Question

You are considering the following two mutually exclusive investment projects: Year 0 1 2 3 4 Project A -$200,000 $40,000 $60,000 $80,000 $153,500 Project

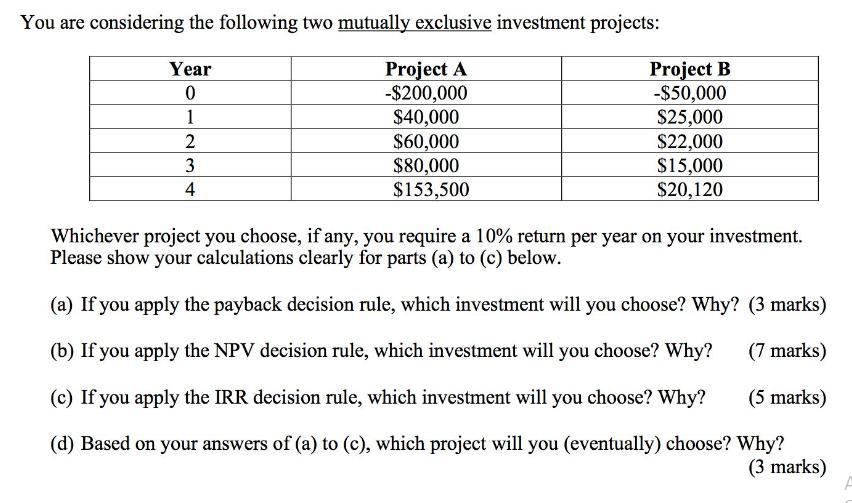

You are considering the following two mutually exclusive investment projects: Year 0 1 2 3 4 Project A -$200,000 $40,000 $60,000 $80,000 $153,500 Project B -$50,000 $25,000 $22,000 $15,000 $20,120 Whichever project you choose, if any, you require a 10% return per year on your investment. Please show your calculations clearly for parts (a) to (c) below. (a) If you apply the payback decision rule, which investment will you choose? Why? (3 marks) (7 marks) (b) If you apply the NPV decision rule, which investment will you choose? Why? (c) If you apply the IRR decision rule, which investment will you choose? Why? (5 marks) (d) Based on your answers of (a) to (c), which project will you (eventually) choose? Why? (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Theory and Practice

Authors: Eugene F. Brigham, Michael C. Ehrhardt

15th edition

130563229X, 978-1305632301, 1305632303, 978-0357685877, 978-1305886902, 1305886909, 978-1305632295

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App