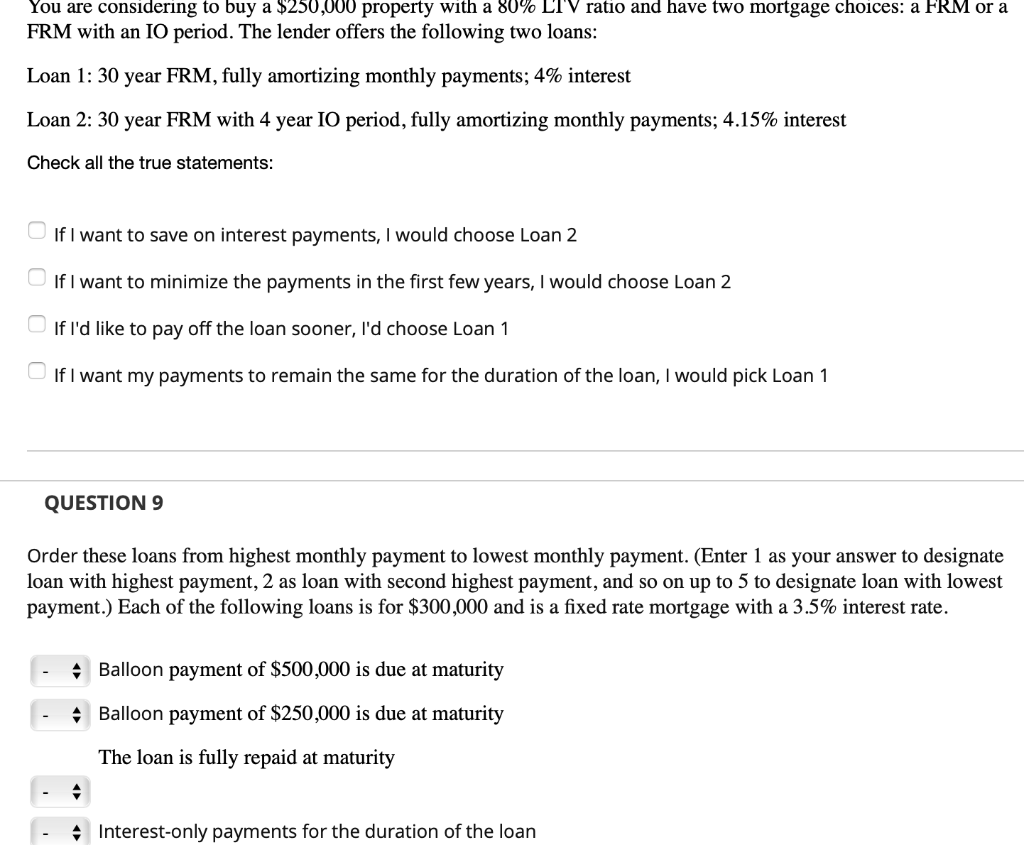

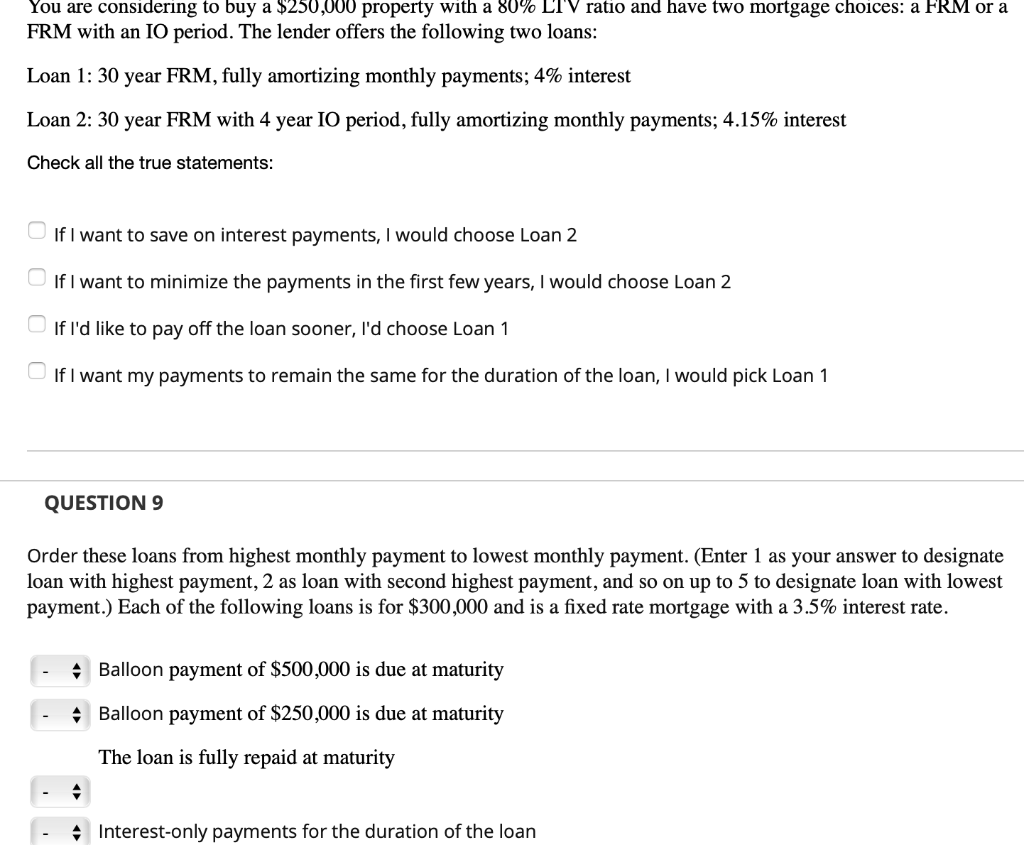

You are considering to buy a $250,00U property with a 80% LTV ratio and have two mortgage choices: a FRM or a FRM with an IO period. The lender offers the following two loans: Loan 1: 30 year FRM, fully amortizing monthly payments; 4% interest Loan 2: 30 year FRM with 4 year 10 period, fully amortizing monthly payments; 4.15% interest Check all the true statements: If I want to save on interest payments, I would choose Loan 2 If I want to minimize the payments in the first few years, I would choose Loan 2 If I'd like to pay off the loan sooner, I'd choose Loan 1 If I want my payments to remain the same for the duration of the loan, I would pick Loan 1 QUESTION 9 Order these loans from highest monthly payment to lowest monthly payment. (Enter 1 as your answer to designate loan with highest payment, 2 as loan with second highest payment, and so on up to 5 to designate loan with lowest payment.) Each of the following loans is for $300,000 and is a fixed rate mortgage with a 3.5% interest rate. - Balloon payment of $500,000 is due at maturity - Balloon payment of $250,000 is due at maturity The loan is fully repaid at maturity - Interest-only payments for the duration of the loan You are considering to buy a $250,00U property with a 80% LTV ratio and have two mortgage choices: a FRM or a FRM with an IO period. The lender offers the following two loans: Loan 1: 30 year FRM, fully amortizing monthly payments; 4% interest Loan 2: 30 year FRM with 4 year 10 period, fully amortizing monthly payments; 4.15% interest Check all the true statements: If I want to save on interest payments, I would choose Loan 2 If I want to minimize the payments in the first few years, I would choose Loan 2 If I'd like to pay off the loan sooner, I'd choose Loan 1 If I want my payments to remain the same for the duration of the loan, I would pick Loan 1 QUESTION 9 Order these loans from highest monthly payment to lowest monthly payment. (Enter 1 as your answer to designate loan with highest payment, 2 as loan with second highest payment, and so on up to 5 to designate loan with lowest payment.) Each of the following loans is for $300,000 and is a fixed rate mortgage with a 3.5% interest rate. - Balloon payment of $500,000 is due at maturity - Balloon payment of $250,000 is due at maturity The loan is fully repaid at maturity - Interest-only payments for the duration of the loan