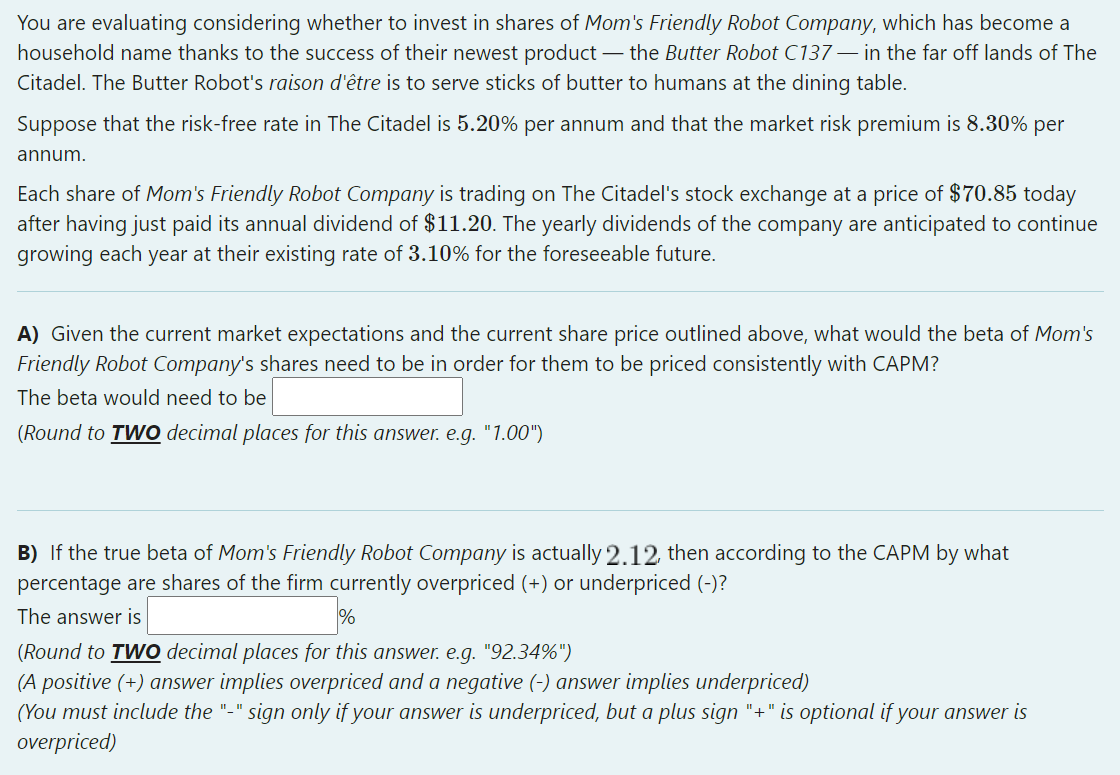

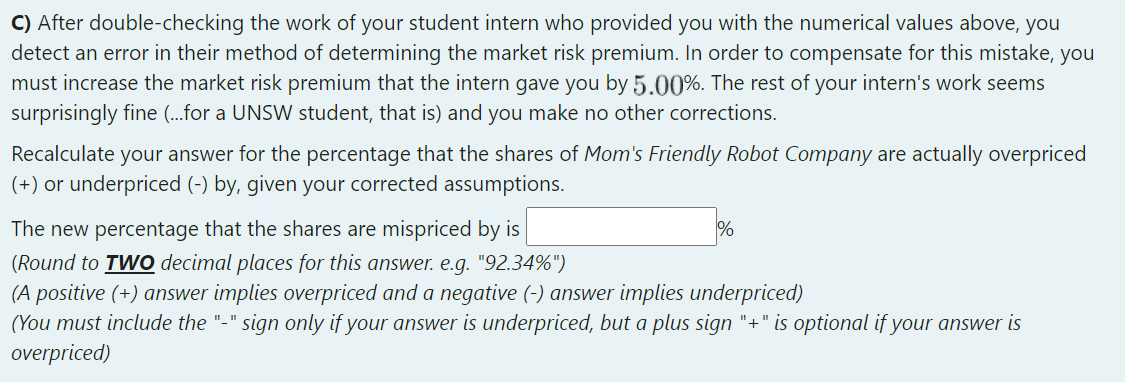

You are evaluating considering whether to invest in shares of Mom's Friendly Robot Company, which has become a household name thanks to the success of their newest product the Butter Robot C137 in the far off lands of The Citadel. The Butter Robot's raison d'tre is to serve sticks of butter to humans at the dining table. Suppose that the risk-free rate in The Citadel is 5.20% per annum and that the market risk premium is 8.30% per annum. Each share of Mom's Friendly Robot Company is trading on The Citadel's stock exchange at a price of $ 70.85 today after having just paid its annual dividend of $11.20. The yearly dividends of the company are anticipated to continue growing each year at their existing rate of 3.10% for the foreseeable future. A) Given the current market expectations and the current share price outlined above, what would the beta of Mom's Friendly Robot Company's shares need to be in order for them to be priced consistently with CAPM? The beta would need to be (Round to TWO decimal places for this answer. e.g. "7.00") B) If the true beta of Mom's Friendly Robot Company is actually 2.12, then according to the CAPM by what percentage are shares of the firm currently overpriced (+) or underpriced (-)? The answer is % (Round to TWO decimal places for this answer. e.g. "92.34%") (A positive (+) answer implies overpriced and a negative (-) answer implies underpriced) (You must include the "-" sign only if your answer is underpriced, but a plus sign "+" is optional if your answer is overpriced) C) After double-checking the work of your student intern who provided you with the numerical values above, you detect an error in their method of determining the market risk premium. In order to compensate for this mistake, you must increase the market risk premium that the intern gave you by 5.00%. The rest of your intern's work seems surprisingly fine ...for a UNSW student, that is) and you make no other corrections. Recalculate your answer for the percentage that the shares of Mom's Friendly Robot Company are actually overpriced (+) or underpriced (-) by, given your corrected assumptions. The new percentage that the shares are mispriced by is % (Round to TWO decimal places for this answer. e.g. "92.34%") (A positive (+) answer implies overpriced and a negative (-) answer implies underpriced) (You must include the "." sign only if your answer is underpriced, but a plus sign "+" is optional if your answer is overpriced) You are evaluating considering whether to invest in shares of Mom's Friendly Robot Company, which has become a household name thanks to the success of their newest product the Butter Robot C137 in the far off lands of The Citadel. The Butter Robot's raison d'tre is to serve sticks of butter to humans at the dining table. Suppose that the risk-free rate in The Citadel is 5.20% per annum and that the market risk premium is 8.30% per annum. Each share of Mom's Friendly Robot Company is trading on The Citadel's stock exchange at a price of $ 70.85 today after having just paid its annual dividend of $11.20. The yearly dividends of the company are anticipated to continue growing each year at their existing rate of 3.10% for the foreseeable future. A) Given the current market expectations and the current share price outlined above, what would the beta of Mom's Friendly Robot Company's shares need to be in order for them to be priced consistently with CAPM? The beta would need to be (Round to TWO decimal places for this answer. e.g. "7.00") B) If the true beta of Mom's Friendly Robot Company is actually 2.12, then according to the CAPM by what percentage are shares of the firm currently overpriced (+) or underpriced (-)? The answer is % (Round to TWO decimal places for this answer. e.g. "92.34%") (A positive (+) answer implies overpriced and a negative (-) answer implies underpriced) (You must include the "-" sign only if your answer is underpriced, but a plus sign "+" is optional if your answer is overpriced) C) After double-checking the work of your student intern who provided you with the numerical values above, you detect an error in their method of determining the market risk premium. In order to compensate for this mistake, you must increase the market risk premium that the intern gave you by 5.00%. The rest of your intern's work seems surprisingly fine ...for a UNSW student, that is) and you make no other corrections. Recalculate your answer for the percentage that the shares of Mom's Friendly Robot Company are actually overpriced (+) or underpriced (-) by, given your corrected assumptions. The new percentage that the shares are mispriced by is % (Round to TWO decimal places for this answer. e.g. "92.34%") (A positive (+) answer implies overpriced and a negative (-) answer implies underpriced) (You must include the "." sign only if your answer is underpriced, but a plus sign "+" is optional if your answer is overpriced)