Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are evaluating two funds: Berkshire Getaway (BGT) and Quantum Strategy Fund (QSF). The two funds are well diversified, and invest in different asset classes,

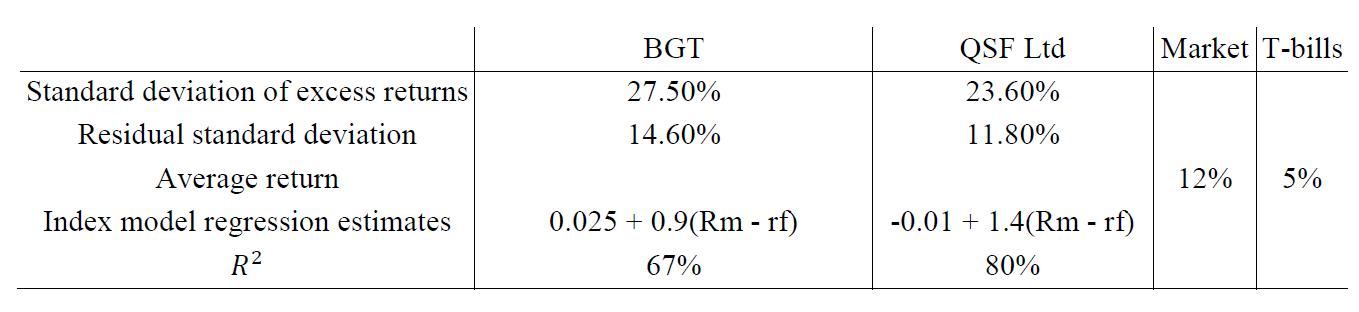

You are evaluating two funds: Berkshire Getaway (BGT) and Quantum Strategy Fund (QSF). The two funds are well diversified, and invest in different asset classes, e.g. equity, bonds, alternative investments etc.

The information about the two funds is provided below. The index model regression estimates are based on excess returns. The market index is ASX200.

What are the funds' excess returns?

B. What are the funds' Sharpe Ratios?

C. What are the funds' Treynor Ratios?

D. Which funds are more tilted towards equity? Explain.

Standard deviation of excess returns Residual standard deviation Average return Index model regression estimates R BGT 27.50% 14.60% 0.025 +0.9(Rm - rf) 67% QSF Ltd 23.60% 11.80% -0.01 + 1.4(Rm - rf) 80% Market T-bills 12% 5%

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the excess returns of the funds we need to subtract the riskfree rate from the average ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started