Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are employed by an audit firm as audit assistant. You have been seconded to PJ Bhd, a trading and manufacturing company, to help

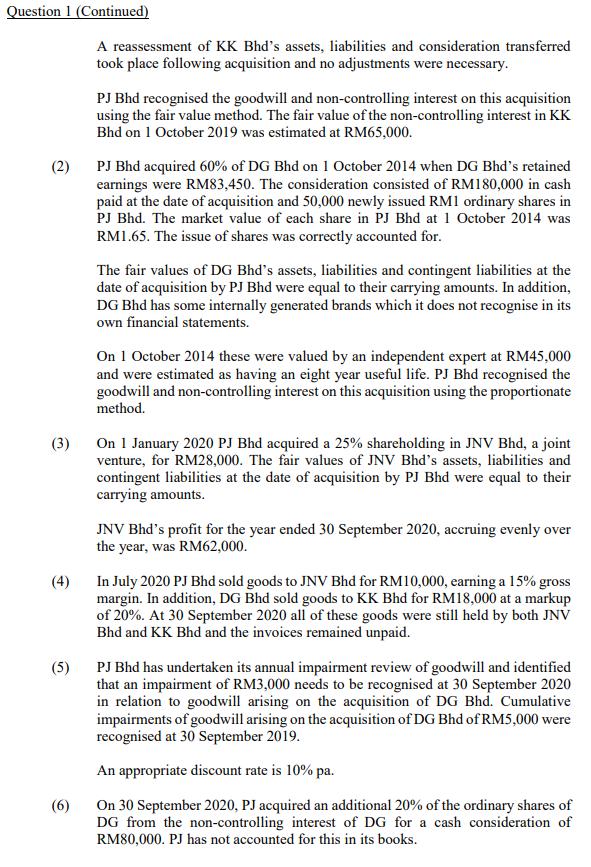

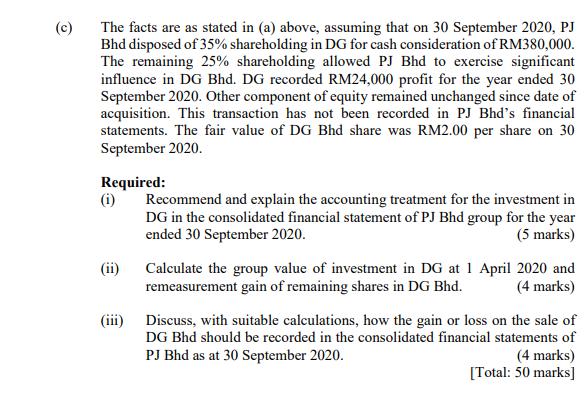

You are employed by an audit firm as audit assistant. You have been seconded to PJ Bhd, a trading and manufacturing company, to help with the preparation of their consolidated financial statements for the year ended 30 September 2020. At 1 October 2019, PJ Bhd had investments in two subsidiaries, KK Bhd and DG Bhd, as well as a number of other small investments. The draft summarised statements of financial position for PJ Bhd and its two subsidiaries at 30 September 2020 are shown below: PJ DG ASSETS RM RM RM Non-current assets 533,000 369,000 390,000 Property, plant and equipment Investments 554,000 Current assets Inventories 75,300 53,700 35,900 Trade and other receivables 98,600 39,600 29,000 5,400 2.700 2.300 Cash and cash equivalents Total assets 1.266.300 465.000 457,200 EQUITY AND LIABILITIES Equity Ordinary share capital 650,000 210,000 250,000 Other components of equity (OCE) 150,000 25,000 Retained earnings 132,300 147,000 123,000 Non-current liabilities Deferred consideration 121,000 Current liabilities 112,000 51,000 38,200 Trade and other payables Income tax 101,000 32.000 46.000 Total equity and liabilities 1.266.300 465.000 457.200 Number of ordinary shares 650,000 210,000 250,000 Additional information: (1) On 1 October 2019 PJ Bhd acquired 80% of KK Bhd for RM261,000 when KK Bhd's retained earnings were RM112,500. RM140,000 was paid immediately and the remaining RM121,000 is payable on 1 October 2021. The full RM261,000 was recognized by PJ Bhd as a non-current asset investment and a liability was set up for the deferred consideration. The fair values of KK Bhd's assets and liabilities at the date of acquisition by PJ Bhd were equal to their carrying amounts. In addition, a contingent liability which had been reliably measured at a fair value of RM32,000 was disclosed, but not recognised, in KK Bhd's financial statements for the year ended 30 September 2020. This amount was subsequently settled at the estimated fair value. Question 1 (Continued) A reassessment of KK Bhd's assets, liabilities and consideration transferred took place following acquisition and no adjustments were necessary. PJ Bhd recognised the goodwill and non-controlling interest on this acquisition using the fair value method. The fair value of the non-controlling interest in KK Bhd on 1 October 2019 was estimated at RM65,000. (2) PJ Bhd acquired 60% of DG Bhd on 1 October 2014 when DG Bhd's retained earnings were RM83,450. The consideration consisted of RM180,000 in cash paid at the date of acquisition and 50,000 newly issued RM1 ordinary shares in PJ Bhd. The market value of each share in PJ Bhd at 1 October 2014 was RM1.65. The issue of shares was correctly accounted for. The fair values of DG Bhd's assets, liabilities and contingent liabilities at the date of acquisition by PJ Bhd were equal to their carrying amounts. In addition, DG Bhd has some internally generated brands which it does not recognise in its own financial statements. On 1 October 2014 these were valued by an independent expert at RM45,000 and were estimated as having an eight year useful life. PJ Bhd recognised the goodwill and non-controlling interest on this acquisition using the proportionate method. (3) On 1 January 2020 PJ Bhd acquired a 25% shareholding in JNV Bhd, a joint venture, for RM28,000. The fair values of JNV Bhd's assets, liabilities and contingent liabilities at the date of acquisition by PJ Bhd were equal to their carrying amounts. JNV Bhd's profit for the year ended 30 September 2020, accruing evenly over the year, was RM62,000. (4) In July 2020 PJ Bhd sold goods to JNV Bhd for RM10,000, earning a 15% gross margin. In addition, DG Bhd sold goods to KK Bhd for RM18,000 at a markup of 20%. At 30 September 2020 all of these goods were still held by both JNV Bhd and KK Bhd and the invoices remained unpaid. (5) PJ Bhd has undertaken its annual impairment review of goodwill and identified that an impairment of RM3,000 needs to be recognised at 30 September 2020 in relation to goodwill arising on the acquisition of DG Bhd. Cumulative impairments of goodwill arising on the acquisition of DG Bhd of RM5,000 were recognised at 30 September 2019. An appropriate discount rate is 10% pa. (6) On 30 September 2020, PJ acquired an additional 20% of the ordinary shares of DG from the non-controlling interest of DG for a cash consideration of RM80,000. PJ has not accounted for this in its books. (c) The facts are as stated in (a) above, assuming that on 30 September 2020, PJ Bhd disposed of 35% shareholding in DG for cash consideration of RM380,000. The remaining 25% shareholding allowed PJ Bhd to exercise significant influence in DG Bhd. DG recorded RM24,000 profit for the year ended 30 September 2020. Other component of equity remained unchanged since date of acquisition. This transaction has not been recorded in PJ Bhd's financial statements. The fair value of DG Bhd share was RM2.00 per share on 30 September 2020. Required: (i) Recommend and explain the accounting treatment for the investment in DG in the consolidated financial statement of PJ Bhd group for the year ended 30 September 2020. (5 marks) (ii) Calculate the group value of investment in DG at 1 April 2020 and remeasurement gain of remaining shares in DG Bhd. (4 marks) (iii) Discuss, with suitable calculations, how the gain or loss on the sale of DG Bhd should be recorded in the consolidated financial statements of PJ Bhd as at 30 September 2020. (4 marks) [Total: 50 marks] You are employed by an audit firm as audit assistant. You have been seconded to PJ Bhd, a trading and manufacturing company, to help with the preparation of their consolidated financial statements for the year ended 30 September 2020. At 1 October 2019, PJ Bhd had investments in two subsidiaries, KK Bhd and DG Bhd, as well as a number of other small investments. The draft summarised statements of financial position for PJ Bhd and its two subsidiaries at 30 September 2020 are shown below: PJ DG ASSETS RM RM RM Non-current assets 533,000 369,000 390,000 Property, plant and equipment Investments 554,000 Current assets Inventories 75,300 53,700 35,900 Trade and other receivables 98,600 39,600 29,000 5,400 2.700 2.300 Cash and cash equivalents Total assets 1.266.300 465.000 457,200 EQUITY AND LIABILITIES Equity Ordinary share capital 650,000 210,000 250,000 Other components of equity (OCE) 150,000 25,000 Retained earnings 132,300 147,000 123,000 Non-current liabilities Deferred consideration 121,000 Current liabilities 112,000 51,000 38,200 Trade and other payables Income tax 101,000 32.000 46.000 Total equity and liabilities 1.266.300 465.000 457.200 Number of ordinary shares 650,000 210,000 250,000 Additional information: (1) On 1 October 2019 PJ Bhd acquired 80% of KK Bhd for RM261,000 when KK Bhd's retained earnings were RM112,500. RM140,000 was paid immediately and the remaining RM121,000 is payable on 1 October 2021. The full RM261,000 was recognized by PJ Bhd as a non-current asset investment and a liability was set up for the deferred consideration. The fair values of KK Bhd's assets and liabilities at the date of acquisition by PJ Bhd were equal to their carrying amounts. In addition, a contingent liability which had been reliably measured at a fair value of RM32,000 was disclosed, but not recognised, in KK Bhd's financial statements for the year ended 30 September 2020. This amount was subsequently settled at the estimated fair value. Question 1 (Continued) A reassessment of KK Bhd's assets, liabilities and consideration transferred took place following acquisition and no adjustments were necessary. PJ Bhd recognised the goodwill and non-controlling interest on this acquisition using the fair value method. The fair value of the non-controlling interest in KK Bhd on 1 October 2019 was estimated at RM65,000. (2) PJ Bhd acquired 60% of DG Bhd on 1 October 2014 when DG Bhd's retained earnings were RM83,450. The consideration consisted of RM180,000 in cash paid at the date of acquisition and 50,000 newly issued RM1 ordinary shares in PJ Bhd. The market value of each share in PJ Bhd at 1 October 2014 was RM1.65. The issue of shares was correctly accounted for. The fair values of DG Bhd's assets, liabilities and contingent liabilities at the date of acquisition by PJ Bhd were equal to their carrying amounts. In addition, DG Bhd has some internally generated brands which it does not recognise in its own financial statements. On 1 October 2014 these were valued by an independent expert at RM45,000 and were estimated as having an eight year useful life. PJ Bhd recognised the goodwill and non-controlling interest on this acquisition using the proportionate method. (3) On 1 January 2020 PJ Bhd acquired a 25% shareholding in JNV Bhd, a joint venture, for RM28,000. The fair values of JNV Bhd's assets, liabilities and contingent liabilities at the date of acquisition by PJ Bhd were equal to their carrying amounts. JNV Bhd's profit for the year ended 30 September 2020, accruing evenly over the year, was RM62,000. (4) In July 2020 PJ Bhd sold goods to JNV Bhd for RM10,000, earning a 15% gross margin. In addition, DG Bhd sold goods to KK Bhd for RM18,000 at a markup of 20%. At 30 September 2020 all of these goods were still held by both JNV Bhd and KK Bhd and the invoices remained unpaid. (5) PJ Bhd has undertaken its annual impairment review of goodwill and identified that an impairment of RM3,000 needs to be recognised at 30 September 2020 in relation to goodwill arising on the acquisition of DG Bhd. Cumulative impairments of goodwill arising on the acquisition of DG Bhd of RM5,000 were recognised at 30 September 2019. An appropriate discount rate is 10% pa. (6) On 30 September 2020, PJ acquired an additional 20% of the ordinary shares of DG from the non-controlling interest of DG for a cash consideration of RM80,000. PJ has not accounted for this in its books. (c) The facts are as stated in (a) above, assuming that on 30 September 2020, PJ Bhd disposed of 35% shareholding in DG for cash consideration of RM380,000. The remaining 25% shareholding allowed PJ Bhd to exercise significant influence in DG Bhd. DG recorded RM24,000 profit for the year ended 30 September 2020. Other component of equity remained unchanged since date of acquisition. This transaction has not been recorded in PJ Bhd's financial statements. The fair value of DG Bhd share was RM2.00 per share on 30 September 2020. Required: (i) Recommend and explain the accounting treatment for the investment in DG in the consolidated financial statement of PJ Bhd group for the year ended 30 September 2020. (5 marks) (ii) Calculate the group value of investment in DG at 1 April 2020 and remeasurement gain of remaining shares in DG Bhd. (4 marks) (iii) Discuss, with suitable calculations, how the gain or loss on the sale of DG Bhd should be recorded in the consolidated financial statements of PJ Bhd as at 30 September 2020. (4 marks) [Total: 50 marks] You are employed by an audit firm as audit assistant. You have been seconded to PJ Bhd, a trading and manufacturing company, to help with the preparation of their consolidated financial statements for the year ended 30 September 2020. At 1 October 2019, PJ Bhd had investments in two subsidiaries, KK Bhd and DG Bhd, as well as a number of other small investments. The draft summarised statements of financial position for PJ Bhd and its two subsidiaries at 30 September 2020 are shown below: PJ DG ASSETS RM RM RM Non-current assets 533,000 369,000 390,000 Property, plant and equipment Investments 554,000 Current assets Inventories 75,300 53,700 35,900 Trade and other receivables 98,600 39,600 29,000 5,400 2.700 2.300 Cash and cash equivalents Total assets 1.266.300 465.000 457,200 EQUITY AND LIABILITIES Equity Ordinary share capital 650,000 210,000 250,000 Other components of equity (OCE) 150,000 25,000 Retained earnings 132,300 147,000 123,000 Non-current liabilities Deferred consideration 121,000 Current liabilities 112,000 51,000 38,200 Trade and other payables Income tax 101,000 32.000 46.000 Total equity and liabilities 1.266.300 465.000 457.200 Number of ordinary shares 650,000 210,000 250,000 Additional information: (1) On 1 October 2019 PJ Bhd acquired 80% of KK Bhd for RM261,000 when KK Bhd's retained earnings were RM112,500. RM140,000 was paid immediately and the remaining RM121,000 is payable on 1 October 2021. The full RM261,000 was recognized by PJ Bhd as a non-current asset investment and a liability was set up for the deferred consideration. The fair values of KK Bhd's assets and liabilities at the date of acquisition by PJ Bhd were equal to their carrying amounts. In addition, a contingent liability which had been reliably measured at a fair value of RM32,000 was disclosed, but not recognised, in KK Bhd's financial statements for the year ended 30 September 2020. This amount was subsequently settled at the estimated fair value. Question 1 (Continued) A reassessment of KK Bhd's assets, liabilities and consideration transferred took place following acquisition and no adjustments were necessary. PJ Bhd recognised the goodwill and non-controlling interest on this acquisition using the fair value method. The fair value of the non-controlling interest in KK Bhd on 1 October 2019 was estimated at RM65,000. (2) PJ Bhd acquired 60% of DG Bhd on 1 October 2014 when DG Bhd's retained earnings were RM83,450. The consideration consisted of RM180,000 in cash paid at the date of acquisition and 50,000 newly issued RM1 ordinary shares in PJ Bhd. The market value of each share in PJ Bhd at 1 October 2014 was RM1.65. The issue of shares was correctly accounted for. The fair values of DG Bhd's assets, liabilities and contingent liabilities at the date of acquisition by PJ Bhd were equal to their carrying amounts. In addition, DG Bhd has some internally generated brands which it does not recognise in its own financial statements. On 1 October 2014 these were valued by an independent expert at RM45,000 and were estimated as having an eight year useful life. PJ Bhd recognised the goodwill and non-controlling interest on this acquisition using the proportionate method. (3) On 1 January 2020 PJ Bhd acquired a 25% shareholding in JNV Bhd, a joint venture, for RM28,000. The fair values of JNV Bhd's assets, liabilities and contingent liabilities at the date of acquisition by PJ Bhd were equal to their carrying amounts. JNV Bhd's profit for the year ended 30 September 2020, accruing evenly over the year, was RM62,000. (4) In July 2020 PJ Bhd sold goods to JNV Bhd for RM10,000, earning a 15% gross margin. In addition, DG Bhd sold goods to KK Bhd for RM18,000 at a markup of 20%. At 30 September 2020 all of these goods were still held by both JNV Bhd and KK Bhd and the invoices remained unpaid. (5) PJ Bhd has undertaken its annual impairment review of goodwill and identified that an impairment of RM3,000 needs to be recognised at 30 September 2020 in relation to goodwill arising on the acquisition of DG Bhd. Cumulative impairments of goodwill arising on the acquisition of DG Bhd of RM5,000 were recognised at 30 September 2019. An appropriate discount rate is 10% pa. (6) On 30 September 2020, PJ acquired an additional 20% of the ordinary shares of DG from the non-controlling interest of DG for a cash consideration of RM80,000. PJ has not accounted for this in its books. (c) The facts are as stated in (a) above, assuming that on 30 September 2020, PJ Bhd disposed of 35% shareholding in DG for cash consideration of RM380,000. The remaining 25% shareholding allowed PJ Bhd to exercise significant influence in DG Bhd. DG recorded RM24,000 profit for the year ended 30 September 2020. Other component of equity remained unchanged since date of acquisition. This transaction has not been recorded in PJ Bhd's financial statements. The fair value of DG Bhd share was RM2.00 per share on 30 September 2020. Required: (i) Recommend and explain the accounting treatment for the investment in DG in the consolidated financial statement of PJ Bhd group for the year ended 30 September 2020. (5 marks) (ii) Calculate the group value of investment in DG at 1 April 2020 and remeasurement gain of remaining shares in DG Bhd. (4 marks) (iii) Discuss, with suitable calculations, how the gain or loss on the sale of DG Bhd should be recorded in the consolidated financial statements of PJ Bhd as at 30 September 2020. (4 marks) [Total: 50 marks] You are employed by an audit firm as audit assistant. You have been seconded to PJ Bhd, a trading and manufacturing company, to help with the preparation of their consolidated financial statements for the year ended 30 September 2020. At 1 October 2019, PJ Bhd had investments in two subsidiaries, KK Bhd and DG Bhd, as well as a number of other small investments. The draft summarised statements of financial position for PJ Bhd and its two subsidiaries at 30 September 2020 are shown below: PJ DG ASSETS RM RM RM Non-current assets 533,000 369,000 390,000 Property, plant and equipment Investments 554,000 Current assets Inventories 75,300 53,700 35,900 Trade and other receivables 98,600 39,600 29,000 5,400 2.700 2.300 Cash and cash equivalents Total assets 1.266.300 465.000 457,200 EQUITY AND LIABILITIES Equity Ordinary share capital 650,000 210,000 250,000 Other components of equity (OCE) 150,000 25,000 Retained earnings 132,300 147,000 123,000 Non-current liabilities Deferred consideration 121,000 Current liabilities 112,000 51,000 38,200 Trade and other payables Income tax 101,000 32.000 46.000 Total equity and liabilities 1.266.300 465.000 457.200 Number of ordinary shares 650,000 210,000 250,000 Additional information: (1) On 1 October 2019 PJ Bhd acquired 80% of KK Bhd for RM261,000 when KK Bhd's retained earnings were RM112,500. RM140,000 was paid immediately and the remaining RM121,000 is payable on 1 October 2021. The full RM261,000 was recognized by PJ Bhd as a non-current asset investment and a liability was set up for the deferred consideration. The fair values of KK Bhd's assets and liabilities at the date of acquisition by PJ Bhd were equal to their carrying amounts. In addition, a contingent liability which had been reliably measured at a fair value of RM32,000 was disclosed, but not recognised, in KK Bhd's financial statements for the year ended 30 September 2020. This amount was subsequently settled at the estimated fair value. Question 1 (Continued) A reassessment of KK Bhd's assets, liabilities and consideration transferred took place following acquisition and no adjustments were necessary. PJ Bhd recognised the goodwill and non-controlling interest on this acquisition using the fair value method. The fair value of the non-controlling interest in KK Bhd on 1 October 2019 was estimated at RM65,000. (2) PJ Bhd acquired 60% of DG Bhd on 1 October 2014 when DG Bhd's retained earnings were RM83,450. The consideration consisted of RM180,000 in cash paid at the date of acquisition and 50,000 newly issued RM1 ordinary shares in PJ Bhd. The market value of each share in PJ Bhd at 1 October 2014 was RM1.65. The issue of shares was correctly accounted for. The fair values of DG Bhd's assets, liabilities and contingent liabilities at the date of acquisition by PJ Bhd were equal to their carrying amounts. In addition, DG Bhd has some internally generated brands which it does not recognise in its own financial statements. On 1 October 2014 these were valued by an independent expert at RM45,000 and were estimated as having an eight year useful life. PJ Bhd recognised the goodwill and non-controlling interest on this acquisition using the proportionate method. (3) On 1 January 2020 PJ Bhd acquired a 25% shareholding in JNV Bhd, a joint venture, for RM28,000. The fair values of JNV Bhd's assets, liabilities and contingent liabilities at the date of acquisition by PJ Bhd were equal to their carrying amounts. JNV Bhd's profit for the year ended 30 September 2020, accruing evenly over the year, was RM62,000. (4) In July 2020 PJ Bhd sold goods to JNV Bhd for RM10,000, earning a 15% gross margin. In addition, DG Bhd sold goods to KK Bhd for RM18,000 at a markup of 20%. At 30 September 2020 all of these goods were still held by both JNV Bhd and KK Bhd and the invoices remained unpaid. (5) PJ Bhd has undertaken its annual impairment review of goodwill and identified that an impairment of RM3,000 needs to be recognised at 30 September 2020 in relation to goodwill arising on the acquisition of DG Bhd. Cumulative impairments of goodwill arising on the acquisition of DG Bhd of RM5,000 were recognised at 30 September 2019. An appropriate discount rate is 10% pa. (6) On 30 September 2020, PJ acquired an additional 20% of the ordinary shares of DG from the non-controlling interest of DG for a cash consideration of RM80,000. PJ has not accounted for this in its books. (c) The facts are as stated in (a) above, assuming that on 30 September 2020, PJ Bhd disposed of 35% shareholding in DG for cash consideration of RM380,000. The remaining 25% shareholding allowed PJ Bhd to exercise significant influence in DG Bhd. DG recorded RM24,000 profit for the year ended 30 September 2020. Other component of equity remained unchanged since date of acquisition. This transaction has not been recorded in PJ Bhd's financial statements. The fair value of DG Bhd share was RM2.00 per share on 30 September 2020. Required: (i) Recommend and explain the accounting treatment for the investment in DG in the consolidated financial statement of PJ Bhd group for the year ended 30 September 2020. (5 marks) (ii) Calculate the group value of investment in DG at 1 April 2020 and remeasurement gain of remaining shares in DG Bhd. (4 marks) (iii) Discuss, with suitable calculations, how the gain or loss on the sale of DG Bhd should be recorded in the consolidated financial statements of PJ Bhd as at 30 September 2020. (4 marks) [Total: 50 marks]

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

i The accounting treatment for the investment in DG On 1 Oct 2012 PJ acquired 60 equity interest in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started