Question

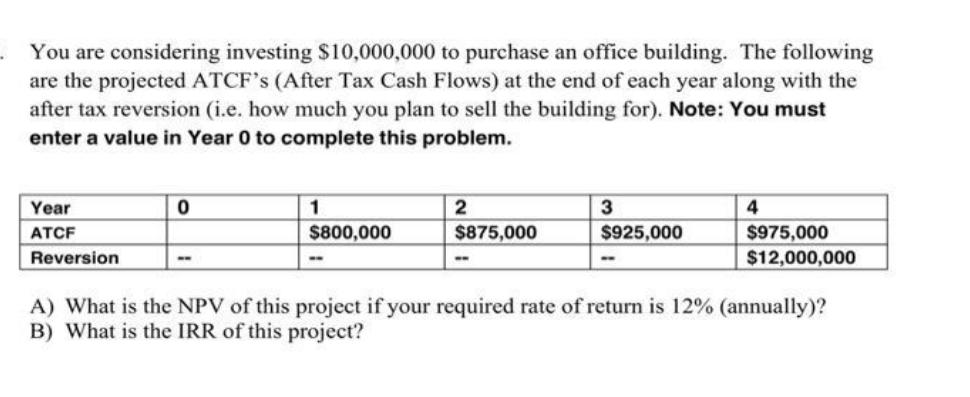

You are considering investing $10,000,000 to purchase an office building. The following are the projected ATCF's (After Tax Cash Flows) at the end of

You are considering investing $10,000,000 to purchase an office building. The following are the projected ATCF's (After Tax Cash Flows) at the end of each year along with the after tax reversion (i.e. how much you plan to sell the building for). Note: You must enter a value in Year 0 to complete this problem. Year ATCF Reversion 0 1 $800,000 2 $875,000 -- 3 $925,000 -- 4 $975,000 $12,000,000 A) What is the NPV of this project if your required rate of return is 12% (annually)? B) What is the IRR of this project?

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the NPV and IRR of the project we need to discount the cash flows and the reversion val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction to Operations Research

Authors: Frederick S. Hillier, Gerald J. Lieberman

10th edition

978-0072535105, 72535105, 978-1259162985

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App