Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are determined to have at least one million dollars on the day you retire. How much will you need to save each year over

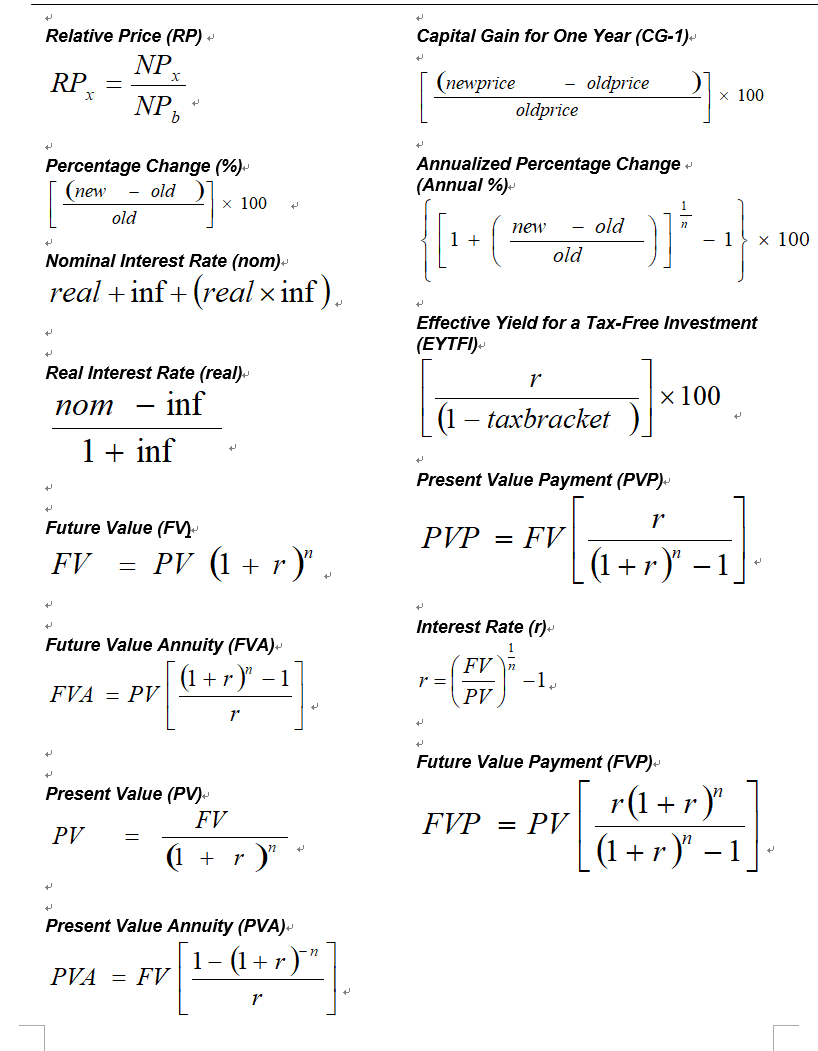

You are determined to have at least one million dollars on the day you retire. How much will you need to save each year over the next 40 years of your career in order to meet this goal of $1,000,000 assuming you put you money into an account that averages 10% each year?

show the step and which formula is used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started