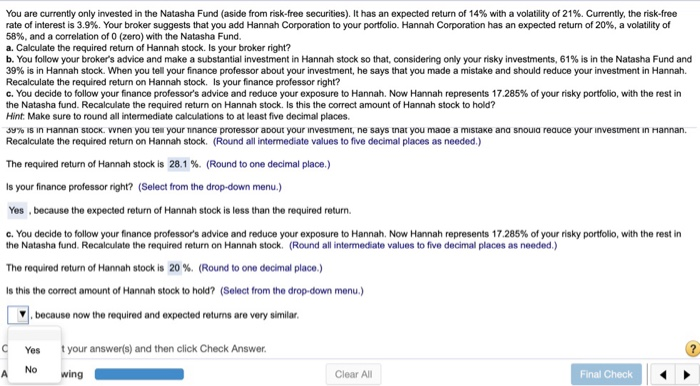

You are currently only invested in the Natasha Fund aside from risk-free securities). It has an expected return of 14% with a volatility of 21%. Currently, the risk-free rate of interest is 3.9%. Your broker suggests that you add Hannah Corporation to your portfolio. Hannah Corporation has an expected return of 20%, a volatility of 58%, and a correlation of 0 (zero) with the Natasha Fund. a. Calculate the required return of Hannah stock. Is your broker right? b You follow your broker's advice and make a substantial investment in Hannah stock so that considering only your risky investments 61% is in the Natasha Fund and 39% is in Hannah stock. When you tell your finance professor about your investment, he says that you made a mistake and should reduce your investment in Hannah. Recalculate the required return on Hannah stock. Is your finance professor right? c. You decide to follow your finance professor's advice and reduce your exposure to Hannah. Now Hannah represents 17.285% of your risky portfolio with the rest in the Natasha fund. Recalculate the required return on Hannah stock. Is this the correct amount of Hannah stock to hold? Hint: Make sure to round all intermediate calculations to at least five decimal places. 3To is in Hannan stock. Vvnen you tea your nance protessor apout your investment, ne says tnat you maoe a mistake ana snouia reauce your investment in Hannan. Recalculate the required return on Hannah stock. (Round all intermediate values to five decimal places as needed.) The required return of Hannah stock is 28.1 %. (Round to one decimal place.) Is your finance professor right? (Select from the drop-down menu.) Yes, because the expected return of Hannah stock is less than the required return. c. You decide to follow your finance professor's advice and reduce your exposure to Hannah. Now Hannah represents 17.285% of your risky portfolio with the rest in the Natasha fund. Recalculate the required return on Hannah stock. (Round all intermediate values to five decimal places as needed.) The required return of Hannah stock is 20 %. (Round to one decimal place.) Is this the correct amount of Hannah stock to hold? (Select from the drop-down menu.) because now the required and expected returns are very similar your answerls) and then click Check Answer. Yes No wing Clear All Final Check