Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are facing the decision of whether to replace an old machine at your factory. A new machine will cost $47 to purchase it

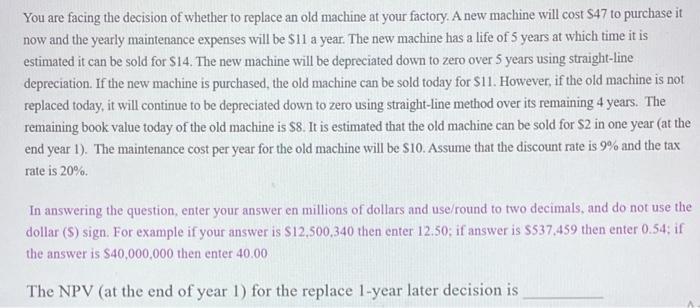

You are facing the decision of whether to replace an old machine at your factory. A new machine will cost $47 to purchase it now and the yearly maintenance expenses will be $11 a year. The new machine has a life of 5 years at which time it is estimated it can be sold for $14. The new machine will be depreciated down to zero over 5 years using straight-line depreciation. If the new machine is purchased, the old machine can be sold today for $11. However, if the old machine is not replaced today, it will continue to be depreciated down to zero using straight-line method over its remaining 4 years. The remaining book value today of the old machine is $8. It is estimated that the old machine can be sold for $2 in one year (at the end year 1). The maintenance cost per year for the old machine will be $10. Assume that the discount rate is 9% and the tax rate is 20%. In answering the question, enter your answer en millions of dollars and use/round to two decimals, and do not use the dollar ($) sign. For example if your answer is $12,500,340 then enter 12.50; if answer is $537,459 then enter 0.54; if the answer is $40,000,000 then enter 40.00 The NPV (at the end of year 1) for the replace 1-year later decision is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the NPV at the end of year 1 for the replace 1year later decision we need to consider t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started