Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are conducting an audit on the estimated fixed assets of PT Sukses Abadi for the year ended as of December 31, 2002. Schedule a

You are conducting an audit on the estimated fixed assets of PT Sukses Abadi for the year ended as of December 31, 2002. Schedule a fixed asset that your client has prepared and accumulated depreciation can be seen in the schedule below. You have been comparing with the audit work paper last year. The information found during the audit is as follows:

Make a working paper with top schedule and supporting schedule by posting an adjusting journal (if any) to determine the balance according to the audit for fixed assets as of 31/12/02.

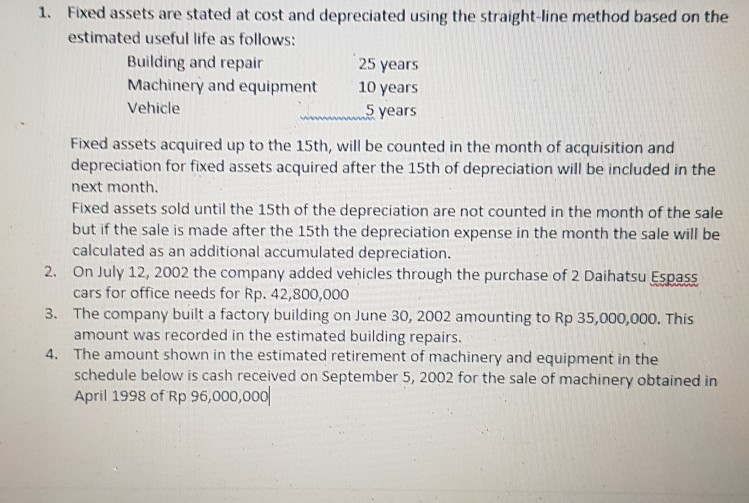

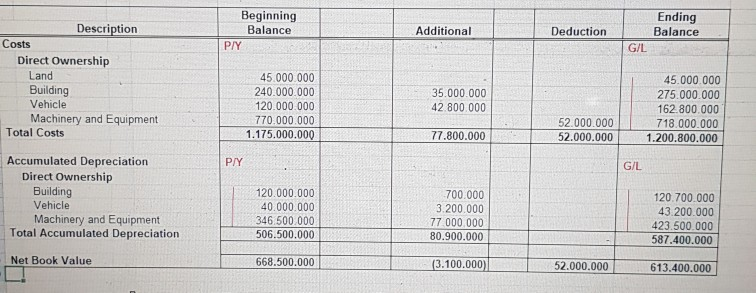

1. Fixed assets are stated at cost and depreciated using the straight-line method based on the estimated useful life as follows: Building and repair 25 years Machinery and equipment 10 years Vehicle 5 years www Fixed assets acquired up to the 15th, will be counted in the month of acquisition and depreciation for fixed assets acquired after the 15th of depreciation will be included in the next month. Fixed assets sold until the 15th of the depreciation are not counted in the month of the sale but if the sale is made after the 15th the depreciation expense in the month the sale will be calculated as an additional accumulated depreciation. 2. On July 12, 2002 the company added vehicles through the purchase of 2 Daihatsu Espass cars for office needs for Rp. 42,800,000 3. The company built a factory building on June 30, 2002 amounting to Rp 35,000,000. This amount was recorded in the estimated building repairs. 4. The amount shown in the estimated retirement of machinery and equipment in the schedule below is cash received on September 5, 2002 for the sale of machinery obtained in April 1998 of Rp 96,000,000 Beginning Balance PHY Ending Balance Additional Deduction G/L Description Costs Direct Ownership Land Building Vehicle Machinery and Equipment Total Costs 45.000.000 240.000.000 120.000.000 770.000.000 1.175.000.000 35.000.000 42.800.000 45.000.000 275.000.000 162.800.000 718.000.000 1.200.800.000 52.000.000 52.000.000 77.800.000 P/Y G/L Accumulated Depreciation Direct Ownership Building Vehicle Machinery and Equipment Total Accumulated Depreciation 120.000.000 40.000.000 346.500.000 506.500.000 700.000 3.200.000 77.000.000 80.900.000 120.700.000 43.200.000 423.500.000 587.400.000 Net Book Value 668.500.000 (3.100.000) 52.000.000 613.400.000 1. Fixed assets are stated at cost and depreciated using the straight-line method based on the estimated useful life as follows: Building and repair 25 years Machinery and equipment 10 years Vehicle 5 years www Fixed assets acquired up to the 15th, will be counted in the month of acquisition and depreciation for fixed assets acquired after the 15th of depreciation will be included in the next month. Fixed assets sold until the 15th of the depreciation are not counted in the month of the sale but if the sale is made after the 15th the depreciation expense in the month the sale will be calculated as an additional accumulated depreciation. 2. On July 12, 2002 the company added vehicles through the purchase of 2 Daihatsu Espass cars for office needs for Rp. 42,800,000 3. The company built a factory building on June 30, 2002 amounting to Rp 35,000,000. This amount was recorded in the estimated building repairs. 4. The amount shown in the estimated retirement of machinery and equipment in the schedule below is cash received on September 5, 2002 for the sale of machinery obtained in April 1998 of Rp 96,000,000 Beginning Balance PHY Ending Balance Additional Deduction G/L Description Costs Direct Ownership Land Building Vehicle Machinery and Equipment Total Costs 45.000.000 240.000.000 120.000.000 770.000.000 1.175.000.000 35.000.000 42.800.000 45.000.000 275.000.000 162.800.000 718.000.000 1.200.800.000 52.000.000 52.000.000 77.800.000 P/Y G/L Accumulated Depreciation Direct Ownership Building Vehicle Machinery and Equipment Total Accumulated Depreciation 120.000.000 40.000.000 346.500.000 506.500.000 700.000 3.200.000 77.000.000 80.900.000 120.700.000 43.200.000 423.500.000 587.400.000 Net Book Value 668.500.000 (3.100.000) 52.000.000 613.400.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started