Answered step by step

Verified Expert Solution

Question

1 Approved Answer

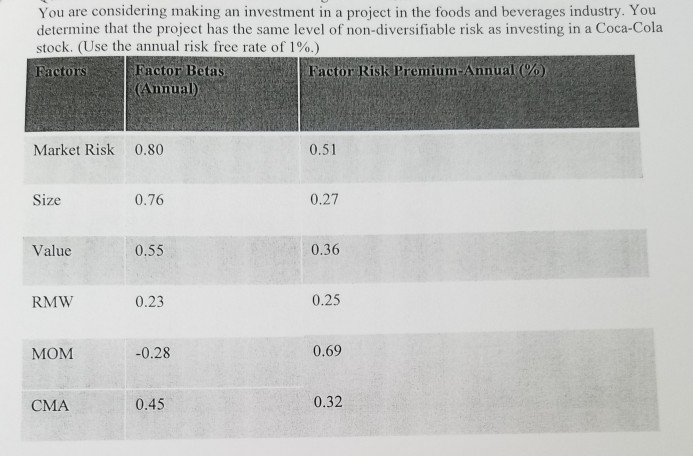

You are considering making an investment in a project in the foods and beverages industry. You determine that the project has the same level of

You are considering making an investment in a project in the foods and beverages industry. You determine that the project has the same level of non-diversifiable risk as investing in a Coca-Cola stock. (Use the annual risk free rate of 1%.) Factor Risk Premium-Annual (%), . Factor Betas (Annual) Factors Market Risk 0.80 0.51 Size 0.76 0.27 Value 0.55 0.36 RMW 0.23 0.25 MOM 0.28 0.69 CMA 0.45 0.32 6. (a) Calculate the expected returns of Coca-Cola based on Fama-French-Carhart model? (b) Calculate the expected returns of Coca-Cola based on Fama-French 5 factor mo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started