Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are discussing the investment of your pen- You are die with Sam in Lee, a representative of Red Rock Financial Services. Samson is

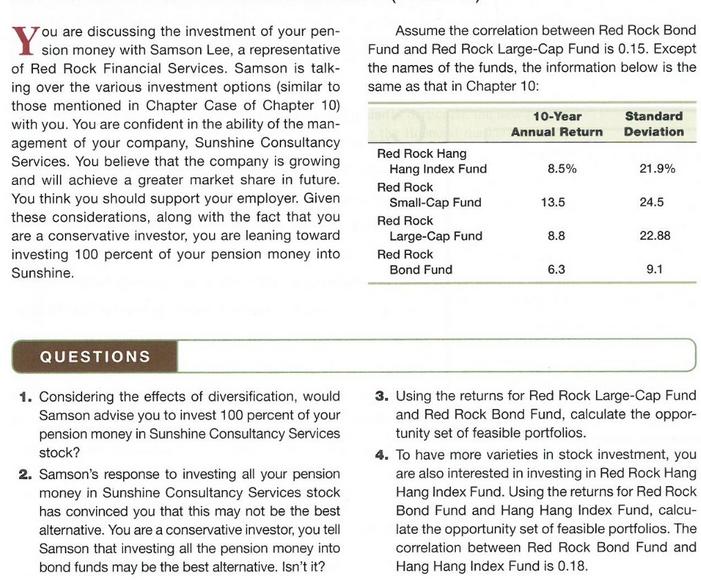

You are discussing the investment of your pen- You are die with Sam in Lee, a representative of Red Rock Financial Services. Samson is talk- ing over the various investment options (similar to those mentioned in Chapter Case of Chapter 10) with you. You are confident in the ability of the man- agement of your company, Sunshine Consultancy Services. You believe that the company is growing and will achieve a greater market share in future. You think you should support your employer. Given these considerations, along with the fact that you are a conservative investor, you are leaning toward investing 100 percent of your pension money into Sunshine. Assume the correlation between Red Rock Bond Fund and Red Rock Large-Cap Fund is 0.15. Except the names of the funds, the information below is the same as that in Chapter 10: Red Rock Hang Hang Index Fund Red Rock 10-Year Annual Return Standard Deviation 8.5% 21.9% Small-Cap Fund Red Rock 13.5 24.5 Large-Cap Fund 8.8 22.88 Red Rock Bond Fund 6.3 9.1 QUESTIONS 1. Considering the effects of diversification, would Samson advise you to invest 100 percent of your pension money in Sunshine Consultancy Services stock? 2. Samson's response to investing all your pension money in Sunshine Consultancy Services stock has convinced you that this may not be the best alternative. You are a conservative investor, you tell Samson that investing all the pension money into bond funds may be the best alternative. Isn't it? 3. Using the returns for Red Rock Large-Cap Fund and Red Rock Bond Fund, calculate the oppor- tunity set of feasible portfolios. 4. To have more varieties in stock investment, you are also interested in investing in Red Rock Hang Hang Index Fund. Using the returns for Red Rock Bond Fund and Hang Hang Index Fund, calcu- late the opportunity set of feasible portfolios. The correlation between Red Rock Bond Fund and Hang Hang Index Fund is 0.18.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started