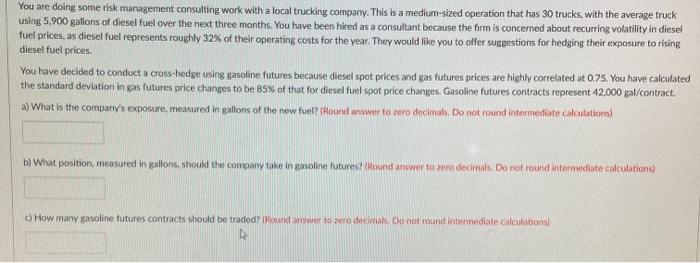

You are doing some risk management consulting work with a local trucking company. This is a medium-sized operation that has 30 trucks, with the average truck using 5,900 gallons of diesel fuel over the next three months. You have been hired as a consultant because the firm is concerned about recurring volatility in diesel fuel prices, as diesel fuel represents roughly 32% of their operating costs for the year. They would like you to offer suggestions for hedging their exposure to rising diesel fuel prices You have decided to conduct a cross-hedge usine sasoline futures because diesel spet prices and gas futures prices are highly correlated at 0.75. You have calculated the standard deviation in gas futures price changes to be 85% of that for diesel fuel spot price changes. Gasoline futures contracts represent 42.000 gal/contract. a) What is the company's exposure measured in gallons of the new fuel? (Round answer to zero decimal. Do not round intermediate calculatora) b) What position, measured in gallons, should the company take in gasoline futures? (Round answer to zero decimals. Do not round intermediate calculations) How many casoline futures contracts should be traded Round answer to zero decimus. Do not round intermediate calculations! You are doing some risk management consulting work with a local trucking company. This is a medium-sized operation that has 30 trucks, with the average truck using 5,900 gallons of diesel fuel over the next three months. You have been hired as a consultant because the firm is concerned about recurring volatility in diesel fuel prices, as diesel fuel represents roughly 32% of their operating costs for the year. They would like you to offer suggestions for hedging their exposure to rising diesel fuel prices You have decided to conduct a cross-hedge usine sasoline futures because diesel spet prices and gas futures prices are highly correlated at 0.75. You have calculated the standard deviation in gas futures price changes to be 85% of that for diesel fuel spot price changes. Gasoline futures contracts represent 42.000 gal/contract. a) What is the company's exposure measured in gallons of the new fuel? (Round answer to zero decimal. Do not round intermediate calculatora) b) What position, measured in gallons, should the company take in gasoline futures? (Round answer to zero decimals. Do not round intermediate calculations) How many casoline futures contracts should be traded Round answer to zero decimus. Do not round intermediate calculations