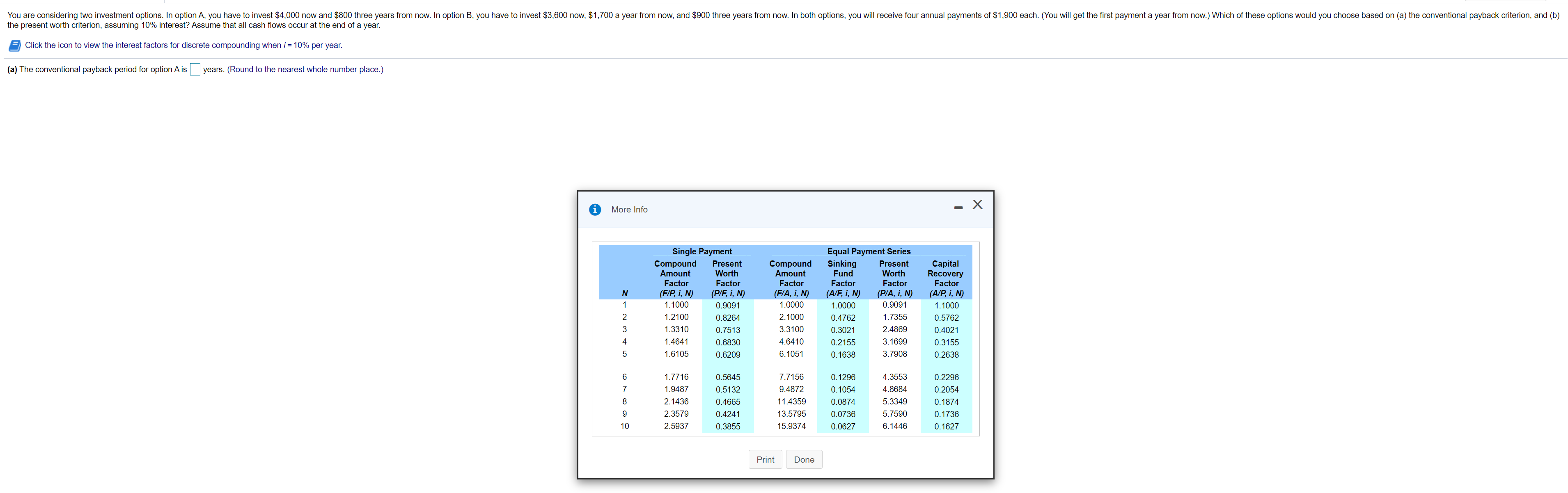

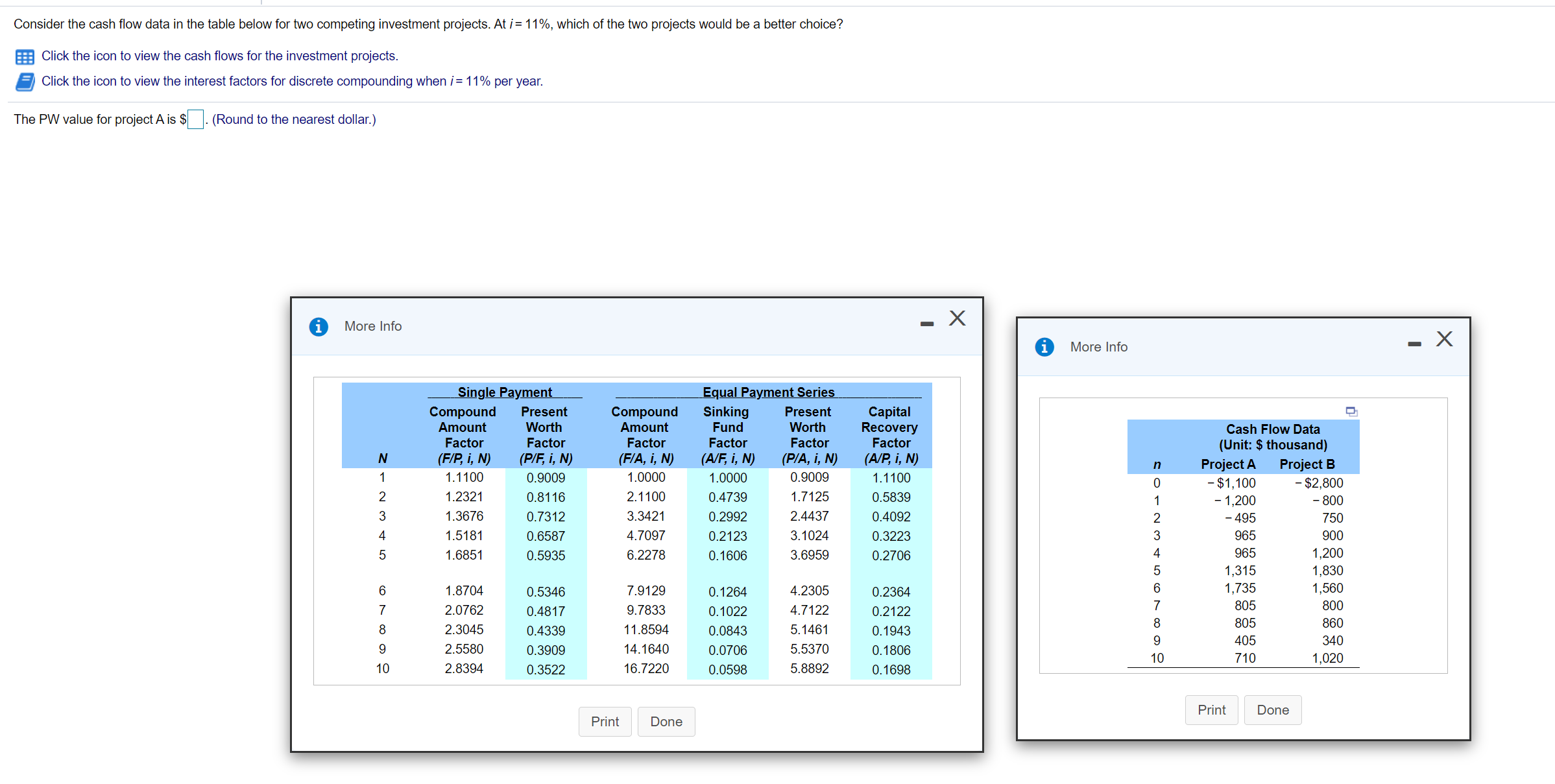

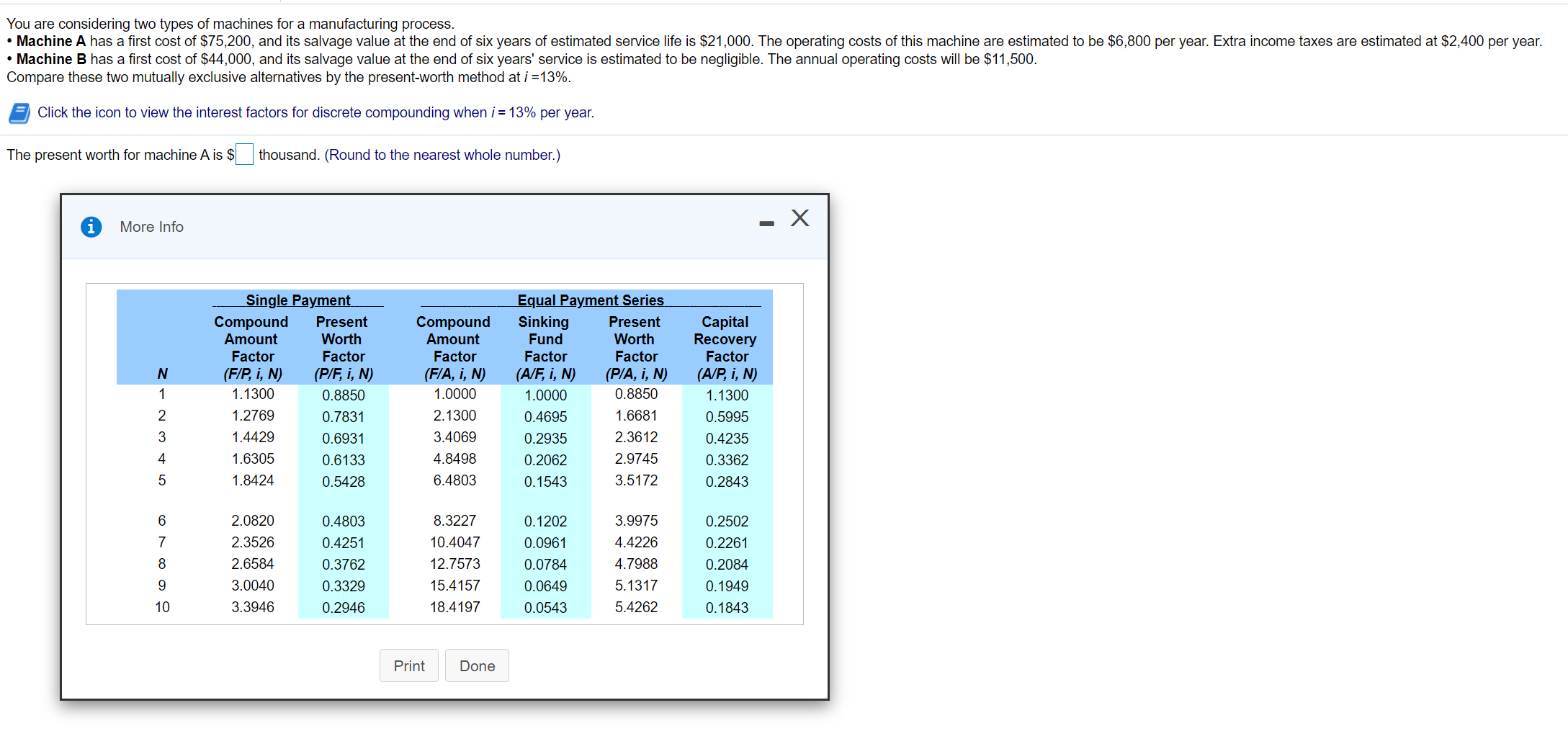

You are considering two investment options. In option A, you have to invest $4,000 now and $800 three years from now. In option B, you have to invest $3,600 now, $1,700 a year from now, and $900 three years from now. In both options, you will receive four annual payments of $1,900 each. (You will get the first payment a year from now.) Which of these options would you choose based on (a) the conventional payback criterion, and (b) the present worth criterion, assuming 10% interest? Assume that all cash flows occur at the end of a year. Click the icon to view the interest factors for discrete compounding when i = 10% per year. (a) The conventional payback period for option A is | | years. (Round to the nearest whole number place.) - X 1 More Info Single Payment Equal Payment Series Compound Present Compound Sinking Present Capital Amoun Worth Amount Fund Worth Recovery Factor Factor Factor Factor Factor Factor (F/P, i, N) (P/F, i, N (F/A, i, N) (A/F, i, N) (P/A, i, N) (A/P, i, N) 1.1000 0.9091 1.0000 1.0000 0.9091 1. 100 1.2100 0.8264 2.1000 0.4762 1.7355 0.5762 U AWN- 1.3310 0.7513 3.310 0.3021 2.4869 0.402 1.4641 0.6830 4.6410 0.2155 3. 1699 0.3155 1.6105 0.6209 6.1051 0. 1638 3.7908 0.2638 1.7716 0.5645 7.7156 0. 1296 .3553 0.2296 1.9487 0.5132 9.487 0. 1054 4.8684 0.2054 2.1436 0.4665 11.4359 0.0874 5.3349 0.1874 2.357 0.4241 13.579 0.0736 5.7590 0.1736 2.5937 0.3855 15.9374 0.0627 6.1446 0.1627 Print DoneConsider the cash flow data in the table below for two competing investment projects. At i= 11%, which of the two projects would be a better choice? Click the icon to view the cash flows for the investment projects. Click the icon to view the interest factors for discrete compounding when i = 11% per year. The PW value for project A is $ . (Round to the nearest dollar.) i More Info - X i More Info - X Single Payment Equal Payment Series Compound Present Compound Sinking Present Capital Amount Worth Amount Fund Worth Recovery Cash Flow Data Factor Factor Factor Factor Factor Factor (Unit: $ thousand) (F/P, i, N) (P/F, i, N) (F/A, i, N) (A/F, i, N) (P/A, i, N) (A/P, i, N) Project A Project B 1.1100 0.9009 1.0000 1.0000 0.9009 1.1100 - $1, 100 - $2,800 1.2321 0.8116 2.1100 0.4739 1.7125 0.5839 - 1,200 - 800 U A W N - Z 1.3676 0.7312 3.3421 0.2992 2.4437 0.4092 - 495 750 1.5181 0.6587 4.7097 0.2123 3. 1024 0.3223 965 900 1.6851 0.5935 6.2278 0. 1606 3.6959 0.2706 965 1,200 FOOD VOUIA WN - 1,315 1,830 1.8704 0.5346 7.9129 0.1264 4.2305 0.2364 1,735 1.560 2.0762 0.4817 9.7833 0. 1022 4.7122 0.2122 805 800 2.3045 0.4339 11.8594 0.0843 5.1461 0. 1943 805 860 2.5580 0.3909 14.1640 405 340 0.0706 5.5370 0. 1806 710 1.020 2.8394 0.3522 16.7220 0.0598 5.8892 0. 1698 Print Done Print DoneYou are considering two types of machines for a manufacturing process. . Machine A has a first cost of $75,200, and its salvage value at the end of six years of estimated service life is $21 ,000. The operating costs of this machine are estimated to be $6,800 per year. Extra income taxes are estimated at $2,400 per year. - Machine B has a rst cost of $44,000, and its salvage value at the end of six years' service is estimated to be negligible. The annual operating costs will be $11,500. Compare these two mutually exclusive alternatives by the present-worth method at i =13%. a Click the icon to view the interest factors for discrete compounding when i= 13% per year. The present worth for machine A is $ thousand. (Round to the nearest whole number.) o More Info 1 .0000 2.1300 3.4069 4.8498 6.4803 8.3227 10.4047 12.7573 15.4157 18.4197 l Print H Done l