Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are currently busy with the planning of the audit for Spring Arrows CC for the financial year end 31 May 2020. The company

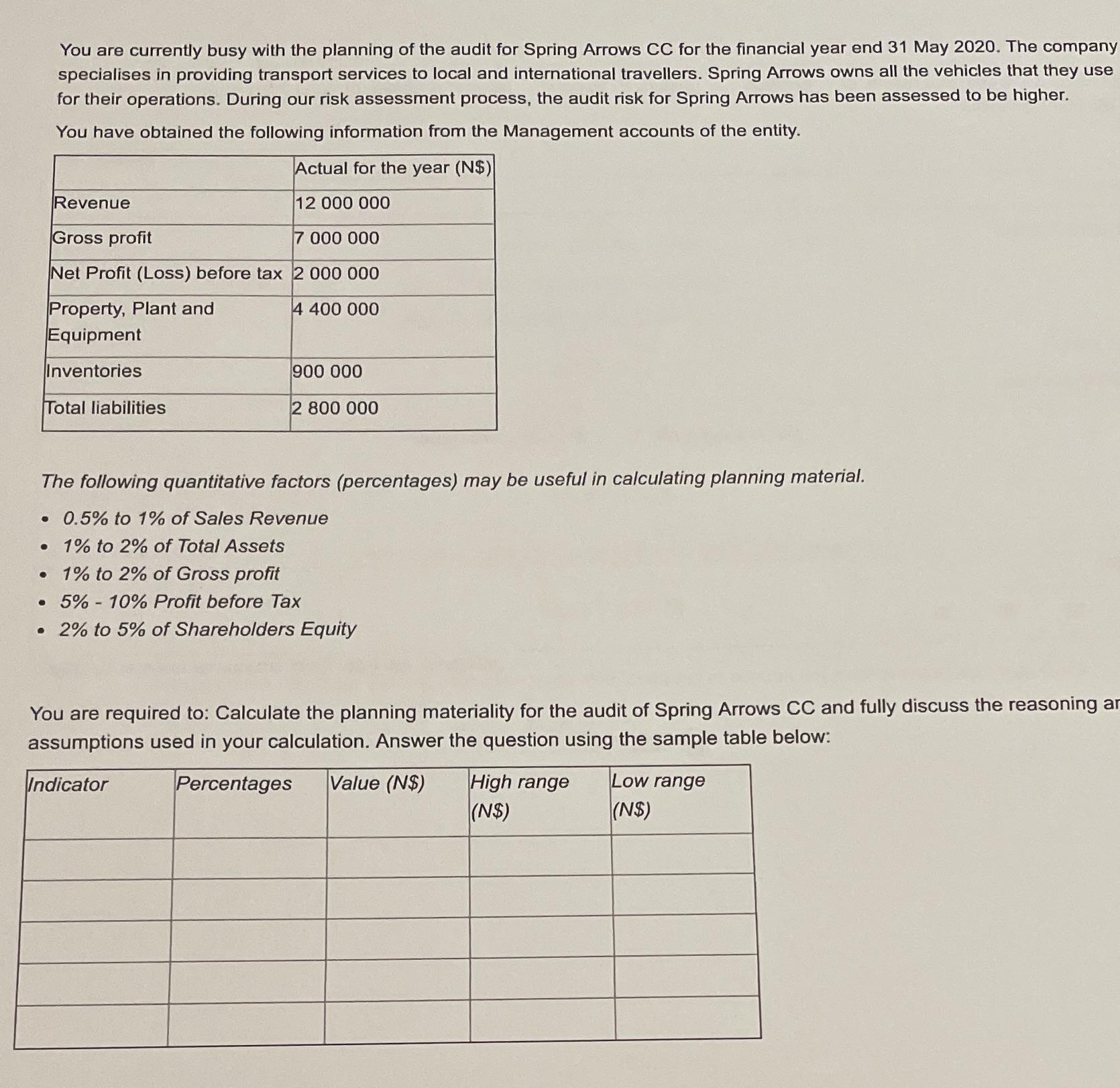

You are currently busy with the planning of the audit for Spring Arrows CC for the financial year end 31 May 2020. The company specialises in providing transport services to local and international travellers. Spring Arrows owns all the vehicles that they use for their operations. During our risk assessment process, the audit risk for Spring Arrows has been assessed to be higher. You have obtained the following information from the Management accounts of the entity. Actual for the year (N$) Revenue 12 000 000 Gross profit 7 000 000 Net Profit (Loss) before tax 2 000 000 perty, Plant and 4 400 000 Equipment Inventories Total liabilities 900 000 2 800 000 The following quantitative factors (percentages) may be useful in calculating planning material. . 0.5% to 1% of Sales Revenue . 1% to 2% of Total Assets 1% to 2% of Gross profit . 5%-10% Profit before Tax 2% to 5% of Shareholders Equity You are required to: Calculate the planning materiality for the audit of Spring Arrows CC and fully discuss the reasoning ar assumptions used in your calculation. Answer the question using the sample table below: Indicator Percentages Value (N$) High range (N$) Low range (N$)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Planning materiality is the threshold used by auditors to determine the level of misstatement in the financial statements that would be considered mat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started