Answered step by step

Verified Expert Solution

Question

1 Approved Answer

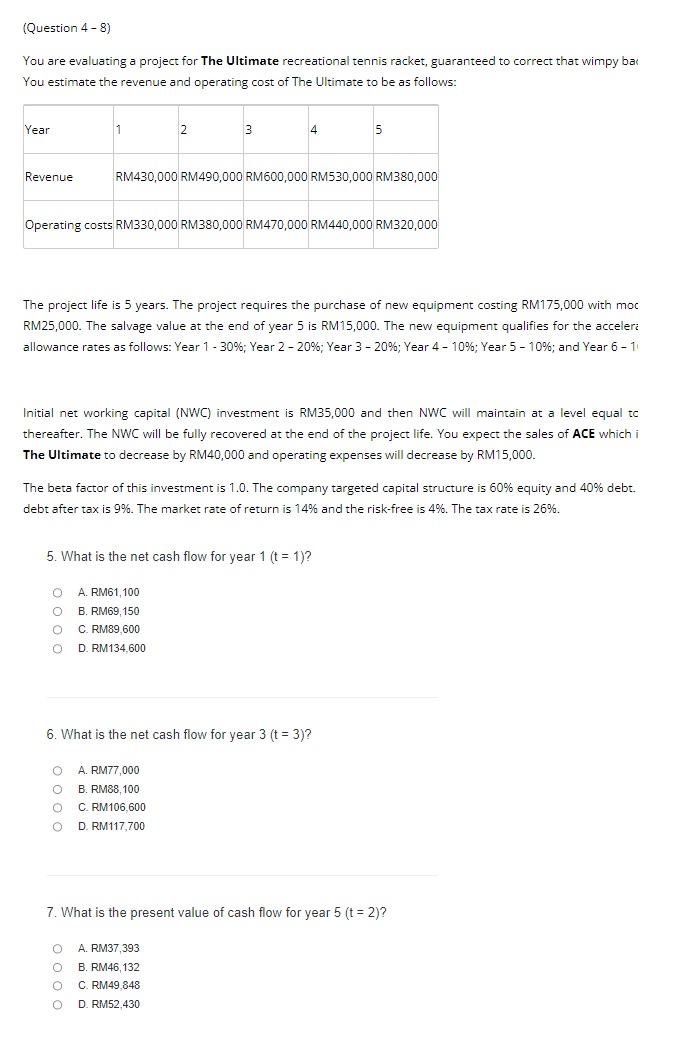

You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy bac You estimate the revenue and operating cost of

You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy bac You estimate the revenue and operating cost of The Ultimate to be as follows: The project life is 5 years. The project requires the purchase of new equipment costing RM175,000 with moc RM25,000. The salvage value at the end of year 5 is RM15,000. The new equipment qualifies for the acceleri allowance rates as follows: Year 1 - 30\%; Year 2 - 20\%; Year 3 - 20\%; Year 410%; Year 5 - 10\%; and Year 6 - 1 Initial net working capital (NWC) investment is RM35,000 and then NWC will maintain at a level equal tc thereafter. The NWC will be fully recovered at the end of the project life. You expect the sales of ACE which i The Ultimate to decrease by RM40,000 and operating expenses will decrease by RM15,000. The beta factor of this investment is 1.0. The company targeted capital structure is 60% equity and 40% debt. debt after tax is 9%. The market rate of return is 14% and the risk-free is 4%. The tax rate is 26%. 5. What is the net cash flow for year 1(t=1) ? A. RM61,100 B. RM69,150 C. RM89,600 D. RM 134,600 6. What is the net cash flow for year 3(t=3) ? A. RM77,000 B. RM88,100 C. RM 106,600 D. RM117,700 7. What is the present value of cash flow for year 5(t=2) ? A. RM37,393 B. RM46,132 C. RM49,848 D. RM 52,430

You are evaluating a project for The Ultimate recreational tennis racket, guaranteed to correct that wimpy bac You estimate the revenue and operating cost of The Ultimate to be as follows: The project life is 5 years. The project requires the purchase of new equipment costing RM175,000 with moc RM25,000. The salvage value at the end of year 5 is RM15,000. The new equipment qualifies for the acceleri allowance rates as follows: Year 1 - 30\%; Year 2 - 20\%; Year 3 - 20\%; Year 410%; Year 5 - 10\%; and Year 6 - 1 Initial net working capital (NWC) investment is RM35,000 and then NWC will maintain at a level equal tc thereafter. The NWC will be fully recovered at the end of the project life. You expect the sales of ACE which i The Ultimate to decrease by RM40,000 and operating expenses will decrease by RM15,000. The beta factor of this investment is 1.0. The company targeted capital structure is 60% equity and 40% debt. debt after tax is 9%. The market rate of return is 14% and the risk-free is 4%. The tax rate is 26%. 5. What is the net cash flow for year 1(t=1) ? A. RM61,100 B. RM69,150 C. RM89,600 D. RM 134,600 6. What is the net cash flow for year 3(t=3) ? A. RM77,000 B. RM88,100 C. RM 106,600 D. RM117,700 7. What is the present value of cash flow for year 5(t=2) ? A. RM37,393 B. RM46,132 C. RM49,848 D. RM 52,430 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started