Question

You are considering the acquisition of a 35,000 square foot office building. Currently the building is occupied by a law firm that takes up 15,000

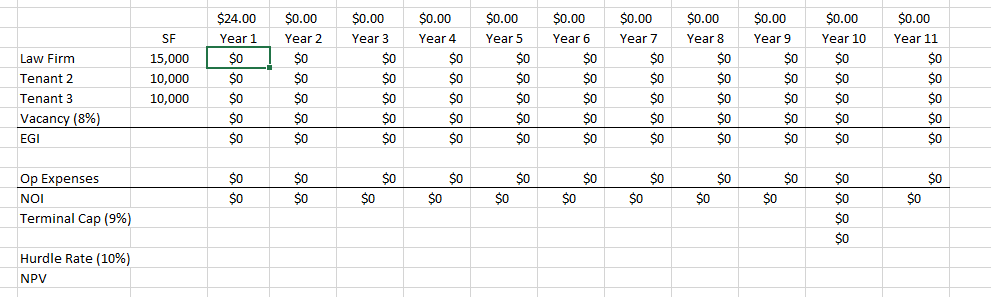

You are considering the acquisition of a 35,000 square foot office building. Currently the building is occupied by a law firm that takes up 15,000 square feet and is paying $24.00 per square foot, full service. Based on current market absorption, you estimate that you will be able to lease 10,000 square feet per year over the next two years at which point the building will be stabilized. You estimate the market lease rate to be $24.00 per square foot, full service, consistent with the current lease in the building. For simplicity, you assume that the new tenants will sign their leases at the end of years one and two. All of the lease rates will grow at a rate of 2.5% annually. There is no other income.

The market vacancy rate is 8% and the operating expenses currently total $6.00 per square foot for all space (vacant and occupied). All operating expenses are paid by the landlord. Operating expenses are anticipated to increase at a rate of 3% per year. You anticipate holding the property for 10 years. Your desired yield on this property is 10%, and your estimated terminal cap rate is 9%. Based on this analysis, how much are you willing to pay for the property?

Complete this table above

$0.00 $0.00 $0.00 $0.00 Year 4 Year 10 Law Firm SF 15,000 10,000 10,000 $24.00 Year 1 $0 $0 $0 $0 $0 Tenant 2 $0.00 Year 2 $0 $0 $0 $0 $0 $0.00 Year 3 $0 $0 $0 $0 $0 $0.00 Year 5 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0.00 Year 6 $0 $0 $0 $0 $0 $0.00 Year 7 $0 $0 $0 $0 $0 $0.00 Year 9 $0 $0 $0 SO Year 8 $0 $0 $0 $0 $0 Tenant 3 Vacancy (8%) EGI Year 11 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Op Expenses NOI Terminal Cap (9%) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Hurdle Rate (10%) NPV $0.00 $0.00 $0.00 $0.00 Year 4 Year 10 Law Firm SF 15,000 10,000 10,000 $24.00 Year 1 $0 $0 $0 $0 $0 Tenant 2 $0.00 Year 2 $0 $0 $0 $0 $0 $0.00 Year 3 $0 $0 $0 $0 $0 $0.00 Year 5 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0.00 Year 6 $0 $0 $0 $0 $0 $0.00 Year 7 $0 $0 $0 $0 $0 $0.00 Year 9 $0 $0 $0 SO Year 8 $0 $0 $0 $0 $0 Tenant 3 Vacancy (8%) EGI Year 11 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Op Expenses NOI Terminal Cap (9%) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Hurdle Rate (10%) NPVStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started