Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering an investment opportunity that requires an initial investment of $45 million today. It will generate two future payments, one of $8

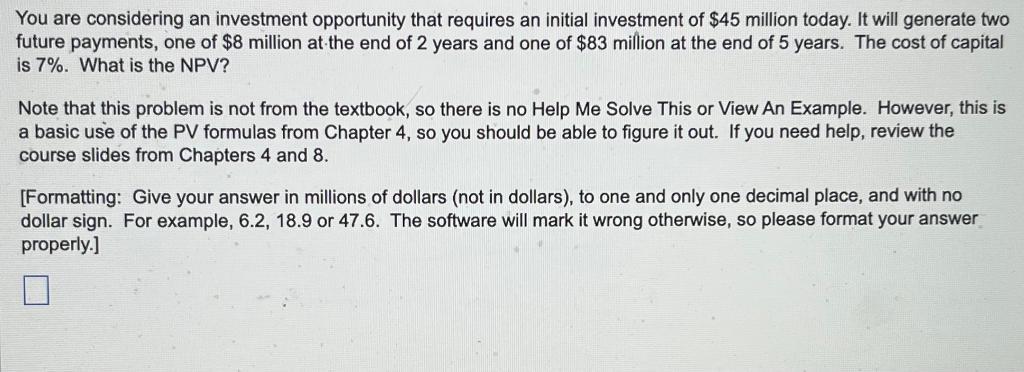

You are considering an investment opportunity that requires an initial investment of $45 million today. It will generate two future payments, one of $8 million at the end of 2 years and one of $83 million at the end of 5 years. The cost of capital is 7%. What is the NPV? Note that this problem is not from the textbook, so there is no Help Me Solve This or View An Example. However, this is a basic use of the PV formulas from Chapter 4, so you should be able to figure it out. If you need help, review the course slides from Chapters 4 and 8. [Formatting: Give your answer in millions of dollars (not in dollars), to one and only one decimal place, and with no dollar sign. For example, 6.2, 18.9 or 47.6. The software will mark it wrong otherwise, so please format your answer properly.]

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Net Present Value NPV of this investment opportunity you need to discount the f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started