You are given a case on business operations from 1st to 31st January 2022. Based on the information provided and the additional information given, you are required to compute:

a) Journal entries

b) General ledger accounts

c) Year-end adjustment journal entries d) Trial balance

e) Financial statements:

(i) Statement of comprehensive income/Income statement (ii) Statement of financial position/Balance sheet

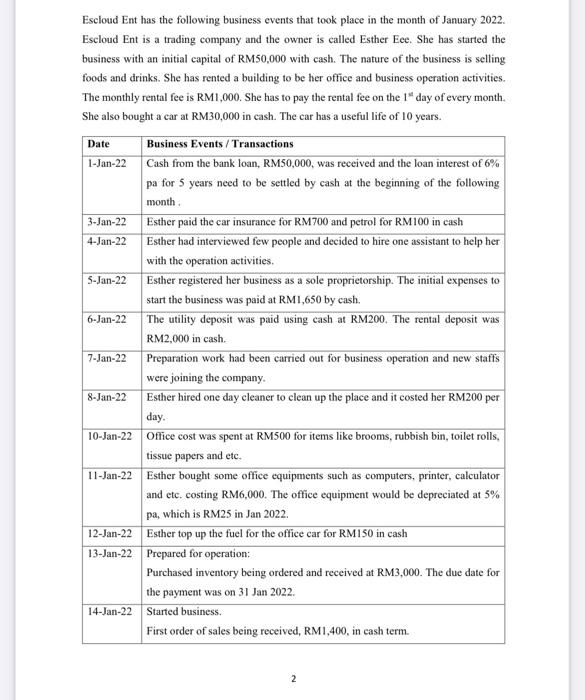

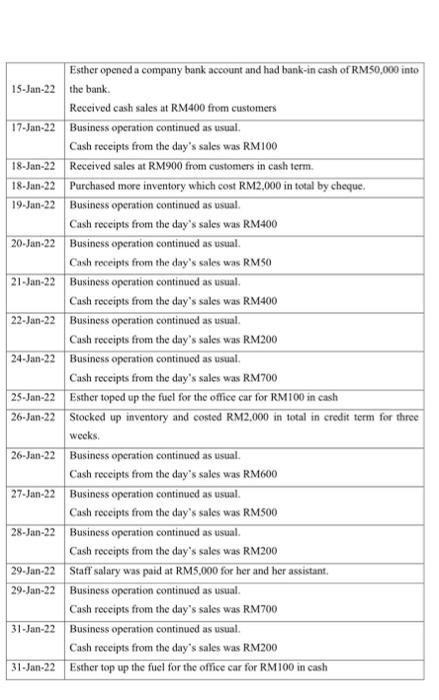

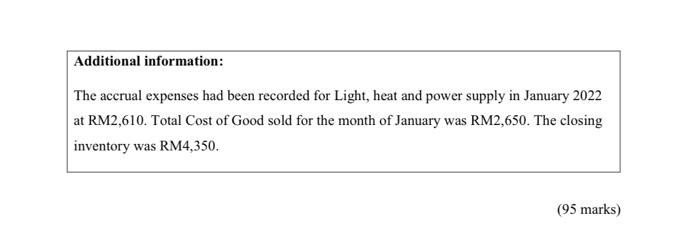

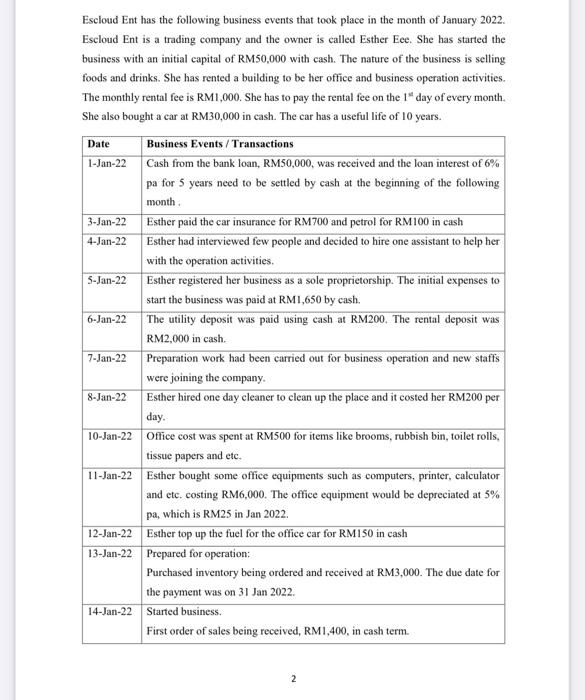

4-Jan-22 Escloud Ent has the following business events that took place in the month of January 2022. Escloud Ent is a trading company and the owner is called Esther Eee. She has started the business with an initial capital of RM50,000 with cash. The nature of the business is selling foods and drinks. She has rented a building to be her office and business operation activities. The monthly rental fee is RM 1,000. She has to pay the rental fee on the 1" day of every month. She also bought a car at RM30,000 in cash. The car has a useful life of 10 years. Date Business Events / Transactions 1-Jan-22 Cash from the bank loan, RM50,000, was received and the loan interest of 6% pa for 5 years need to be settled by cash at the beginning of the following month 3-Jan-22 Esther paid the car insurance for RM700 and petrol for RM100 in cash Esther had interviewed few people and decided to hire one assistant to help her with the operation activities. S-Jan-22 Esther registered her business as a sole proprietorship. The initial expenses to start the business was paid at RM 1,650 by cash. 6-Jan-22 The utility deposit was paid using cash at RM200. The rental deposit was RM2,000 in cash. 7-Jan-22 Preparation work had been carried out for business operation and new staffs were joining the company. 8-Jan-22 Esther hired one day cleaner to clean up the place and it costed her RM200 per day. 10-Jan-22 Office cost was spent at RM500 for items like brooms, rubbish bin, toilet rolls, tissue papers and etc. 11-Jan-22 Esther bought some office equipments such as computers, printer, calculator and etc. costing RM6,000. The office equipment would be depreciated at 5% pa, which is RM25 in Jan 2022. 12-Jan-22 Esther top up the fuel for the office car for RM150 in cash 13-Jan-22 Prepared for operation: Purchased inventory being ordered and received at RM3,000. The due date for the payment was on 31 Jan 2022. 14-Jan-22 Started business. First order of sales being received, RM1,400, in cash term. 2 Esther opened a company bank account and had bank-in cash of RM50,000 into 15-Jan-22 the bank Received cash sales at RM400 from customers 17-Jan-22 Business operation continued as usual, Cash receipts from the day's sales was RM100 18-Jan-22 Received sales at RM900 from customers in cash term. 18-Jan-22 Purchased more inventory which cost RM2,000 in total by cheque. 19-Jan-22 Business operation continued as usual. Cash receipts from the day's sales was RM400 20-Jan-22 Business operation continued as usual. Cash receipts from the day's sales was RM50 21-Jan-22 Business operation continued as usual. Cash receipts from the day's sales was RM400 22-Jan-22 Business operation continued as usual. Cash receipts from the day's sales was RM200 24-Jan-22 Business operation continued as usual, Cash receipts from the day's sales was RM700 25-Jan-22 Esther toped up the fuel for the office car for RM100 in cash 26-Jan-22 Stocked up inventory and costed RM2,000 in total in credit term for three weeks 26-Jan-22 Business operation continued as usual. Cash receipts from the day's sales was RM600 27-Jan-22 Business operation continued as usual. Cash receipts from the day's sales was RM500 28-Jan-22 Business operation continued as usual. Cash receipts from the day's sales was RM200 29-Jan-22 Staff'salary was paid at RM5,000 for her and her assistant 29-Jan-22 Business operation continued as usual. Cash receipts from the day's sales was RM 700 31-Jan-22 Business operation continued as usual. Cash receipts from the day's sales was RM200 31-Jan-22 Esther top up the fuel for the office car for RM100 in cash Additional information: The accrual expenses had been recorded for Light, heat and power supply in January 2022 at RM2,610. Total Cost of Good sold for the month of January was RM2,650. The closing inventory was RM4,350. (95 marks)