Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering buying an asset that has a 3-year life and costs $15,000. As an alternative to buying the asset, you can lease

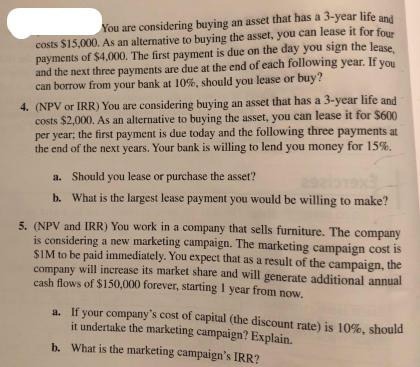

You are considering buying an asset that has a 3-year life and costs $15,000. As an alternative to buying the asset, you can lease it for four payments of $4,000. The first payment is due on the day you sign the lease, and the next three payments are due at the end of each following year. If you can borrow from your bank at 10%, should you lease or buy? 4. (NPV or IRR) You are considering buying an asset that has a 3-year life and costs $2,000. As an alternative to buying the asset, you can lease it for $600 per year; the first payment is due today and the following three payments at the end of the next years. Your bank is willing to lend you money for 15%. a. Should you lease or purchase the asset? b. What is the largest lease payment you would be willing to make? 5. (NPV and IRR) You work in a company that sells furniture. The company is considering a new marketing campaign. The marketing campaign cost is SIM to be paid immediately. You expect that as a result of the campaign, the company will increase its market share and will generate additional annual cash flows of $150,000 forever, starting 1 year from now. a. If your company's cost of capital (the discount rate) is 10%, should it undertake the marketing campaign? Explain. b. What is the marketing campaign's IRR?

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Lease vs Buy Analysis For both scenarios we need to compare the present values PV of the cash flows associated with each option to determine the most ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started