Answered step by step

Verified Expert Solution

Question

1 Approved Answer

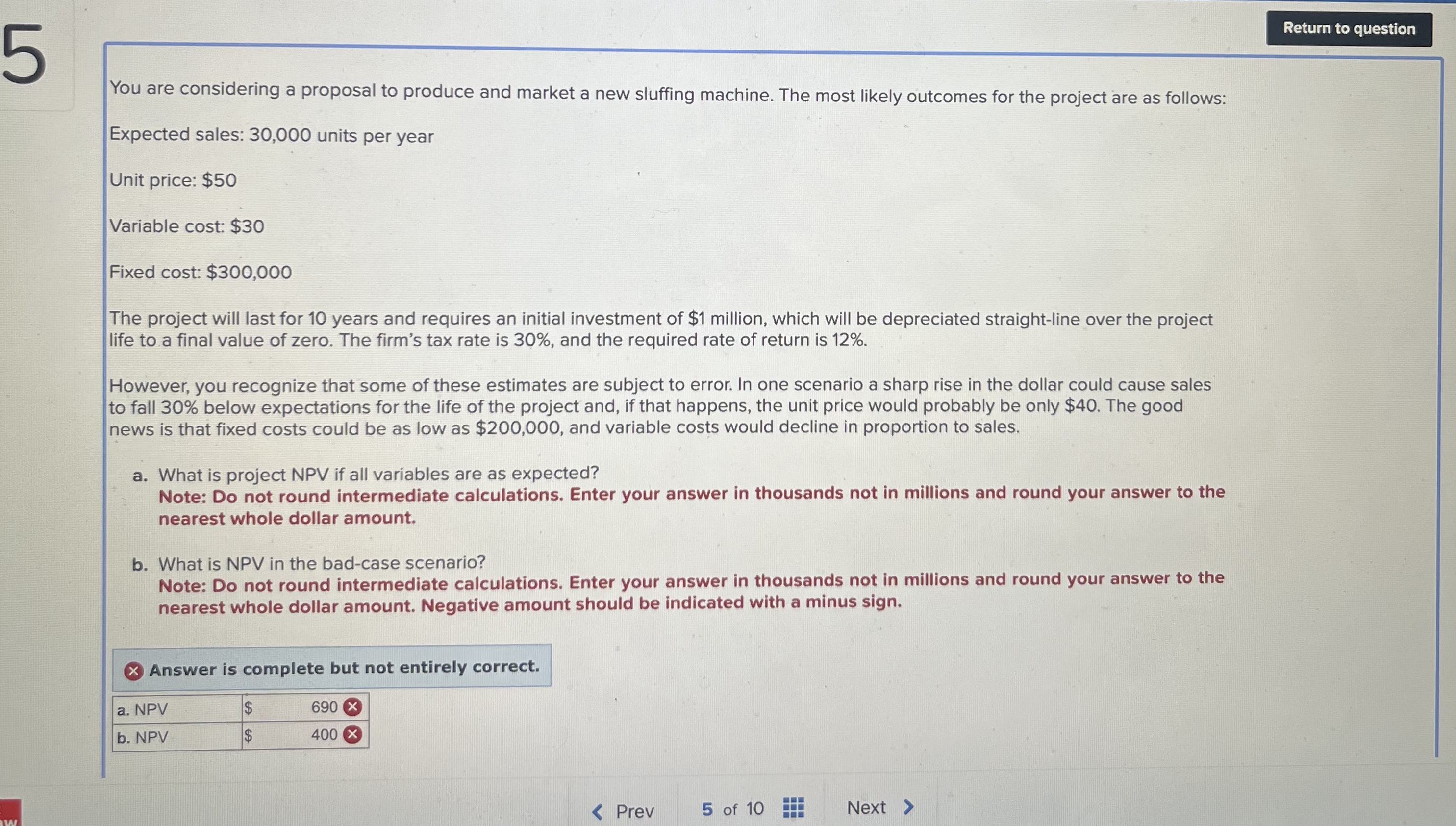

You are considering a proposal to produce and market a new sluffing machine. The most likely outcomes for the project are as follows: Expected sales:

You are considering a proposal to produce and market a new sluffing machine. The most likely outcomes for the project are as follows:

Expected sales: units per year

Unit price: $

Variable cost: $

Fixed cost: $

The project will last for years and requires an initial investment of $ million, which will be depreciated straightline over the project life to a final value of zero. The firm's tax rate is and the required rate of return is

However, you recognize that some of these estimates are subject to error. In one scenario a sharp rise in the dollar could cause sales to fall below expectations for the life of the project and, if that happens, the unit price would probably be only $ The good news is that fixed costs could be as low as $ and variable costs would decline in proportion to sales.

a What is project NPV if all variables are as expected?

Note: Do not round intermediate calculations. Enter your answer in thousands not in millions and round your answer to the nearest whole dollar amount.

b What is NPV in the badcase scenario?

Note: Do not round intermediate calculations. Enter your answer in thousands not in millions and round your answer to the nearest whole dollar amount. Negative amount should be indicated with a minus sign.

Answer is complete but not entirely correct.

tablea NPV$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started