Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are currently 40 years old. You have a good job that allows you to save $800 a month in an account currently paying

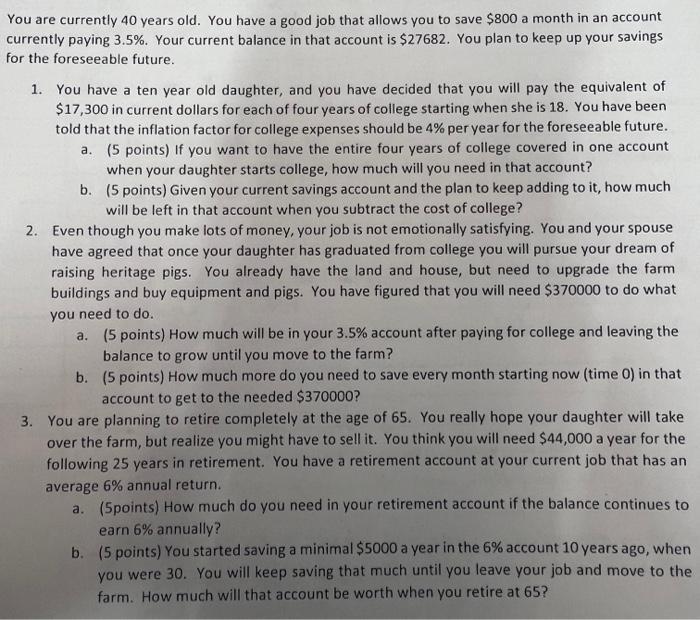

You are currently 40 years old. You have a good job that allows you to save $800 a month in an account currently paying 3.5%. Your current balance in that account is $27682. You plan to keep up your savings for the foreseeable future. 1. You have a ten year old daughter, and you have decided that you will pay the equivalent of $17,300 in current dollars for each of four years of college starting when she is 18. You have been told that the inflation factor for college expenses should be 4% per year for the foreseeable future. (5 points) If you want to have the entire four years of college covered in one account when your daughter starts college, how much will you need in that account? a. b. (5 points) Given your current savings account and the plan to keep adding to it, how much will be left in that account when you subtract the cost of college? 2. Even though you make lots of money, your job is not emotionally satisfying. You and your spouse have agreed that once your daughter has graduated from college you will pursue your dream of raising heritage pigs. You already have the land and house, but need to upgrade the farm buildings and buy equipment and pigs. You have figured that you will need $370000 to do what you need to do. a. (5 points) How much will be in your 3.5% account after paying for college and leaving the balance to grow until you move to the farm? b. (5 points) How much more do you need to save every month starting now (time 0) in that account to get to the needed $370000? 3. You are planning to retire completely at the age of 65. You really hope your daughter will take over the farm, but realize you might have to sell it. You think you will need $44,000 a year for the following 25 years in retirement. You have a retirement account at your current job that has an average 6% annual return. a. (Spoints) How much do you need in your retirement account if the balance continues to earn 6% annually? b. (5 points) You started saving a minimal $5000 a year in the 6% account 10 years ago, when you were 30. You will keep saving that much until you leave your job and move to the farm. How much will that account be worth when you retire at 65?

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 1 a College will cost 17300 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started