Answered step by step

Verified Expert Solution

Question

1 Approved Answer

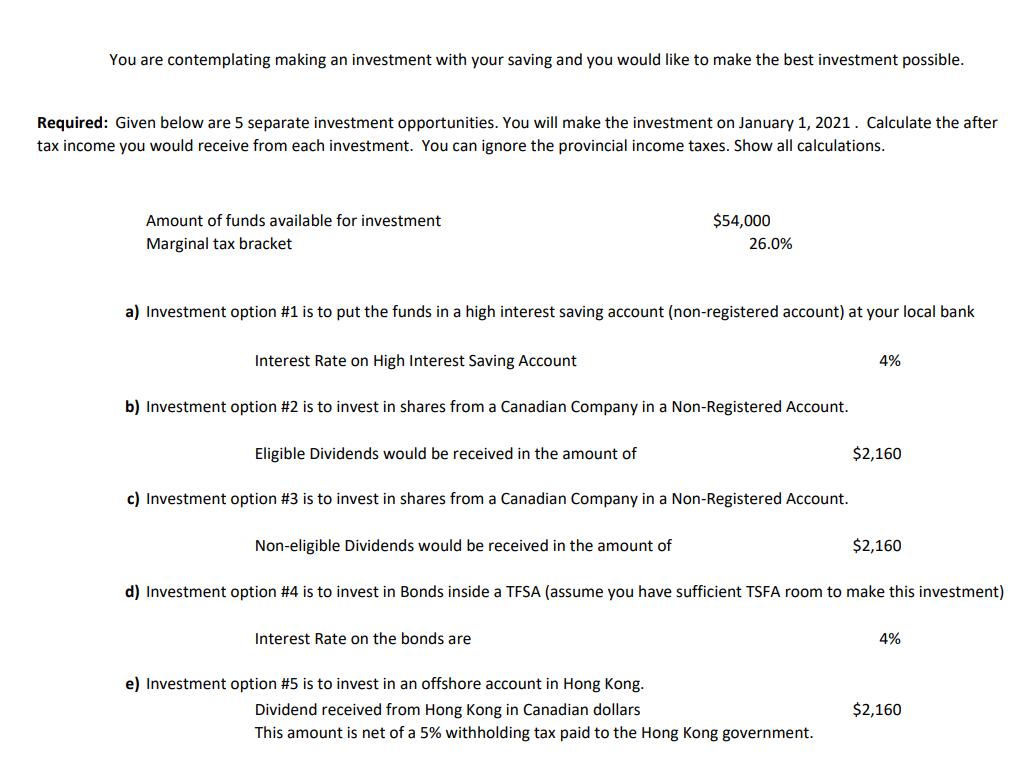

You are contemplating making an investment with your saving and you would like to make the best investment possible. Required: Given below are 5

You are contemplating making an investment with your saving and you would like to make the best investment possible. Required: Given below are 5 separate investment opportunities. You will make the investment on January 1, 2021. Calculate the after tax income you would receive from each investment. You can ignore the provincial income taxes. Show all calculations. Amount of funds available for investment Marginal tax bracket Interest Rate on High Interest Saving Account a) Investment option #1 is to put the funds in a high interest saving account (non-registered account) at your local bank Eligible Dividends would be received in the amount of b) Investment option #2 is to invest in shares from a Canadian Company in a Non-Registered Account. $54,000 Non-eligible Dividends would be received in the amount of 26.0% c) Investment option #3 is to invest in shares from a Canadian Company in a Non-Registered Account. Interest Rate on the bonds are e) Investment option #5 is to invest in an offshore account in Hong Kong. Dividend received from Hong Kong in Canadian dollars 4% d) Investment option #4 is to invest in Bonds inside a TFSA (assume you have sufficient TSFA room to make this investment) This amount is net of a 5% withholding tax paid to the Hong Kong government. $2,160 $2,160 4% $2,160

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Investment option 1 is to put the funds in a high interest saving account nonregistered acc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started