Answered step by step

Verified Expert Solution

Question

1 Approved Answer

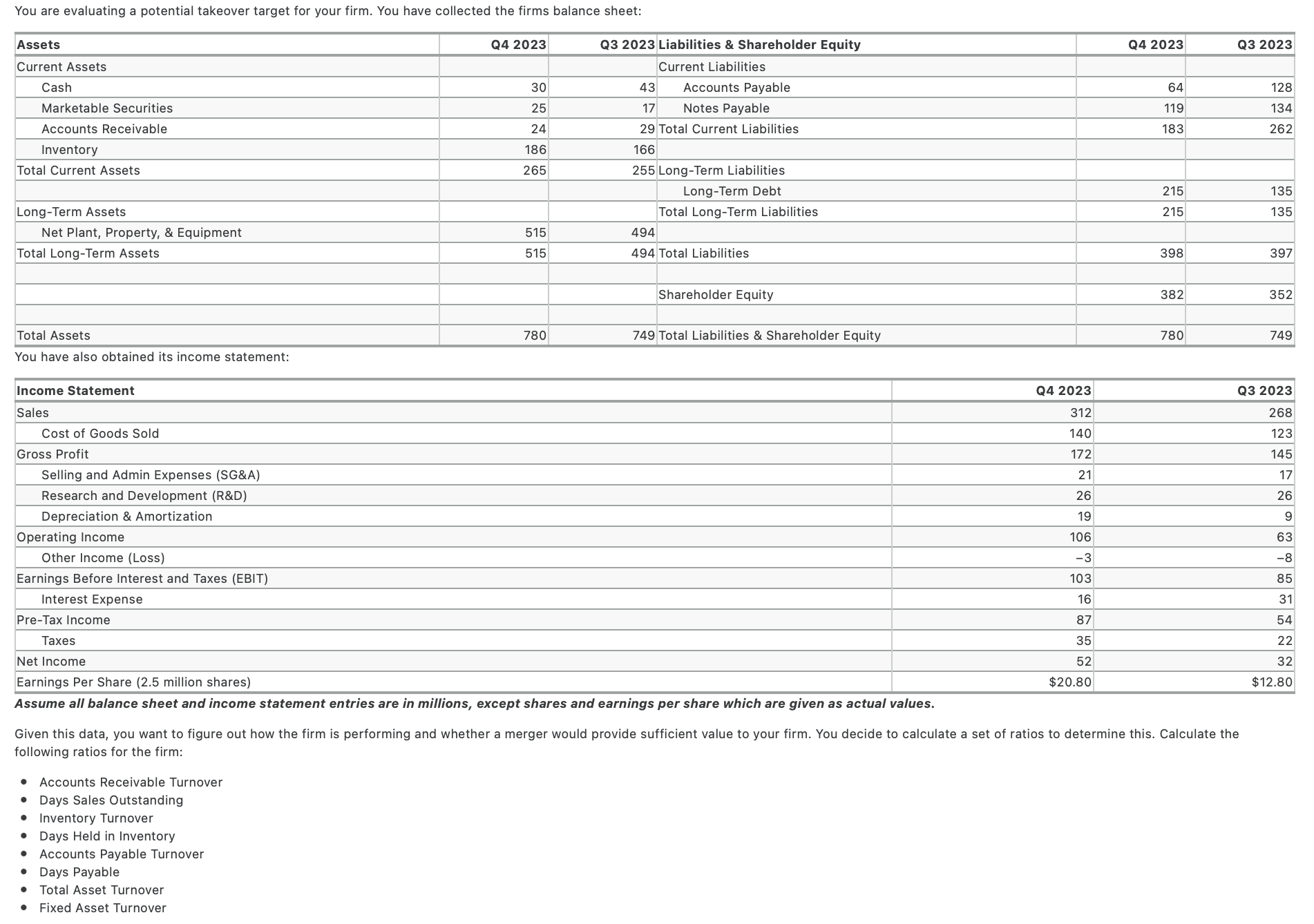

You are evaluating a potential takeover target for your firm. You have collected the firms balance sheet: Assets Current Assets Cash Marketable Securities Accounts

You are evaluating a potential takeover target for your firm. You have collected the firms balance sheet: Assets Current Assets Cash Marketable Securities Accounts Receivable Q4 2023 Q3 2023 Liabilities & Shareholder Equity Current Liabilities Accounts Payable Notes Payable 30 43 25 17 24 29 Total Current Liabilities 186 166 265 Inventory Total Current Assets Long-Term Assets 255 Long-Term Liabilities Long-Term Debt Total Long-Term Liabilities Net Plant, Property, & Equipment 515 494 Total Long-Term Assets 515 494 Total Liabilities Shareholder Equity Total Assets 780 749 Total Liabilities & Shareholder Equity You have also obtained its income statement: Income Statement Sales Cost of Goods Sold Gross Profit Selling and Admin Expenses (SG&A) Research and Development (R&D) Depreciation & Amortization Operating Income Other Income (Loss) Earnings Before Interest and Taxes (EBIT) Interest Expense Pre-Tax Income Taxes Net Income Earnings Per Share (2.5 million shares) Q4 2023 Q3 2023 64 128 119 134 183 262 215 135 215 135 398 397 382 352 780 749 Q4 2023 Q3 2023 312 268 140 123 172 145 21 17 26 26 19 9 106 63 -3 -8 103 85 16 31 87 54 35 22 52 32 $20.80 $12.80 Assume all balance sheet and income statement entries are in millions, except shares and earnings per share which are given as actual values. Given this data, you want to figure out how the firm is performing and whether a merger would provide sufficient value to your firm. You decide to calculate a set of ratios to determine this. Calculate the following ratios for the firm: Accounts Receivable Turnover Days Sales Outstanding Inventory Turnover Days Held in Inventory Accounts Payable Turnover Days Payable . Total Asset Turnover Fixed Asset Turnover

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the ratios we will use the following formulas 1 Accounts Receivable Turnover Sales Average Accounts Receivable 2 Days Sales Outsta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started