Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering a project that has been assigned a discount rate of 9 percent. If you start the project today ( t=0 ), you

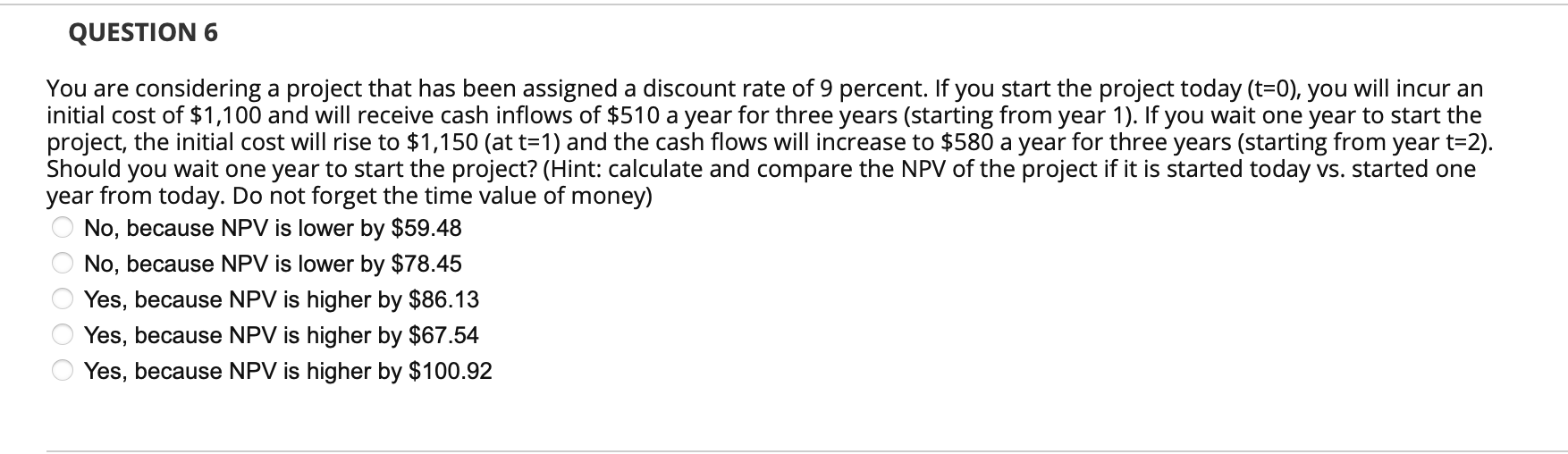

You are considering a project that has been assigned a discount rate of 9 percent. If you start the project today ( t=0 ), you will incur an initial cost of $1,100 and will receive cash inflows of $510 a year for three years (starting from year 1). If you wait one year to start the project, the initial cost will rise to $1,150 (at t=1 ) and the cash flows will increase to $580 a year for three years (starting from year t=2 ). Should you wait one year to start the project? (Hint: calculate and compare the NPV of the project if it is started today vs. started one year from today. Do not forget the time value of money) No, because NPV is lower by $59.48 No, because NPV is lower by $78.45 Yes, because NPV is higher by $86.13 Yes, because NPV is higher by $67.54 Yes, because NPV is higher by $100.92

You are considering a project that has been assigned a discount rate of 9 percent. If you start the project today ( t=0 ), you will incur an initial cost of $1,100 and will receive cash inflows of $510 a year for three years (starting from year 1). If you wait one year to start the project, the initial cost will rise to $1,150 (at t=1 ) and the cash flows will increase to $580 a year for three years (starting from year t=2 ). Should you wait one year to start the project? (Hint: calculate and compare the NPV of the project if it is started today vs. started one year from today. Do not forget the time value of money) No, because NPV is lower by $59.48 No, because NPV is lower by $78.45 Yes, because NPV is higher by $86.13 Yes, because NPV is higher by $67.54 Yes, because NPV is higher by $100.92 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started