Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are considering the possibility of starting a new business and you have the option to either start the business today or in exactly

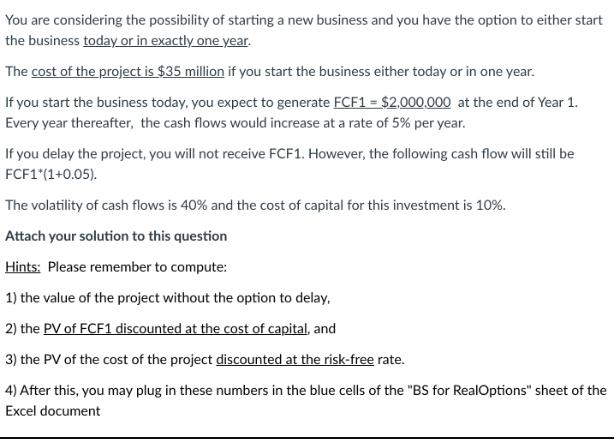

You are considering the possibility of starting a new business and you have the option to either start the business today or in exactly one year. The cost of the project is $35 million if you start the business either today or in one year. If you start the business today, you expect to generate FCF1 = $2,000,000 at the end of Year 1. Every year thereafter, the cash flows would increase at a rate of 5% per year. If you delay the project, you will not receive FCF1. However, the following cash flow will still be FCF1*(1+0.05). The volatility of cash flows is 40% and the cost of capital for this investment is 10%. Attach your solution to this question Hints: Please remember to compute: 1) the value of the project without the option to delay. 2) the PV of FCF1 discounted at the cost of capital, and 3) the PV of the cost of the project discounted at the risk-free rate. 4) After this, you may plug in these numbers in the blue cells of the "BS for RealOptions" sheet of the Excel document

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Valuation with Real Option to Delay Unfortunately I cannot directly attach files or execute external code However I can guide you through the solution ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started