Answered step by step

Verified Expert Solution

Question

1 Approved Answer

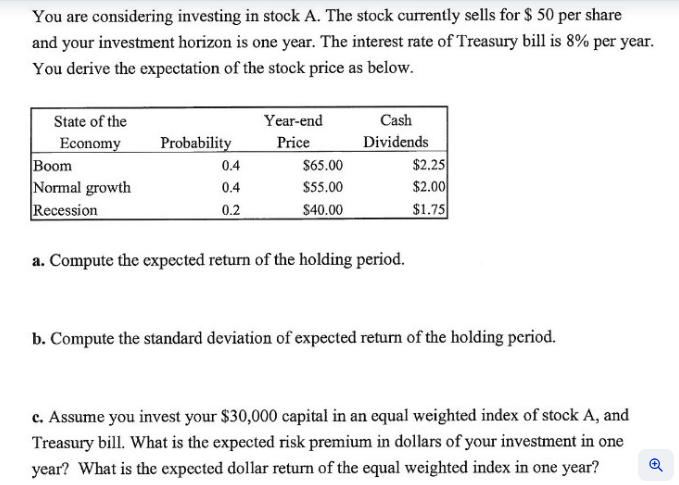

You are considering investing in stock A. The stock currently sells for $ 50 per share and your investment horizon is one year. The

You are considering investing in stock A. The stock currently sells for $ 50 per share and your investment horizon is one year. The interest rate of Treasury bill is 8% per year. You derive the expectation of the stock price as below. State of the Economy Boom Normal growth Recession Probability 0.4 0.4 0.2 Year-end Price $65.00 $55.00 $40.00 Cash Dividends a. Compute the expected return of the holding period. $2.25 $2.00 $1.75 b. Compute the standard deviation of expected return of the holding period. c. Assume you invest your $30,000 capital in an equal weighted index of stock A, and Treasury bill. What is the expected risk premium in dollars of your investment in one year? What is the expected dollar return of the equal weighted index in one year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the expected return and standard deviation of the holding period you can use the followin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started