Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are evaluating an investment into Cape Charles Electric, a privately owned electric utility company that needs more capital to expand its solar farm

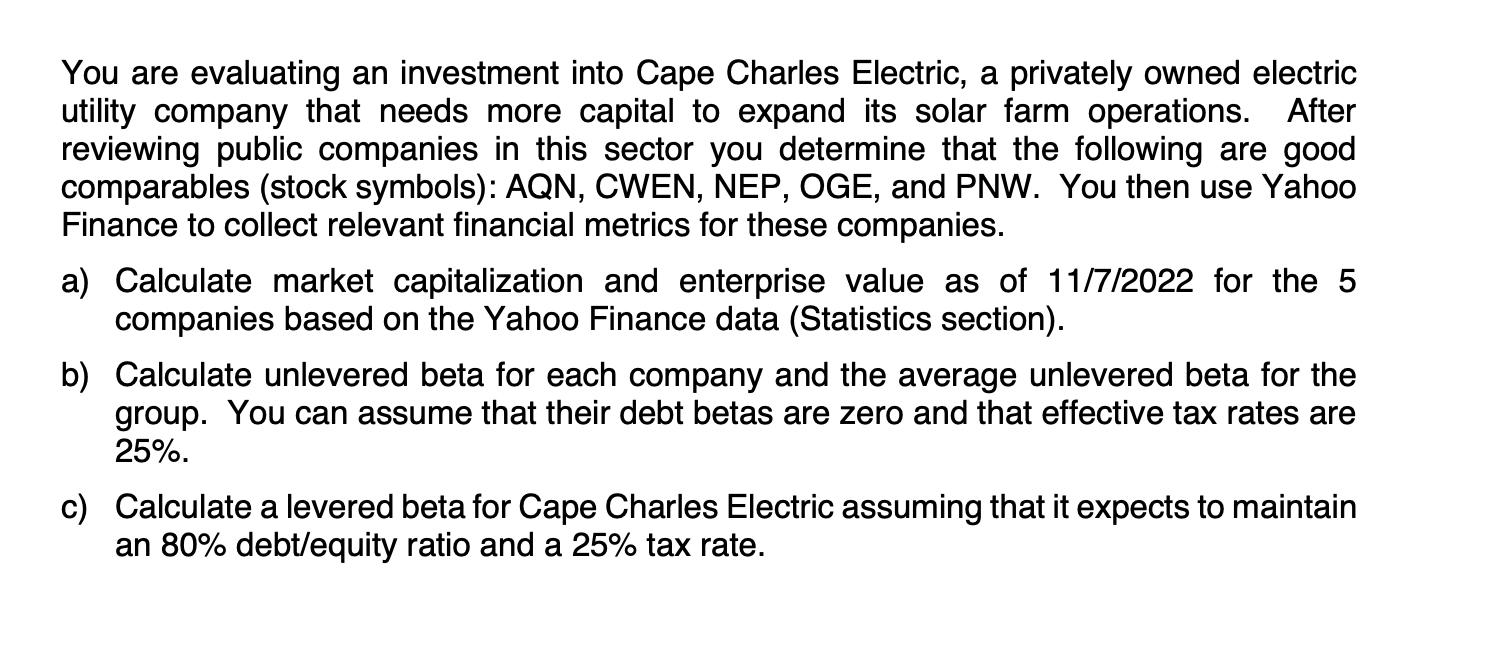

You are evaluating an investment into Cape Charles Electric, a privately owned electric utility company that needs more capital to expand its solar farm operations. After reviewing public companies in this sector you determine that the following are good comparables (stock symbols): AQN, CWEN, NEP, OGE, and PNW. You then use Yahoo Finance to collect relevant financial metrics for these companies. a) Calculate market capitalization and enterprise value as of 11/7/2022 for the 5 companies based on the Yahoo Finance data (Statistics section). b) Calculate unlevered beta for each company and the average unlevered beta for the group. You can assume that their debt betas are zero and that effective tax rates are 25%. c) Calculate a levered beta for Cape Charles Electric assuming that it expects to maintain an 80% debt/equity ratio and a 25% tax rate.

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

aCalculating market capitalization AQN 2462B CWEN 471B NEP 43...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started