Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are consdering buying an apartment building on Green Street that you will then rent out to students. The property you are examining will

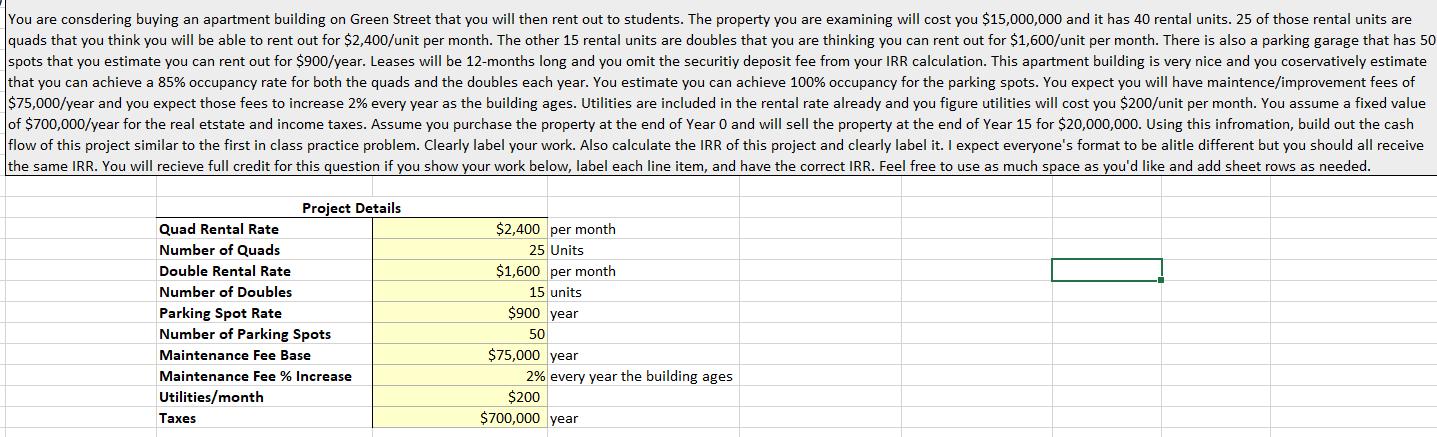

You are consdering buying an apartment building on Green Street that you will then rent out to students. The property you are examining will cost you $15,000,000 and it has 40 rental units. 25 of those rental units are quads that you think you will be able to rent out for $2,400/unit per month. The other 15 rental units are doubles that you are thinking you can rent out for $1,600/unit per month. There is also a parking garage that has 50 spots that you estimate you can rent out for $900/year. Leases will be 12-months long and you omit the securitiy deposit fee from your IRR calculation. This apartment building is very nice and you coservatively estimate that you can achieve a 85% occupancy rate for both the quads and the doubles each year. You estimate you can achieve 100% occupancy for the parking spots. You expect you will have maintence/improvement fees of $75,000/year and you expect those fees to increase 2% every year as the building ages. Utilities are included in the rental rate already and you figure utilities will cost you $200/unit per month. You assume a fixed value of $700,000/year for the real estate and income taxes. Assume you purchase the property at the end of Year 0 and will sell the property at the end of Year 15 for $20,000,000. Using this infromation, build out the cash flow of this project similar to the first in class practice problem. Clearly label your work. Also calculate the IRR of this project and clearly label it. I expect everyone's format to be alitle different but you should all receive the same IRR. You will recieve full credit for this question if you show your work below, label each line item, and have the correct IRR. Feel free to use as much space as you'd like and add sheet rows as needed. Project Details Quad Rental Rate Number of Quads Double Rental Rate Number of Doubles Parking Spot Rate Number of Parking Spots Maintenance Fee Base Maintenance Fee % Increase Utilities/month Taxes $2,400 per month 25 Units $1,600 per month 15 units $900 year 50 $75,000 year 2% every year the building ages $200 $700,000 year Year 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Report IRR Here -->

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To build out the cash flow of the project we will calculate the annual cash inflows and outflows for each year based on the provided information Heres ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started