Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering investing in a new venture. Based on the business plan of the entrepreneur, if the project is successful, it is expected

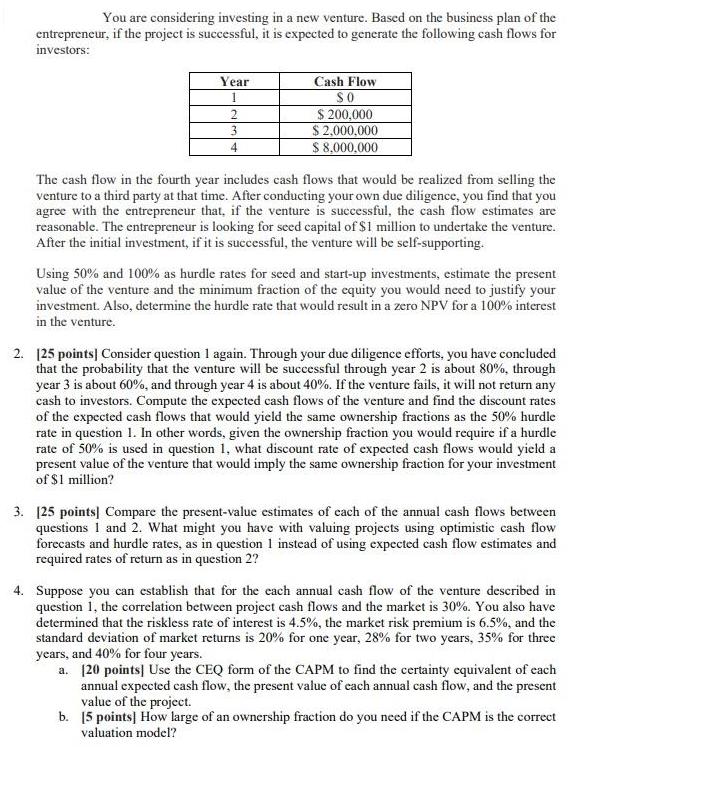

You are considering investing in a new venture. Based on the business plan of the entrepreneur, if the project is successful, it is expected to generate the following cash flows for investors: Year 1 2 3 4 Cash Flow SO $ 200,000 $ 2,000,000 $ 8.000.000 The cash flow in the fourth year includes cash flows that would be realized from selling the venture to a third party at that time. After conducting your own due diligence, you find that you agree with the entrepreneur that, if the venture is successful, the cash flow estimates are reasonable. The entrepreneur is looking for seed capital of $1 million to undertake the venture. After the initial investment, if it is successful, the venture will be self-supporting. Using 50% and 100% as hurdle rates for seed and start-up investments, estimate the present value of the venture and the minimum fraction of the equity you would need to justify your investment. Also, determine the hurdle rate that would result in a zero NPV for a 100% interest in the venture. 2. [25 points] Consider question 1 again. Through your due diligence efforts, you have concluded that the probability that the venture will be successful through year 2 is about 80%, through year 3 is about 60%, and through year 4 is about 40%. If the venture fails, it will not return any cash to investors. Compute the expected cash flows of the venture and find the discount rates of the expected cash flows that would yield the same ownership fractions as the 50% hurdle rate in question 1. In other words, given the ownership fraction you would require if a hurdle rate of 50% is used in question 1, what discount rate of expected cash flows would yield a present value of the venture that would imply the same ownership fraction for your investment of $1 million? 3. [25 points] Compare the present-value estimates of each of the annual cash flows between questions 1 and 2. What might you have with valuing projects using optimistic cash flow forecasts and hurdle rates, as in question 1 instead of using expected cash flow estimates and required rates of return as in question 2? 4. Suppose you can establish that for the each annual cash flow of the venture described in question 1, the correlation between project cash flows and the market is 30%. You also have determined that the riskless rate of interest is 4.5%, the market risk premium is 6.5%, and the standard deviation of market returns is 20% for one year, 28% for two years, 35% for three years, and 40% for four years. a. [20 points] Use the CEQ form of the CAPM to find the certainty equivalent of each annual expected cash flow, the present value of each annual cash flow, and the present value of the project. b. [5 points] How large of an ownership fraction do you need if the CAPM is the correct valuation model?

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

can use the following formula PV P1 CF1 1 r1 P2 CF2 1 r2 Pn CFn 1 rn where PV is the present value CF is the cash flow for a given year P is the proba...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started