Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering investing in the S&P500 index (as a New Zealander), and whether to hedge against exchange rate risk or not. If you

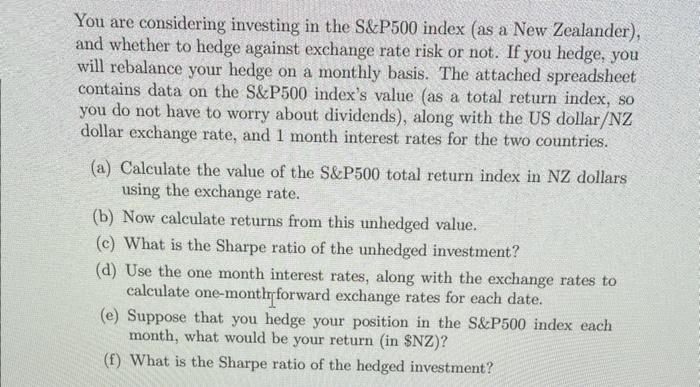

You are considering investing in the S&P500 index (as a New Zealander), and whether to hedge against exchange rate risk or not. If you hedge, you will rebalance your hedge on a monthly basis. The attached spreadsheet contains data on the S&P500 index's value (as a total return index, so you do not have to worry about dividends), along with the US dollar/NZ dollar exchange rate, and 1 month interest rates for the two countries. (a) Calculate the value of the S&P500 total return index in NZ dollars using the exchange rate. (b) Now calculate returns from this unhedged value. (c) What is the Sharpe ratio of the unhedged investment? (d) Use the one month interest rates, along with the exchange rates to calculate one-m -month forward exchange rates for each date. (e) Suppose that you hedge your position in the S&P500 index each month, what would be your return (in $NZ)? (f) What is the Sharpe ratio of the hedged investment?

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Cal cul ations for a S P 500 Total Return Index in NZ dollars S P 500 Index Value x US Do...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started