Answered step by step

Verified Expert Solution

Question

1 Approved Answer

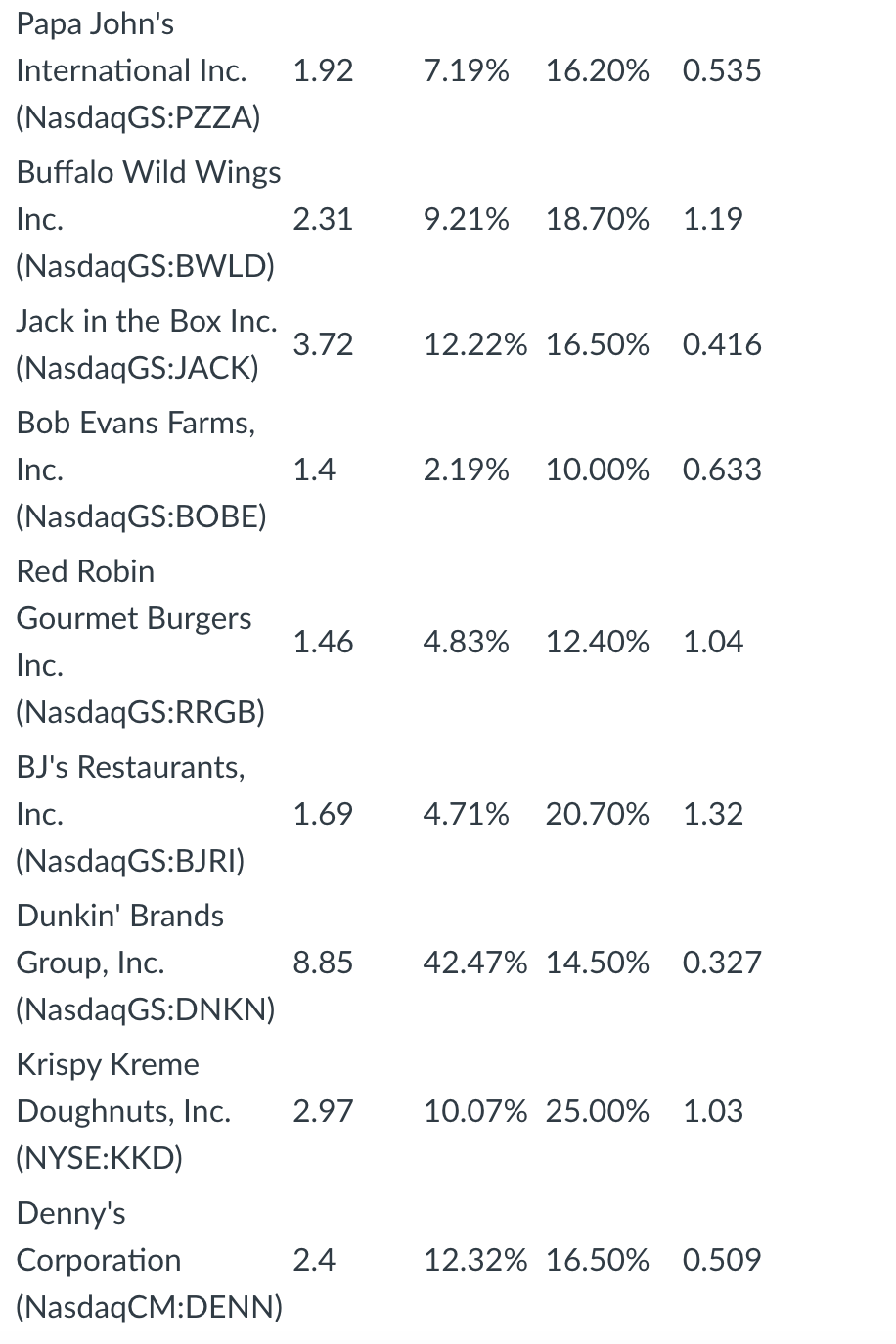

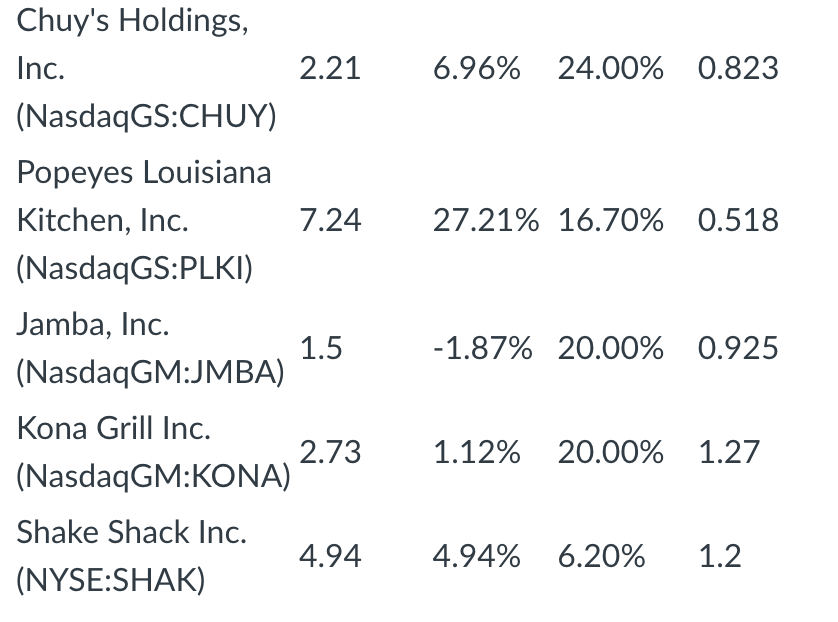

You are evaluating a set of fast food firms. Using the data below you estimated the following regression equation 0.3+18.75*Op.Margin+9.21*EPS growth-1.19*beta. Using % over/undervaluation relative

You are evaluating a set of fast food firms. Using the data below you estimated the following regression equation

| 0.3+18.75*Op.Margin+9.21*EPS growth-1.19*beta. |

Using % over/undervaluation relative to the actual EV/sales, which firm is the most expensive?

1.) Dennys

2.) Dunkin

3.) Kona

4.) Shake Shack

7.19% 16.20% 0.535 9.21% 18.70% 1.19 12.22% 16.50% 0.416 2.19% 10.00% 0.633 4.83% 12.40% 1.04 Papa John's International Inc. 1.92 (NasdaqGS:PZZA) Buffalo Wild Wings Inc. 2.31 (NasdaqGS:BWLD) Jack in the Box Inc. 3.72 (NasdaqGS:JACK) Bob Evans Farms, Inc. 1.4 (NasdaqGS:BOBE) Red Robin Gourmet Burgers 1.46 Inc. (NasdaqGS:RRGB) BJ's Restaurants, Inc. 1.69 (NasdaqGS:BJRI) Dunkin' Brands Group, Inc. 8.85 (NasdaqGS:DNKN) Krispy Kreme Doughnuts, Inc. 2.97 (NYSE:KKD) Denny's Corporation 2.4 (NasdaqCM:DENN) 4.71% 20.70% 1.32 42.47% 14.50% 0.327 10.07% 25.00% 1.03 12.32% 16.50% 0.509 6.96% 24.00% 0.823 Chuy's Holdings, Inc. 2.21 (NasdaqGS:CHUY) Popeyes Louisiana Kitchen, Inc. 7.24 (NasdaqGS:PLKI) Jamba, Inc. 1.5 (NasdaqGM:JMBA) 27.21% 16.70% 0.518 -1.87% 20.00% 0.925 1.12% 20.00% 1.27 Kona Grill Inc. 2.73 (NasdaqGM:KONA) Shake Shack Inc. 4.94 (NYSE:SHAK) 4.94% 6.20% 1.2 7.19% 16.20% 0.535 9.21% 18.70% 1.19 12.22% 16.50% 0.416 2.19% 10.00% 0.633 4.83% 12.40% 1.04 Papa John's International Inc. 1.92 (NasdaqGS:PZZA) Buffalo Wild Wings Inc. 2.31 (NasdaqGS:BWLD) Jack in the Box Inc. 3.72 (NasdaqGS:JACK) Bob Evans Farms, Inc. 1.4 (NasdaqGS:BOBE) Red Robin Gourmet Burgers 1.46 Inc. (NasdaqGS:RRGB) BJ's Restaurants, Inc. 1.69 (NasdaqGS:BJRI) Dunkin' Brands Group, Inc. 8.85 (NasdaqGS:DNKN) Krispy Kreme Doughnuts, Inc. 2.97 (NYSE:KKD) Denny's Corporation 2.4 (NasdaqCM:DENN) 4.71% 20.70% 1.32 42.47% 14.50% 0.327 10.07% 25.00% 1.03 12.32% 16.50% 0.509 6.96% 24.00% 0.823 Chuy's Holdings, Inc. 2.21 (NasdaqGS:CHUY) Popeyes Louisiana Kitchen, Inc. 7.24 (NasdaqGS:PLKI) Jamba, Inc. 1.5 (NasdaqGM:JMBA) 27.21% 16.70% 0.518 -1.87% 20.00% 0.925 1.12% 20.00% 1.27 Kona Grill Inc. 2.73 (NasdaqGM:KONA) Shake Shack Inc. 4.94 (NYSE:SHAK) 4.94% 6.20% 1.2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started