Question

You are considering the purchase of a 3 year Treasury bond with a face value of $1000 and zero-coupons. The market interest rate on

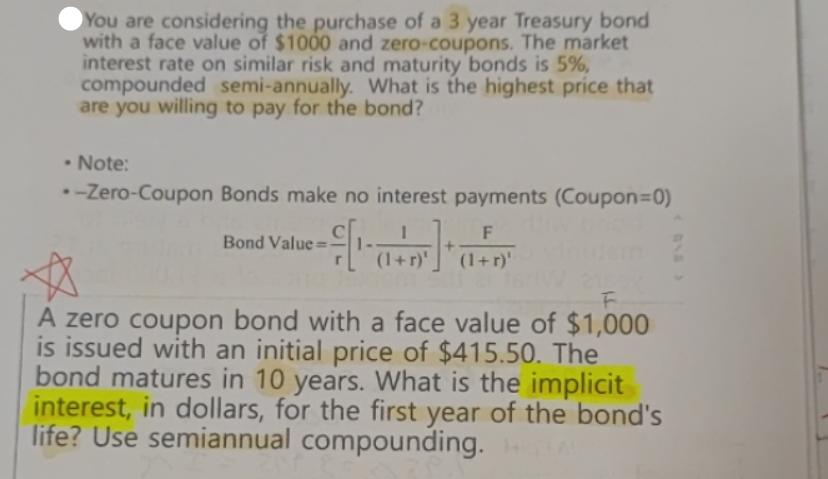

You are considering the purchase of a 3 year Treasury bond with a face value of $1000 and zero-coupons. The market interest rate on similar risk and maturity bonds is 5%, compounded semi-annually. What is the highest price that are you willing to pay for the bond? Note: .-Zero-Coupon Bonds make no interest payments (Coupon=0) F (1+r)' Bond Value= (1+r)' F A zero coupon bond with a face value of $1,000 is issued with an initial price of $415.50. The bond matures in 10 years. What is the implicit interest, in dollars, for the first year of the bond's life? Use semiannual compounding. HULLAY

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the highest price you are willing to pay for the 3year Treasury bond you can use the fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Investment Management

Authors: Geoffrey Hirt, Stanley Block

10th edition

0078034620, 978-0078034626

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App