Answered step by step

Verified Expert Solution

Question

1 Approved Answer

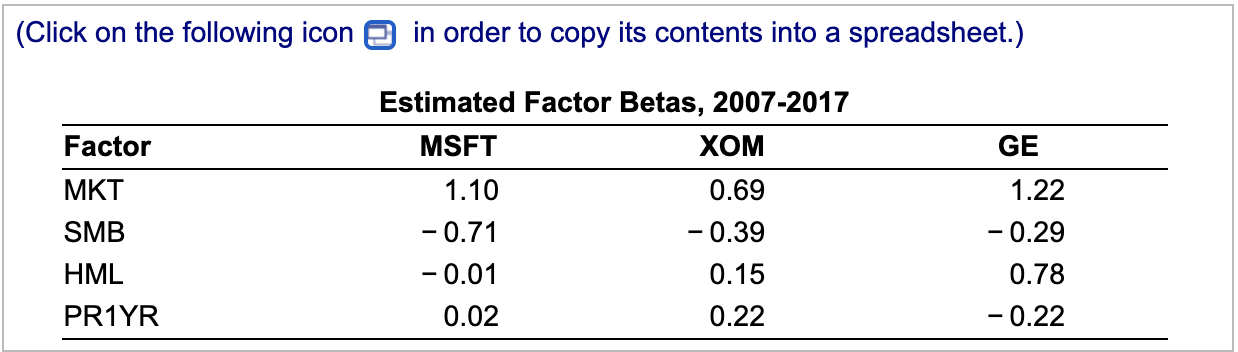

You are currently considering an investment in a project in the energy sector. The investment has the same riskiness as Exxon Mobil stock (ticker:

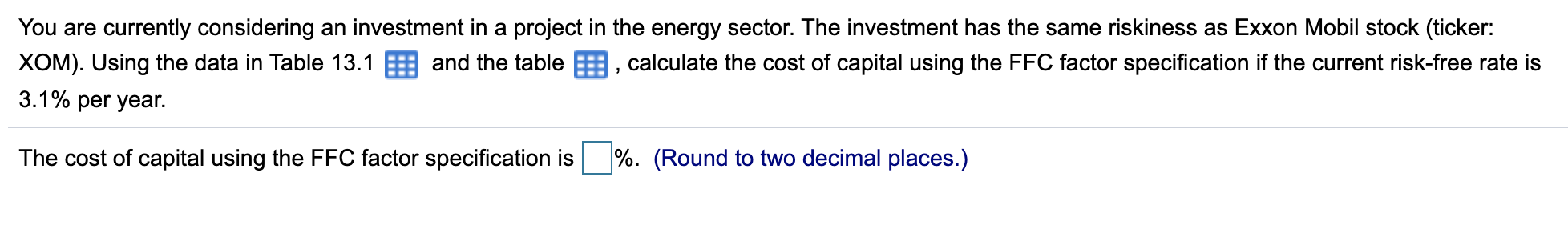

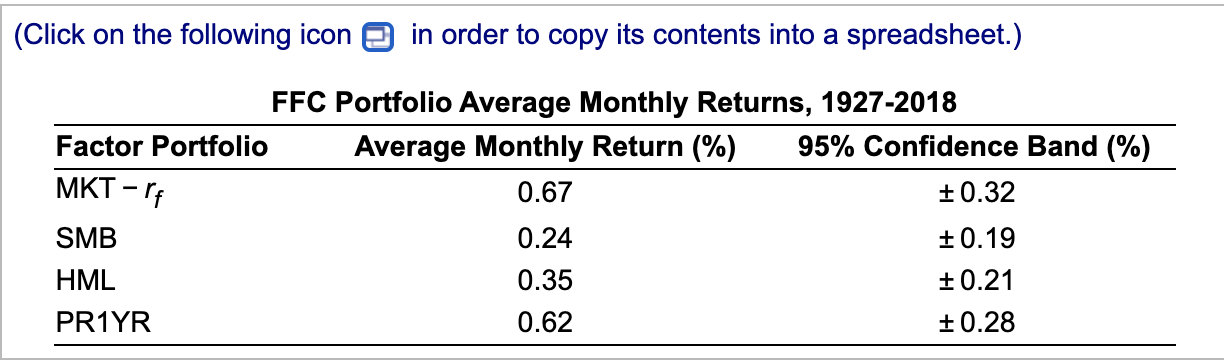

You are currently considering an investment in a project in the energy sector. The investment has the same riskiness as Exxon Mobil stock (ticker: XOM). Using the data in Table 13.1 and the table calculate the cost of capital using the FFC factor specification if the current risk-free rate is 3.1% per year. The cost of capital using the FFC factor specification is %. (Round to two decimal places.) (Click on the following icon in order to copy its contents into a spreadsheet.) Factor Portfolio FFC Portfolio Average Monthly Returns, 1927-2018 Average Monthly Return (%) 0.67 95% Confidence Band (%) MKT -rf SMB HML PR1YR 0.24 0.35 0.62 0.32 0.19 0.21 0.28 (Click on the following icon in order to copy its contents into a spreadsheet.) Estimated Factor Betas, 2007-2017 Factor MSFT XOM GE MKT 1.10 0.69 1.22 SMB -0.71 -0.39 -0.29 HML -0.01 0.15 0.78 PR1YR 0.02 0.22 -0.22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started