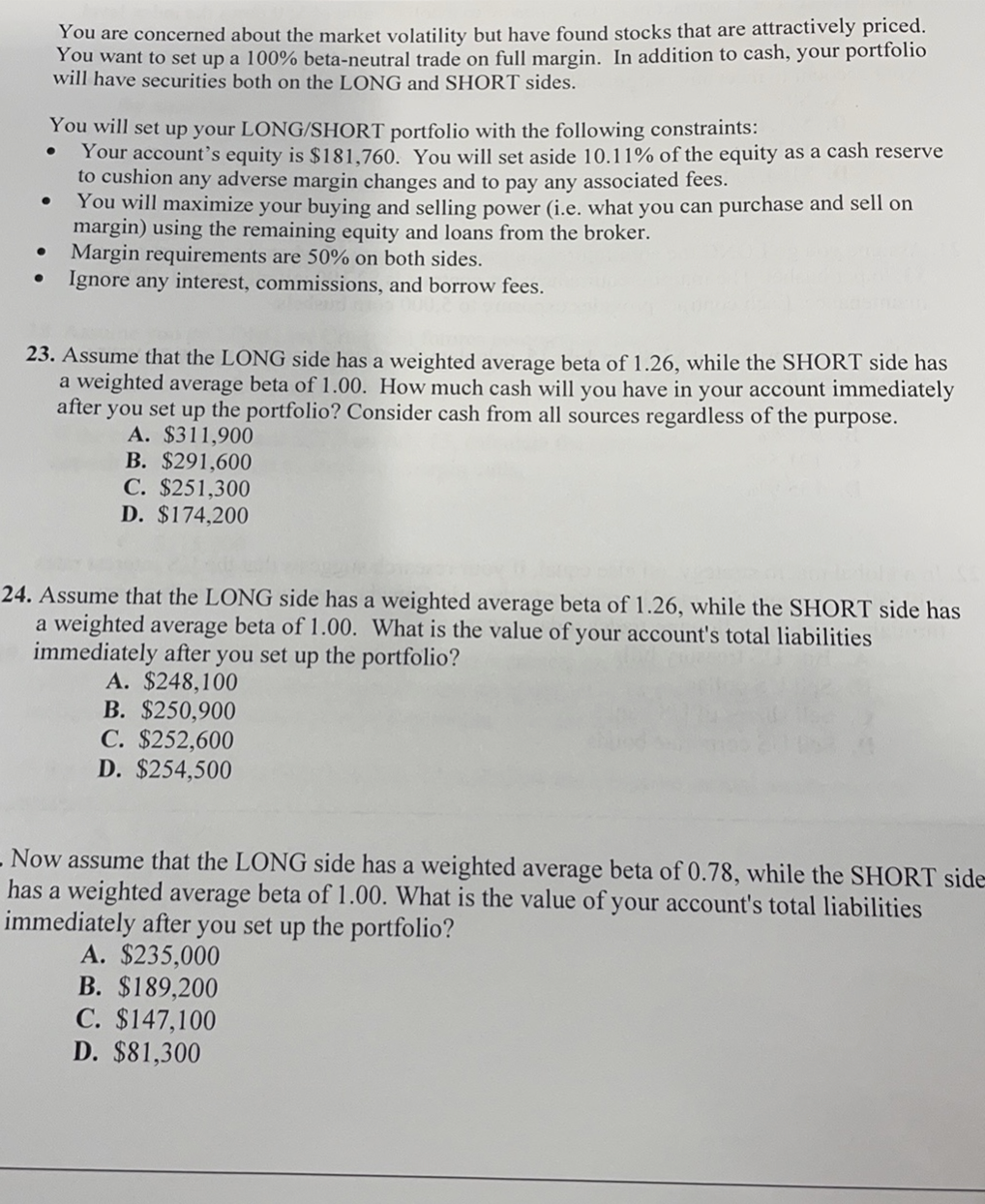

You are concerned about the market volatility but have found stocks that are attractively priced. You want to set up a 100% beta-neutral trade on full margin. In addition to cash, your portfolio will have securities both on the LONG and SHORT sides. You will set up your LONG/SHORT portfolio with the following constraints: - Your account's equity is $181,760. You will set aside 10.11% of the equity as a cash reserve to cushion any adverse margin changes and to pay any associated fees. - You will maximize your buying and selling power (i.e. what you can purchase and sell on margin) using the remaining equity and loans from the broker. - Margin requirements are 50% on both sides. - Ignore any interest, commissions, and borrow fees. 23. Assume that the LONG side has a weighted average beta of 1.26 , while the SHORT side has a weighted average beta of 1.00 . How much cash will you have in your account immediately after you set up the portfolio? Consider cash from all sources regardless of the purpose. A. $311,900 B. $291,600 C. $251,300 D. $174,200 24. Assume that the LONG side has a weighted average beta of 1.26 , while the SHORT side has a weighted average beta of 1.00 . What is the value of your account's total liabilities immediately after you set up the portfolio? A. $248,100 B. $250,900 C. $252,600 D. $254,500 Now assume that the LONG side has a weighted average beta of 0.78 , while the SHORT side has a weighted average beta of 1.00 . What is the value of your account's total liabilities immediately after you set up the portfolio? A. $235,000 B. $189,200 C. $147,100 D. $81,300

You are concerned about the market volatility but have found stocks that are attractively priced. You want to set up a 100% beta-neutral trade on full margin. In addition to cash, your portfolio will have securities both on the LONG and SHORT sides. You will set up your LONG/SHORT portfolio with the following constraints: - Your account's equity is $181,760. You will set aside 10.11% of the equity as a cash reserve to cushion any adverse margin changes and to pay any associated fees. - You will maximize your buying and selling power (i.e. what you can purchase and sell on margin) using the remaining equity and loans from the broker. - Margin requirements are 50% on both sides. - Ignore any interest, commissions, and borrow fees. 23. Assume that the LONG side has a weighted average beta of 1.26 , while the SHORT side has a weighted average beta of 1.00 . How much cash will you have in your account immediately after you set up the portfolio? Consider cash from all sources regardless of the purpose. A. $311,900 B. $291,600 C. $251,300 D. $174,200 24. Assume that the LONG side has a weighted average beta of 1.26 , while the SHORT side has a weighted average beta of 1.00 . What is the value of your account's total liabilities immediately after you set up the portfolio? A. $248,100 B. $250,900 C. $252,600 D. $254,500 Now assume that the LONG side has a weighted average beta of 0.78 , while the SHORT side has a weighted average beta of 1.00 . What is the value of your account's total liabilities immediately after you set up the portfolio? A. $235,000 B. $189,200 C. $147,100 D. $81,300 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started