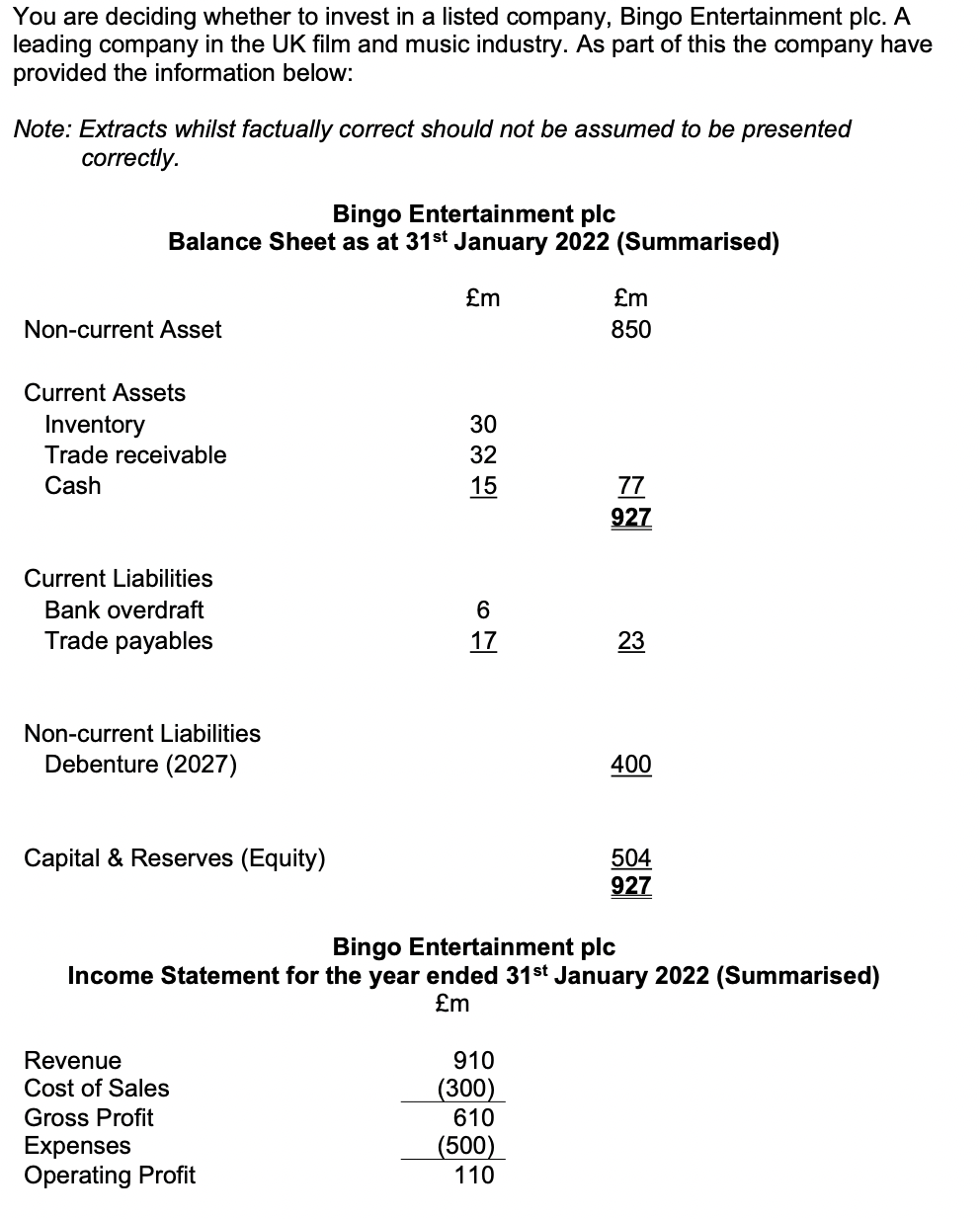

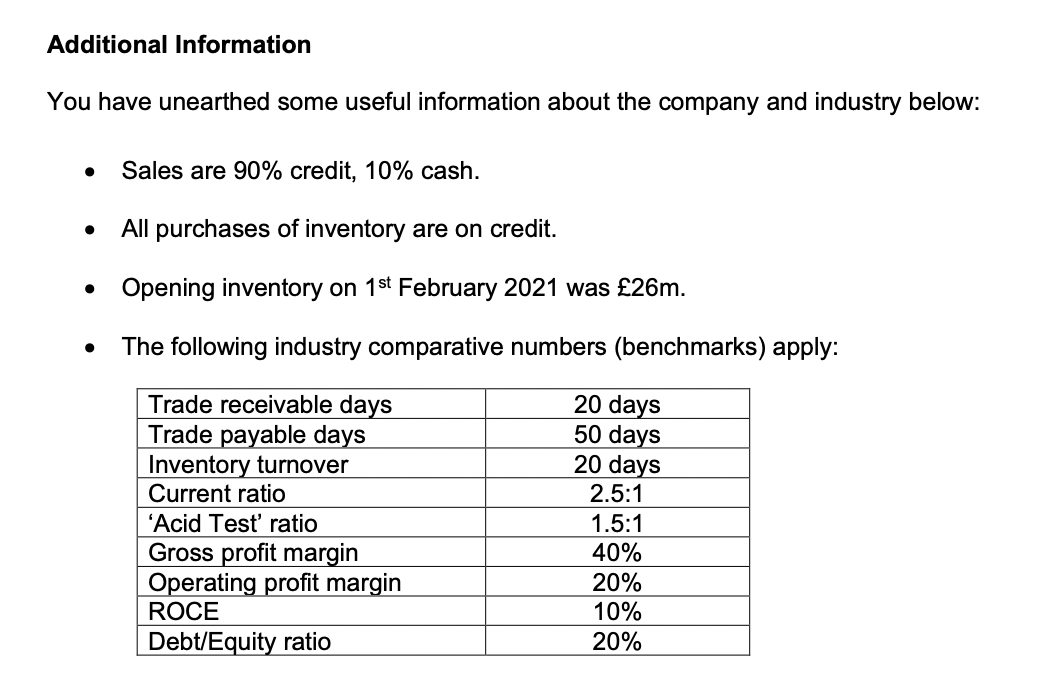

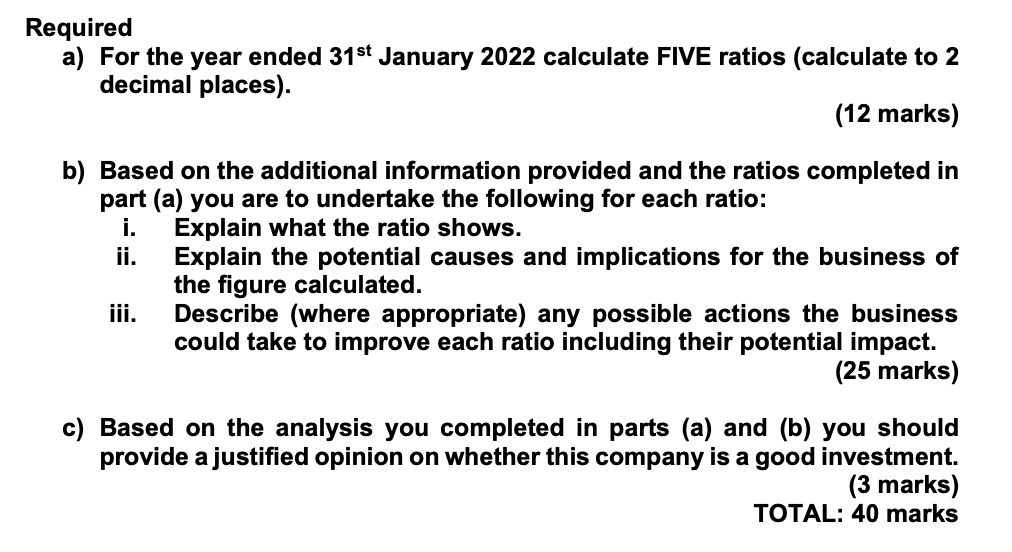

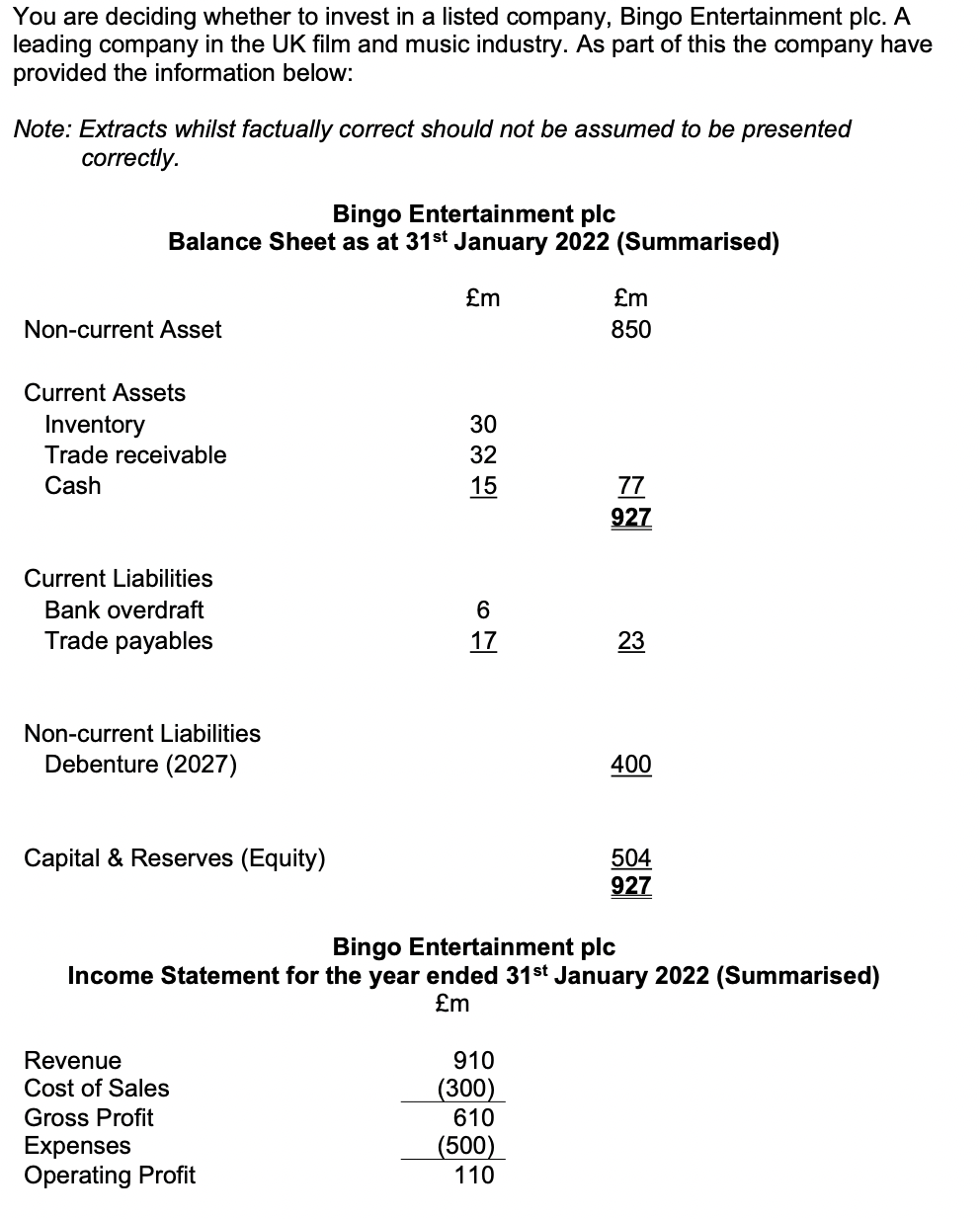

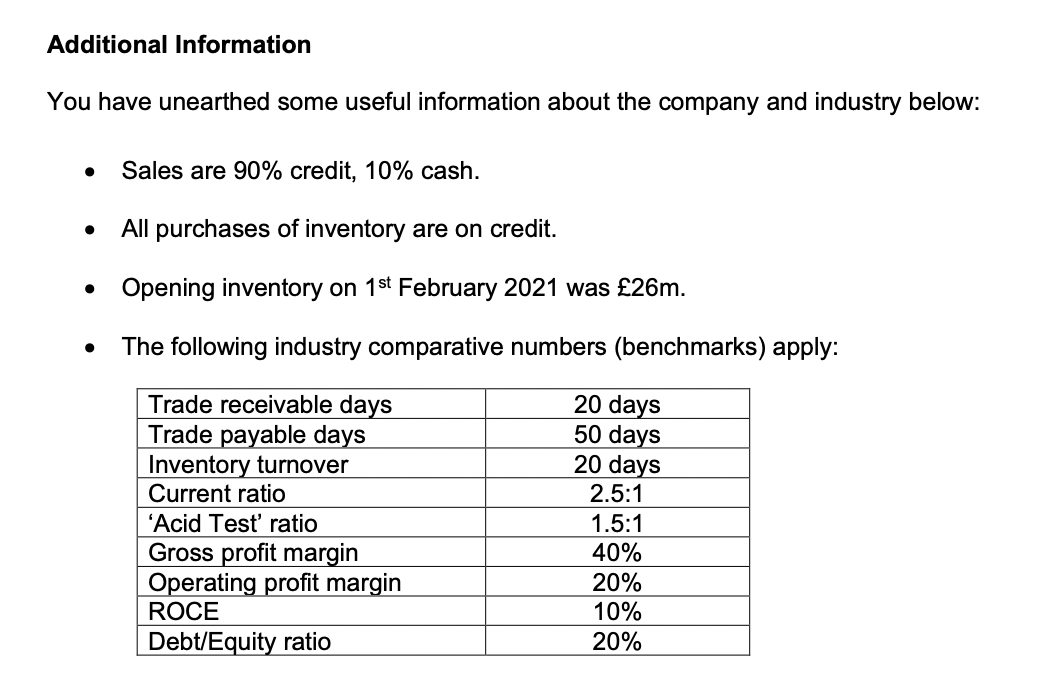

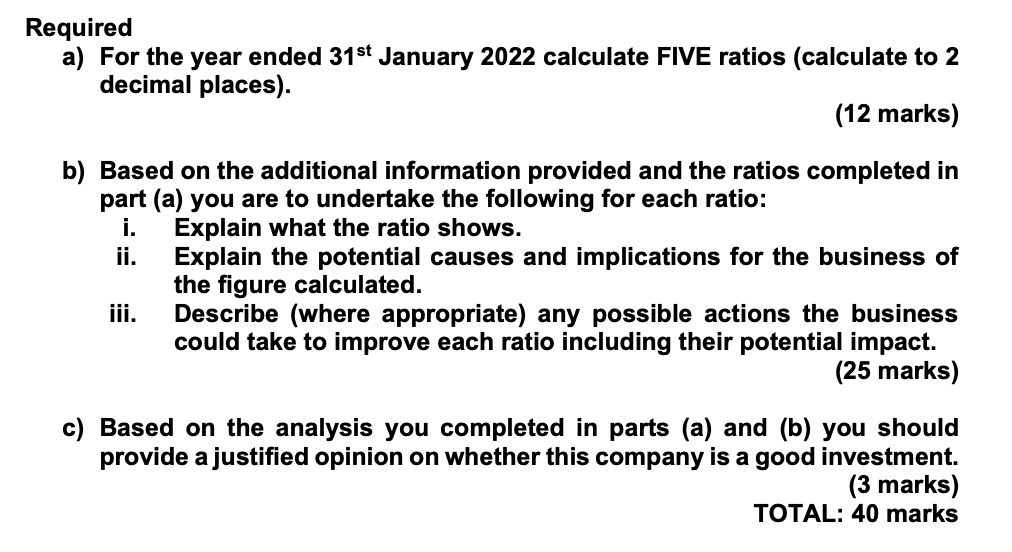

You are deciding whether to invest in a listed company, Bingo Entertainment plc. A leading company in the UK film and music industry. As part of this the company have provided the information below: Note: Extracts whilst factually correct should not be assumed to be presented correctly. Bingo Entertainment plc Balance Sheet as at 31st January 2022 (Summarised) m m 850 Non-current Asset Current Assets Inventory Trade receivable Cash 30 32 15 77 927 Current Liabilities Bank overdraft Trade payables 6 17 23 Non-current Liabilities Debenture (2027) 400 Capital & Reserves (Equity) 504 927 Bingo Entertainment plc Income Statement for the year ended 31st January 2022 (Summarised) m Revenue Cost of Sales Gross Profit Expenses Operating Profit 910 (300) 610 (500) 110 Additional Information You have unearthed some useful information about the company and industry below: Sales are 90% credit, 10% cash. All purchases of inventory are on credit. Opening inventory on 1st February 2021 was 26m. The following industry comparative numbers (benchmarks) apply: Trade receivable days Trade payable days Inventory turnover Current ratio 'Acid Test ratio Gross profit margin Operating profit margin ROCE Debt/Equity ratio 20 days 50 days 20 days 2.5:1 1.5:1 40% 20% 10% 20% Required a) For the year ended 31st January 2022 calculate FIVE ratios (calculate to 2 decimal places). (12 marks) b) Based on the additional information provided and the ratios completed in part (a) you are to undertake the following for each ratio: i. Explain what the ratio shows. ii. Explain the potential causes and implications for the business of the figure calculated. Describe (where appropriate) any possible actions the business could take to improve each ratio including their potential impact. (25 marks) c) Based on the analysis you completed in parts (a) and (b) you should provide a justified opinion on whether this company is a good investment. (3 marks) TOTAL: 40 marks You are deciding whether to invest in a listed company, Bingo Entertainment plc. A leading company in the UK film and music industry. As part of this the company have provided the information below: Note: Extracts whilst factually correct should not be assumed to be presented correctly. Bingo Entertainment plc Balance Sheet as at 31st January 2022 (Summarised) m m 850 Non-current Asset Current Assets Inventory Trade receivable Cash 30 32 15 77 927 Current Liabilities Bank overdraft Trade payables 6 17 23 Non-current Liabilities Debenture (2027) 400 Capital & Reserves (Equity) 504 927 Bingo Entertainment plc Income Statement for the year ended 31st January 2022 (Summarised) m Revenue Cost of Sales Gross Profit Expenses Operating Profit 910 (300) 610 (500) 110 Additional Information You have unearthed some useful information about the company and industry below: Sales are 90% credit, 10% cash. All purchases of inventory are on credit. Opening inventory on 1st February 2021 was 26m. The following industry comparative numbers (benchmarks) apply: Trade receivable days Trade payable days Inventory turnover Current ratio 'Acid Test ratio Gross profit margin Operating profit margin ROCE Debt/Equity ratio 20 days 50 days 20 days 2.5:1 1.5:1 40% 20% 10% 20% Required a) For the year ended 31st January 2022 calculate FIVE ratios (calculate to 2 decimal places). (12 marks) b) Based on the additional information provided and the ratios completed in part (a) you are to undertake the following for each ratio: i. Explain what the ratio shows. ii. Explain the potential causes and implications for the business of the figure calculated. Describe (where appropriate) any possible actions the business could take to improve each ratio including their potential impact. (25 marks) c) Based on the analysis you completed in parts (a) and (b) you should provide a justified opinion on whether this company is a good investment. (3 marks) TOTAL: 40 marks