Question

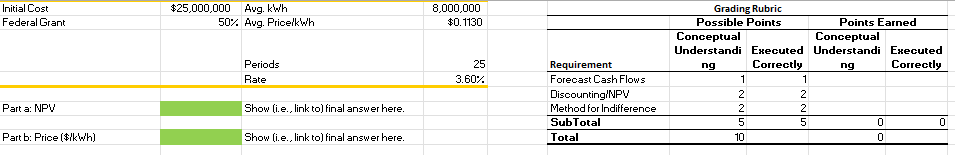

You are considering putting in a wind farm. The initial construction cost is $25,000,000. You receive a Federal tax credit (rebate) of 50% of the

You are considering putting in a wind farm. The initial construction cost is $25,000,000. You receive a Federal tax credit (rebate) of 50% of the cost. Assume you pay the construction cost and receive the tax credits both at date 0.

Across the 25 year expected life of the project, you forecast generating an average of 8,000,000 kWh of electricity each year at an average price of $0.113 per kWh. Assume no other incremental cash flows.

Use the following Image to answer Part-A and Part-B

Part-A: If your investors demand 3.6% annually to pay for the system, what is the NPV of the wind farm?

Part-B: What average electricity price would leave you indifferent (financially) to purchasing the wind farm?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started