Question

You are considering a 4 year project that requires upfront investment in a piece of production machinery to serve increased market demand for protective gear.

You are considering a 4 year project that requires upfront investment in a piece of production machinery to serve increased market demand for protective gear. The initial equipment investment is $5000 and it is depreciatedstraight lineto 20% of its initial cost by the end of the project in year 4.

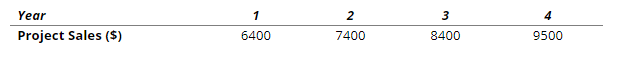

Product revenues from the sale of the gearareforecastedbelow,and project operating costs should be 60% of sales.

The project will also require $500 in net working capital investment to start, and a further $300 in net working capital investment will take place in year 1. The projects net working capital will be reduced to zero at the end of the project.

In four years, the equipment will be sold at the salvage value which is 20% of its initial cost. The relevant tax rate is 30%, and the required return is 15%.

Use the above information to answer the following questions.

a) What is the Project cash OUTFLOW at time zero. Include all contributions. DO NOT enter your answer with a negative sign.

b) What is the forecasted operating cash flow (OCF) in year 2?

c) What is the forecasted Total Project Cash Flow in year 4?

d) Using the relevant discount rate given above what is your estimate for the NPV of the project?

Year Project Sales ($) 1 6400 2 7400 3 8400 4 9500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The project cash outflow at time zero includes the initial equipment investment initial net workin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started