Question: You are following a Collar strategy using a stock, a call option and a put option. The strikes of the call and the put

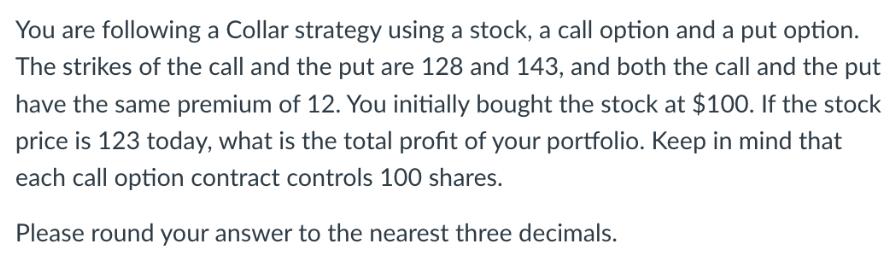

You are following a Collar strategy using a stock, a call option and a put option. The strikes of the call and the put are 128 and 143, and both the call and the put have the same premium of 12. You initially bought the stock at $100. If the stock price is 123 today, what is the total profit of your portfolio. Keep in mind that each call option contract controls 100 shares. Please round your answer to the nearest three decimals.

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

To calculate the total profit of the portfolio we need to determine the value of each of the three c... View full answer

Get step-by-step solutions from verified subject matter experts