Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering investing in a hedge fund. Before you make the decision of investing in the hedge fund, you need to do some research

You are considering investing in a hedge fund. Before you make the decision of investing in the hedge fund, you need to do some research about it and here are some key questions you are trying to address:

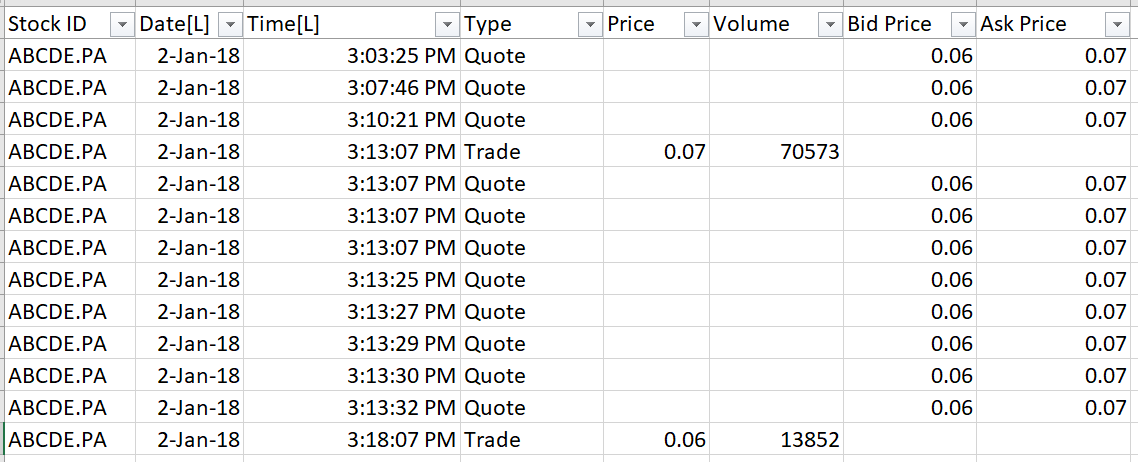

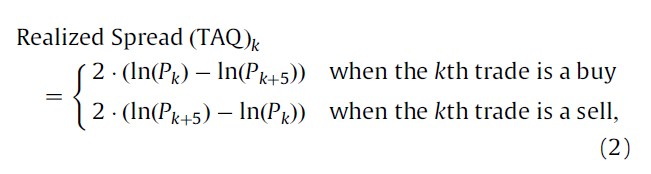

b. Hedge funds may also have some high-frequency trading. Using the trade at 3:13:07 as the kth trade, calculate Huang and Stoll (1996)s realized spread.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started