Question

You are currently 55 years old and intend to retire at age 60. To make your retirement easier, you intend to start a retirement account.

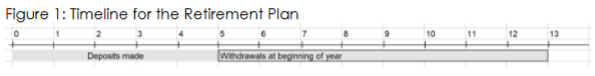

You are currently 55 years old and intend to retire at age 60. To make your retirement easier, you intend to start a retirement account. At the beginning of each years 1, 2, 3, 4 (that is, starting today and at the beginning of each of the next four years), you intend to make a deposit into the retirement account. You assume that the account will earn 8% per year. After retirement at age 60, you anticipate living 8 more years. At the beginning of each of these years, you want to withdraw $30,000 from your retirement account. Your account balances will continue to earn 8% annually. The following figure depicts the timeline. As a challenging problem faced by the retirement plan, one primary question is: How much should you deposit annually in the account?

Solve the problem with Excel

Cash-Flow Formula, e.g., PMT The second approach is based on the following equality: Present value of withdrawals=Present Value of Deposits In this case, you may track the present value of withdraws, which can be treated as an initial loan. Therefore, the annual deposit can be obtained via =PMT() to compute the payment. Compare the results via both approaches, they should be the same. Otherwise, there should be some error. As a manager of retirement plan, it is necessary to have some sense of what-ifs. As the last task of this project, please consider the case with annual interest rate of 10% and 12%, in lieu of 8%. Comparing those annual deposits associated with those annual interest rates. What is your observation? Please comment and explain.

Figure 1: Timeline for the Retirement Plan 10 11 12 13 Deposits made Wthdrawals at beginning of your Figure 1: Timeline for the Retirement Plan 10 11 12 13 Deposits made Wthdrawals at beginning of yourStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started