Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering 2 machines A and B for a manufacturing plant. MachineA has an initial cost of $750,000, will last for 15 years and

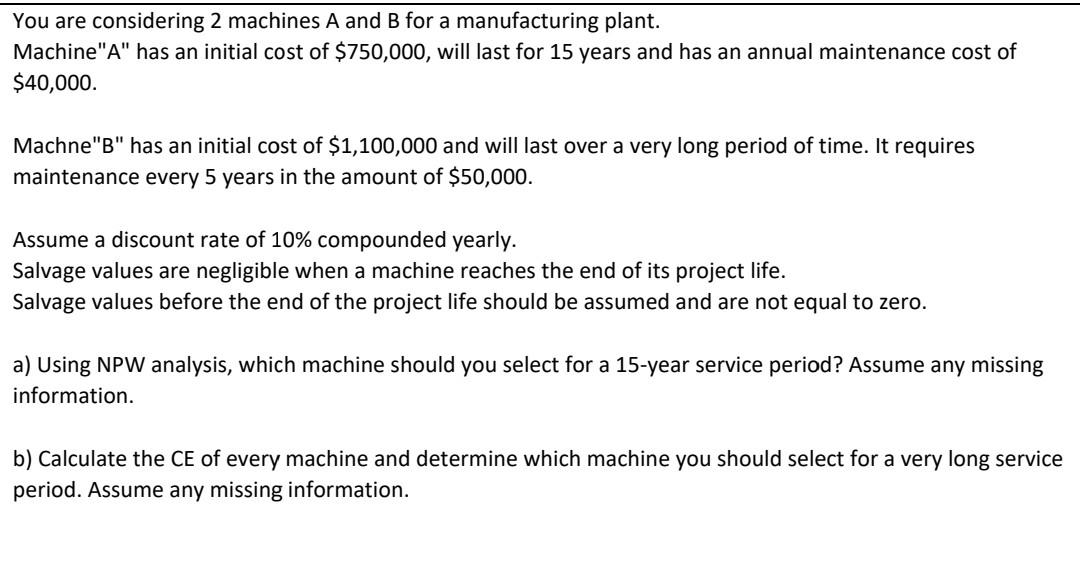

You are considering 2 machines A and B for a manufacturing plant. Machine"A" has an initial cost of $750,000, will last for 15 years and has an annual maintenance cost of $40,000. Machne"B" has an initial cost of $1,100,000 and will last over a very long period of time. It requires maintenance every 5 years in the amount of $50,000. Assume a discount rate of 10% compounded yearly. Salvage values are negligible when a machine reaches the end of its project life. Salvage values before the end of the project life should be assumed and are not equal to zero. a) Using NPW analysis, which machine should you select for a 15-year service period? Assume any missing information. b) Calculate the CE of every machine and determine which machine you should select for a very long service period. Assume any missing information. You are considering 2 machines A and B for a manufacturing plant. Machine"A" has an initial cost of $750,000, will last for 15 years and has an annual maintenance cost of $40,000. Machne"B" has an initial cost of $1,100,000 and will last over a very long period of time. It requires maintenance every 5 years in the amount of $50,000. Assume a discount rate of 10% compounded yearly. Salvage values are negligible when a machine reaches the end of its project life. Salvage values before the end of the project life should be assumed and are not equal to zero. a) Using NPW analysis, which machine should you select for a 15-year service period? Assume any missing information. b) Calculate the CE of every machine and determine which machine you should select for a very long service period. Assume any missing information

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started