Answered step by step

Verified Expert Solution

Question

1 Approved Answer

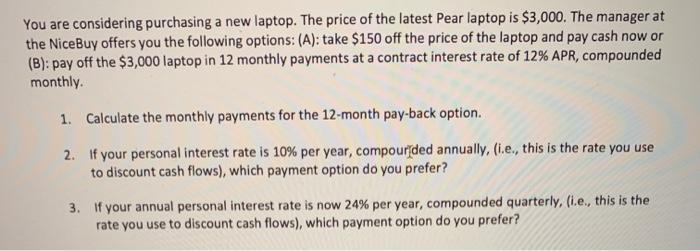

You are considering purchasing a new laptop. The price of the latest Pear laptop is $3,000. The manager at the NiceBuy offers you the

You are considering purchasing a new laptop. The price of the latest Pear laptop is $3,000. The manager at the NiceBuy offers you the following options: (A): take $150 off the price of the laptop and pay cash now or (B): pay off the $3,000 laptop in 12 monthly payments at a contract interest rate of 12% APR, compounded monthly. 1. Calculate the monthly payments for the 12-month pay-back option. 2. If your personal interest rate is 10% per year, compourded annually, (i.e., this is the rate you use to discount cash flows), which payment option do you prefer? 3. If your annual personal interest rate is now 24% per year, compounded quarterly, (i.e., this is the rate you use to discount cash flows), which payment option do you prefer?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Monthly payment for 12month payback option at 12 APR compounded monthly Princip...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started