Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering replacing an existing machine that you purchased five years ago when it cost $130,000. If you keep this machine it will

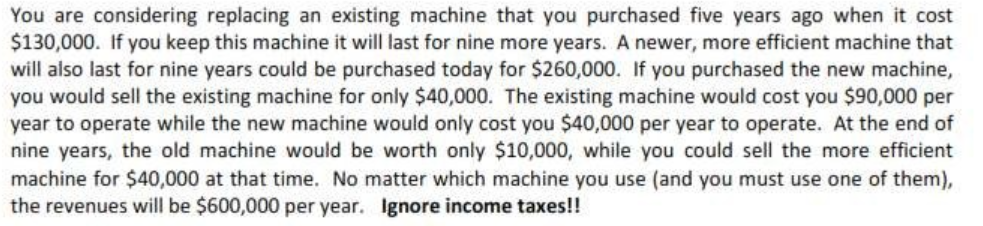

You are considering replacing an existing machine that you purchased five years ago when it cost $130,000. If you keep this machine it will last for nine more years. A newer, more efficient machine that will also last for nine years could be purchased today for $260,000. If you purchased the new machine, you would sell the existing machine for only $40,000. The existing machine would cost you $90,000 per year to operate while the new machine would only cost you $40,000 per year to operate. At the end of nine years, the old machine would be worth only $10,000, while you could sell the more efficient machine for $40,000 at that time. No matter which machine you use (and you must use one of them), the revenues will be $600,000 per year. Ignore income taxes!! What is the Equivalent Uniform Annual Cost (EUAC) of operating the existing machine for the next nine years at 14% per annum? b. What is the Equivalent Uniform Annual Cost (EUAC) of operating the newer, more efficient, machine for the next nine years at 14% per annum? c. What is the present value (at 14%) of the difference between the two EUAC's that you just computed in parts a and b?

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a EUAC of existing m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started