You are considering two possible marketing campaigns for a new product. The first marketing campaign requires an outlay next year of 2M, and then

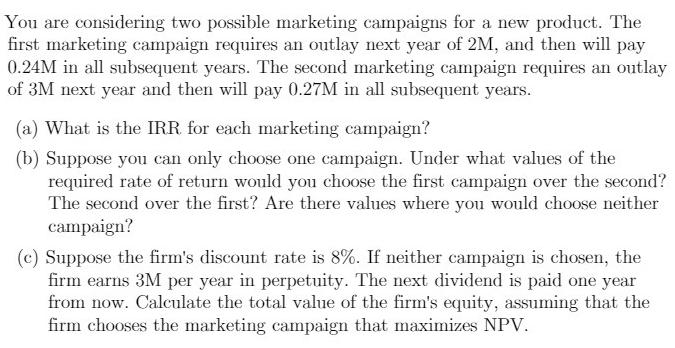

You are considering two possible marketing campaigns for a new product. The first marketing campaign requires an outlay next year of 2M, and then will pay 0.24M in all subsequent years. The second marketing campaign requires an outlay of 3M next year and then will pay 0.27M in all subsequent years. (a) What is the IRR for each marketing campaign? (b) Suppose you can only choose one campaign. Under what values of the required rate of return would you choose the first campaign over the second? The second over the first? Are there values where you would choose neither campaign? (c) Suppose the firm's discount rate is 8%. If neither campaign is chosen, the firm earns 3M per year in perpetuity. The next dividend is paid one year from now. Calculate the total value of the firm's equity, assuming that the firm chooses the marketing campaign that maximizes NPV.

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

aTo calculate the internal rate of return IRR for each marketing campaign we need to find the discount rate that sets the net present value NPV of the cash flows equal to zero For the first marketing ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started