Answered step by step

Verified Expert Solution

Question

1 Approved Answer

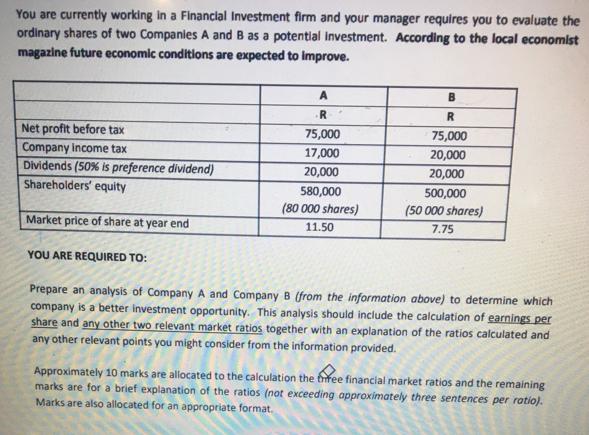

You are currently working in a Financial Investment firm and your manager requires you to evaluate the ordinary shares of two Companies A and

You are currently working in a Financial Investment firm and your manager requires you to evaluate the ordinary shares of two Companies A and B as a potential Investment. According to the local economist magazine future economic conditions are expected to improve. Net profit before tax Company income tax Dividends (50% is preference dividend) Shareholders' equity Market price of share at year end A R 75,000 17,000 20,000 580,000 (80 000 shares) 11.50 B R 75,000 20,000 20,000 500,000 (50 000 shares) 7.75 YOU ARE REQUIRED TO: Prepare an analysis of Company A and Company B (from the information above) to determine which company is a better investment opportunity. This analysis should include the calculation of earnings per share and any other two relevant market ratios together with an explanation of the ratios calculated and any other relevant points you might consider from the information provided. Approximately 10 marks are allocated to the calculation the free financial market ratios and the remaining marks are for a brief explanation of the ratios (not exceeding approximately three sentences per ratio). Marks are also allocated for an appropriate format.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine which company is a better investment opportunity we can calculate some financi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started