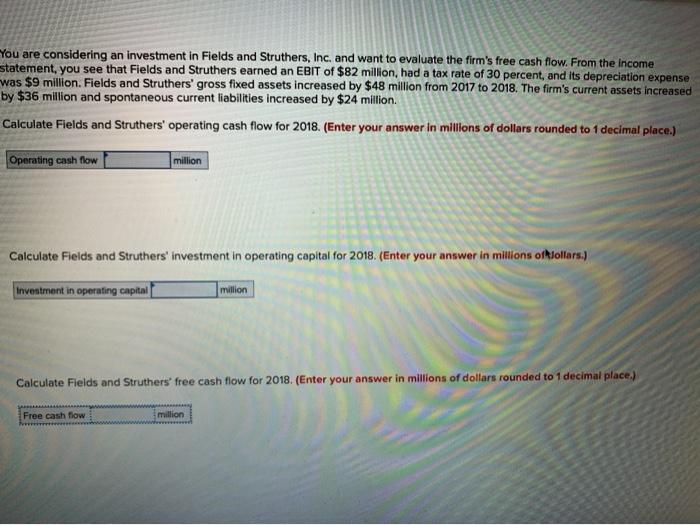

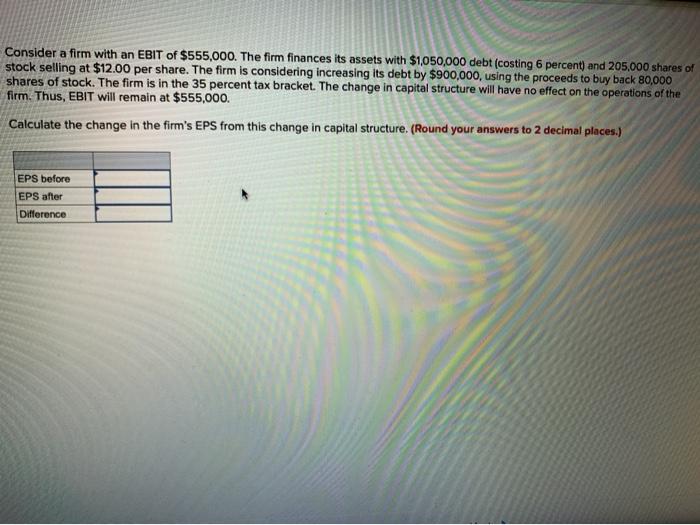

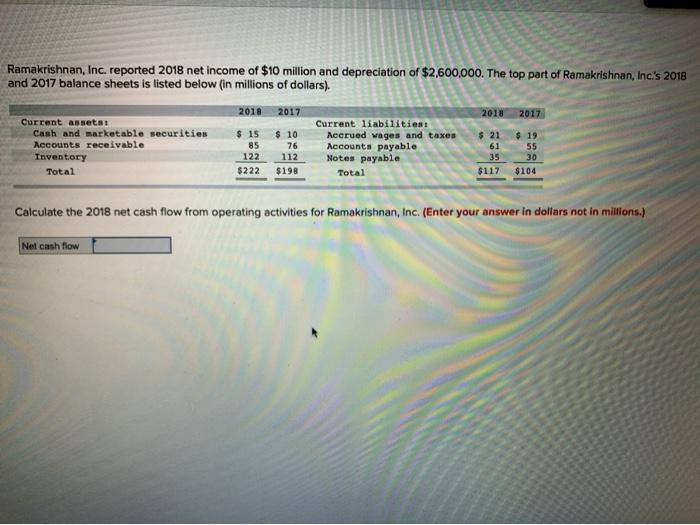

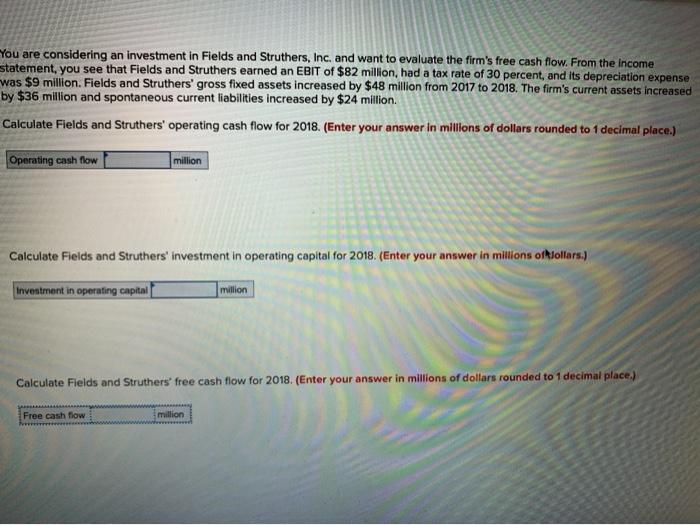

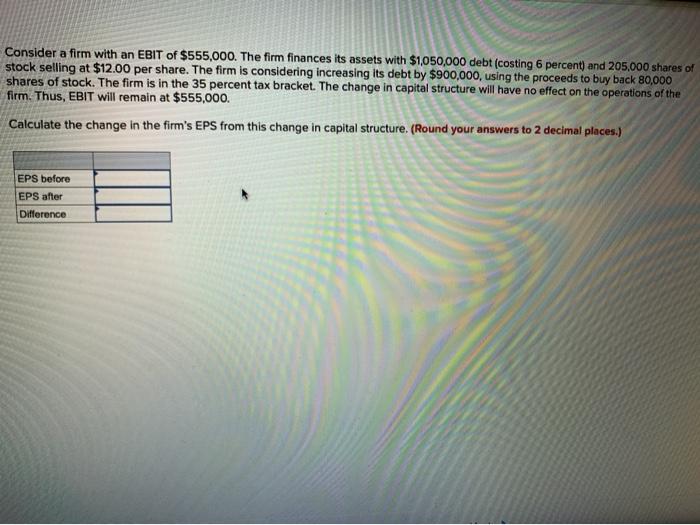

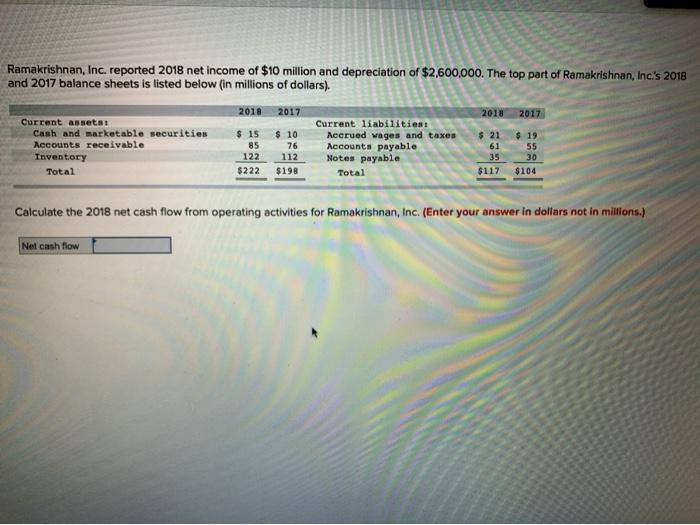

You are considering an investment in Fields and Struthers, Inc. and want to evaluate the firm's free cash flow. From the income statement, you see that Fields and Struthers earned an EBIT of $82 million, had a tax rate of 30 percent, and its depreciation expense was $9 million. Fields and Struthers' gross fixed assets increased by $48 million from 2017 to 2018. The firm's current assets increased by $36 million and spontaneous current liabilities increased by $24 million. Calculate Fields and Struthers' operating cash flow for 2018. (Enter your answer in millions of dollars rounded to 1 decimal place.) Operating cash flow million Calculate Fields and Struthers' investment in operating capital for 2018. (Enter your answer in millions of lollars.) Investment in operating capital million Calculate Fields and Struthers' free cash flow for 2018. (Enter your answer in millions of dollars rounded to 1 decimal place.) Free cash flow million Consider a firm with an EBIT of $555,000. The firm finances its assets with $1,050,000 debt (costing 6 percent) and 205.000 shares of stock selling at $12.00 per share. The firm is considering increasing its debt by $900,000, using the proceeds to buy back 80,000 shares of stock. The firm is in the 35 percent tax bracket. The change in capital structure will have no effect on the operations of the firm. Thus, EBIT will remain at $555,000 Calculate the change in the firm's EPS from this change in capital structure. (Round your answers to 2 decimal places.) EPS before EPS after Difference Ramakrishnan, Inc. reported 2018 net income of $10 million and depreciation of $2,600,000. The top part of Ramakrishnan, Inc's 2018 and 2017 balance sheets is listed below (in millions of dollars). 2018 2017 2018 2017 Current assets Cash and marketable securities Accounts receivable Inventory Total $ 15 85 122 $222 $ 10 76 112 $198 Current liabilities: Accrued wages and taxes Accounts payable Notes payable Total $ 21 61 35 $117 $ 19 55 30 $104 Calculate the 2018 net cash flow from operating activities for Ramakrishnan, Inc. (Enter your answer in dollars not in millions.) Nel cash flow