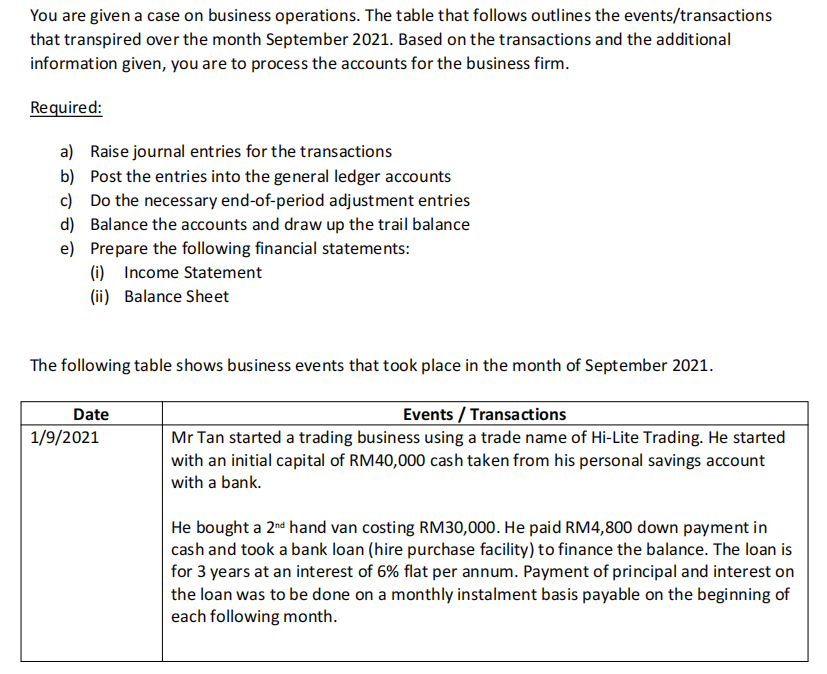

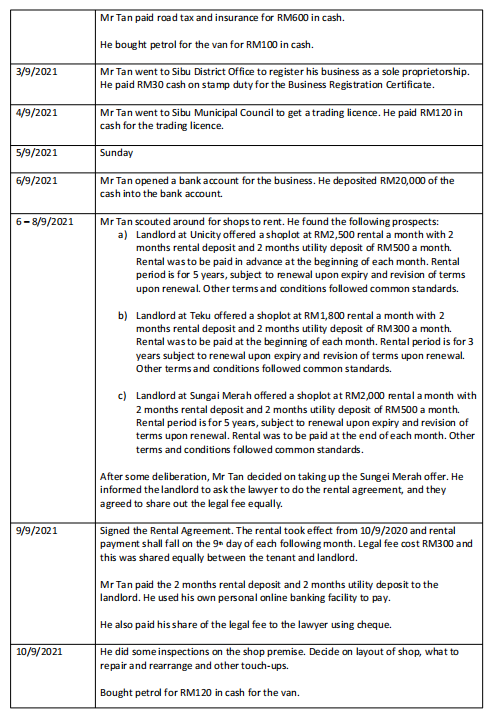

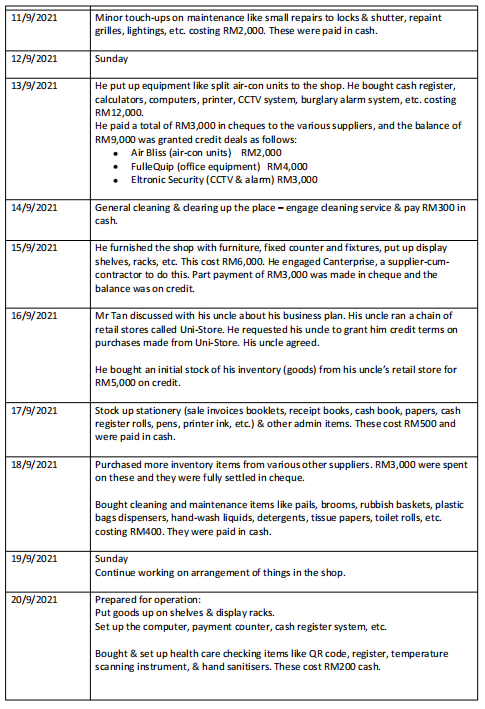

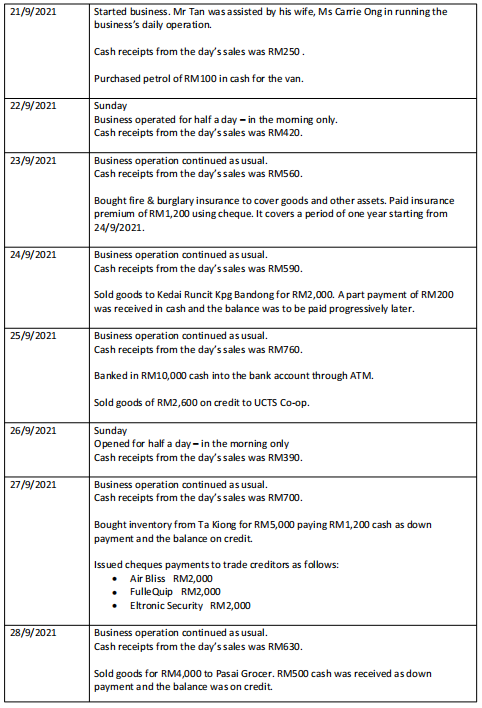

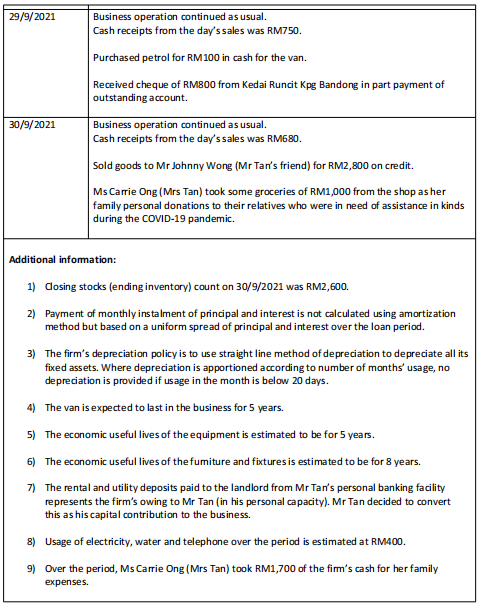

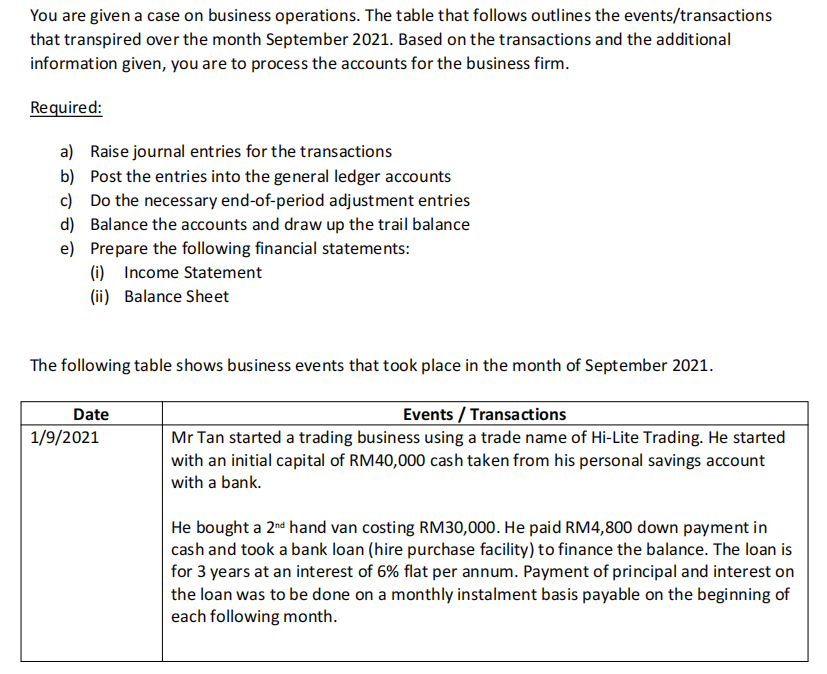

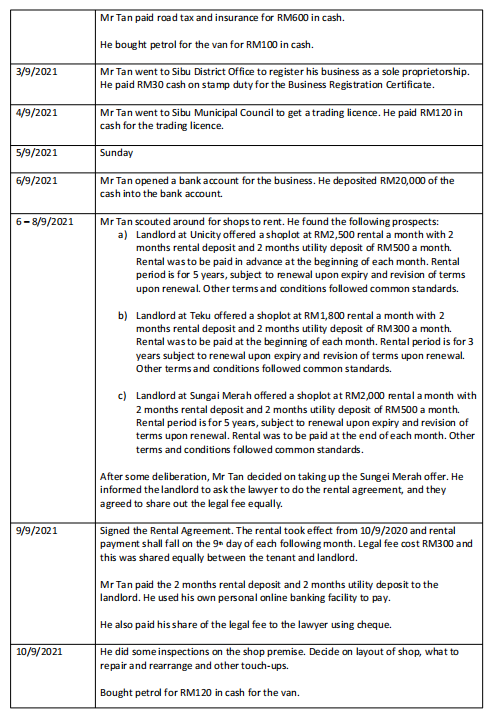

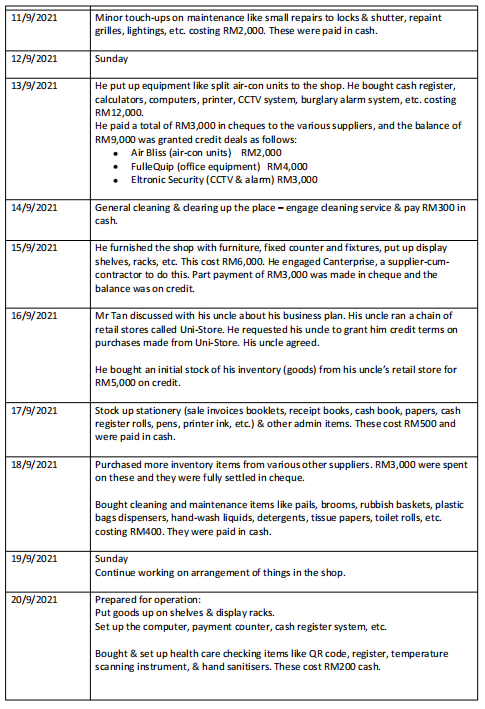

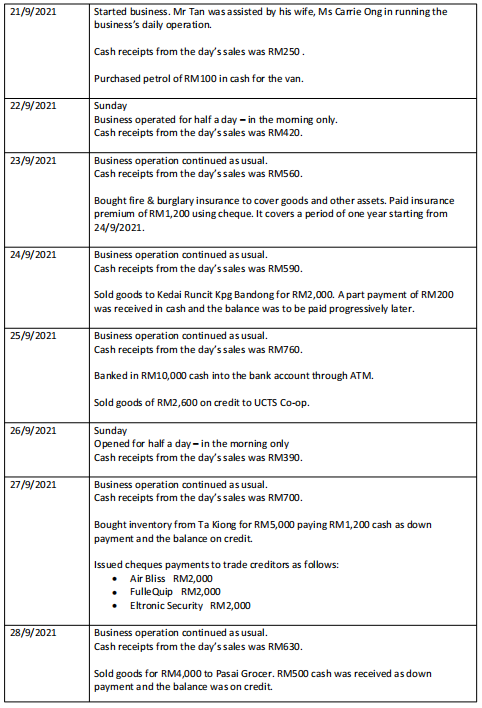

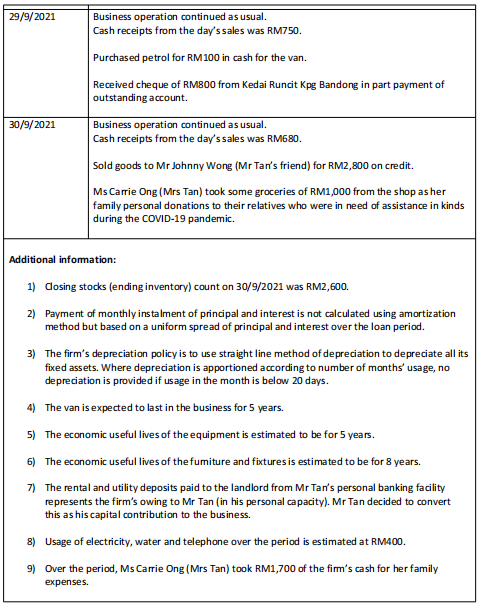

You are given a case on business operations. The table that follows outlines the events/transactions that transpired over the month September 2021. Based on the transactions and the additional information given, you are to process the accounts for the business firm. Required: a) Raise journal entries for the transactions b) Post the entries into the general ledger accounts c) Do the necessary end-of-period adjustment entries d) Balance the accounts and draw up the trail balance e) Prepare the following financial statements: (i) Income Statement (ii) Balance Sheet The following table shows business events that took place in the month of September 2021. Date 1/9/2021 Events / Transactions Mr Tan started a trading business using a trade name of Hi-Lite Trading. He started with an initial capital of RM40,000 cash taken from his personal savings account with a bank. He bought a 2nd hand van costing RM30,000. He paid RM4,800 down payment in cash and took a bank loan (hire purchase facility) to finance the balance. The loan is for 3 years at an interest of 6% flat per annum. Payment of principal and interest on the loan was to be done on a monthly instalment basis payable on the beginning of each following month. Mr Tan paid road tax and insurance for RM600 in cash. 3/9/2021 He bought petrol for the van for RM100 in cash. Mr Tan went to Sibu District Office to register his business as a sole proprietorship. He paid RM30 cash on stamp duty for the Business Registration Certificate. Mr Tan went to Sibu Municipal Council to get a trading licence. He paid RM120 in cash for the trading licence. 4/9/2021 5/9/2021 Sunday 6/9/2021 Mr Tan opened a bank account for the business. He deposited RM20,000 of the cash into the bank account. 6-8/9/2021 Mr Tan scouted around for shops to rent. He found the following prospects: a) Landlord at Unicity offered a shoplot at RM2,500 rental a month with 2 months rental deposit and 2 months utility deposit of RM 500 a month. Rental was to be paid in advance at the beginning of each month. Rental period is for 5 years, subject to renewal upon expiry and revision of terms upon renewal. Other terms and conditions followed common standards. b) Landlord at Teku offered a shoplot at RM1,800 rental a month with 2 months rental deposit and 2 months utility deposit of RM300 a month. Rental was to be paid at the beginning of each month. Rental period is for 3 years subject to renewal upon expiry and revision of terms upon renewal. Other terms and conditions followed common standards. c) Landlord at Sungai Merah offered a shoplot at RM2,000 rental a month with 2 months rental deposit and 2 months utility deposit of RM500 a month. Rental period is for 5 years, subject to renewal upon expiry and revision of terms upon renewal. Rental was to be paid at the end of each month. Other terms and conditions followed common standards. After some deliberation, Mr Tan decided on taking up the Sungei Merah offer. He informed the landlord to ask the lawyer to do the rental agreement, and they agreed to share out the legal fee equally. Signed the Rental Agreement. The rental took effect from 10/9/2020 and rental payment shall fall on the 9 day of each following month. Legal fee cost RM300 and this was shared equally between the tenant and landlord. Mr Tan paid the 2 months rental deposit and 2 months utility deposit to the landlord. He used his own personal online banking facility to pay. He also paid his share of the legal fee to the lawyer using cheque. He did some inspections on the shop premise. Decide on layout of shop, what to repair and rearrange and other touch-ups. 9/9/2021 10/9/2021 Bought petrol for RM120 in cash for the van. 11/9/2021 Minor touch-ups on maintenance like small repairs to locks & shutter, repaint grilles, lightings, etc. costing RM2,000. These were paid in cash. 12/9/2021 Sunday 13/9/2021 He put up equipment like split air-con units to the shop. He bought cash register, calculators, computers, printer, CCTV system, burglary alarm system, etc. costing RM 12,000 He paid a total of RM3,000 in cheques to the various suppliers, and the balance of RM9,000 was granted credit deals as follows: Air Bliss (air-con units) RM2,000 FulleQuip (office equipment) RM4,000 Eltronic Security (CCTV & alarm) RM3,000 General cleaning & cearing up the place - engage cleaning service & pay RM300 in 14/9/2021 cash 15/9/2021 He furnished the shop with furniture, fixed counter and fixtures, put up display shelves, racks, etc. This cost RM6,000. He engaged Canterprise, a supplier-cum- contractor to do this. Part payment of RM3,000 was made in cheque and the balance was on credit 16/9/2021 17/9/2021 Mr Tan discussed with his uncle about his business plan. His uncle ran a chain of retail stores called Uni-Store. He requested his unde to grant him credit terms on purchases made from Uni-Store. His uncle agreed. He bought an initial stock of his inventory (goods) from his uncle's retail store for RM5,000 on credit Stock up stationery (sale invoices booklets, receipt books, cash book, papers, cash register rolls, pens, printer ink, etc.) & other admin items. These cost RM500 and were paid in cash. Purchased more inventory items from various other suppliers. RM3,000 were spent on these and they were fully settled in cheque. Bought cleaning and maintenance items like pails, brooms, rubbish baskets, plastic bags dispensers, hand-wash liquids, detergents, tissue papers, toilet rolls, etc. costing RM400. They were paid in cash. 18/9/2021 19/9/2021 20/9/2021 Sunday Continue working on arrangement of things in the shop. Prepared for operation: Put goods up on shelves & display racks. Set up the computer, payment counter, cash register system, etc. Bought & set up health care checking items like QR code, register, temperature scanning instrument, & hand sanitisers. These cost RM200 cash. 21/9/2021 Started business. Mr Tan was assisted by his wife, Ms Carrie Ong in running the business's daily operation. Cash receipts from the day's sales was RM250. Purchased petrol of RM 100 in cash for the van. 22/9/2021 23/9/2021 24/9/2021 Sunday Business operated for half a day in the moming only. Cash receipts from the day's sales was RM420. Business operation continued as usual. Cash receipts from the day's sales was RM560. Bought fire & burglary insurance to cover goods and other assets. Paid insurance premium of RM1,200 using cheque. It covers a period of one year starting from 24/9/2021. Business operation continued as usual. Cash receipts from the day's sales was RM590. Sold goods to Kedai Runcit Kpg Bandong for RM2,000. A part payment of RM 200 was received in cash and the balance was to be paid progressively later. Business operation continued as usual. Cash receipts from the day's sales was RM760. Banked in RM10,000 cash into the bank account through ATM. Sold goods of RM2,600 on credit to UCTS Co-op. 25/9/2021 26/9/2021 27/9/2021 Sunday Opened for half a day-in the morning only Cash receipts from the day's sales was RM390. Business operation continued as usual. Cash receipts from the day's sales was RM700. Bought inventory from Ta Kiong for RM5,000 paying RM 1,200 cash as down payment and the balance on credit. Issued cheques payments to trade creditors as follows: Air Bliss RM2,000 Fulle Quip RM2,000 Eltronic Security RM2,000 Business operation continued as usual. Cash receipts from the day's sales was RM630. 28/9/2021 Sold goods for RM4,000 to Pasai Grocer. RM500 cash was received as down payment and the balance was on credit 29/9/2021 30/9/2021 Business operation continued as usual. Cash receipts from the day's sales was RM750. Purchased petrol for RM 100 in cash for the van. Received cheque of RM800 from Kedai Runcit Kpg Bandong in part payment of outstanding account Business operation continued as usual. Cash receipts from the day's sales was RM680. Sold goods to Mr Johnny Wong (Mr Tan's friend) for RM2,800 on credit. Ms Carrie Ong (Mrs Tan) took some groceries of RM1,000 from the shop as her family personal donations to their relatives who were in need of assistance in kinds during the COVID-19 pandemic. Additional information: 1) Closing stocks (ending inventory) count on 30/9/2021 was RM2,500. 2) Payment of monthly instalment of principal and interest is not calculated using amortization method but based on a uniform spread of principal and interest over the loan period. 3) The firm's depreciation policy is to use straight line method of depreciation to depreciate all its fixed assets. Where depreciation is apportioned according to number of months' usage, no depreciation is provided if usage in the month is below 20 days. 4) The van is expected to last in the business for 5 years. 5) The economic useful lives of the equipment is estimated to be for 5 years. 6) The economic useful lives of the furniture and fixtures is estimated to be for 8 years. 7) The rental and utility deposits paid to the landlord from Mr Tan's personal banking facility represents the firm's owing to Mr Tan (in his personal capacity). Mr Tan decided to convert this as his capital contribution to the business. 8) Usage of electricity, water and telephone over the period is estimated at RM400. 9) Over the period, Ms Carrie Ong (Mrs Tan) took RM1,700 of the fim's cash for her family expenses. You are given a case on business operations. The table that follows outlines the events/transactions that transpired over the month September 2021. Based on the transactions and the additional information given, you are to process the accounts for the business firm. Required: a) Raise journal entries for the transactions b) Post the entries into the general ledger accounts c) Do the necessary end-of-period adjustment entries d) Balance the accounts and draw up the trail balance e) Prepare the following financial statements: (i) Income Statement (ii) Balance Sheet The following table shows business events that took place in the month of September 2021. Date 1/9/2021 Events / Transactions Mr Tan started a trading business using a trade name of Hi-Lite Trading. He started with an initial capital of RM40,000 cash taken from his personal savings account with a bank. He bought a 2nd hand van costing RM30,000. He paid RM4,800 down payment in cash and took a bank loan (hire purchase facility) to finance the balance. The loan is for 3 years at an interest of 6% flat per annum. Payment of principal and interest on the loan was to be done on a monthly instalment basis payable on the beginning of each following month. Mr Tan paid road tax and insurance for RM600 in cash. 3/9/2021 He bought petrol for the van for RM100 in cash. Mr Tan went to Sibu District Office to register his business as a sole proprietorship. He paid RM30 cash on stamp duty for the Business Registration Certificate. Mr Tan went to Sibu Municipal Council to get a trading licence. He paid RM120 in cash for the trading licence. 4/9/2021 5/9/2021 Sunday 6/9/2021 Mr Tan opened a bank account for the business. He deposited RM20,000 of the cash into the bank account. 6-8/9/2021 Mr Tan scouted around for shops to rent. He found the following prospects: a) Landlord at Unicity offered a shoplot at RM2,500 rental a month with 2 months rental deposit and 2 months utility deposit of RM 500 a month. Rental was to be paid in advance at the beginning of each month. Rental period is for 5 years, subject to renewal upon expiry and revision of terms upon renewal. Other terms and conditions followed common standards. b) Landlord at Teku offered a shoplot at RM1,800 rental a month with 2 months rental deposit and 2 months utility deposit of RM300 a month. Rental was to be paid at the beginning of each month. Rental period is for 3 years subject to renewal upon expiry and revision of terms upon renewal. Other terms and conditions followed common standards. c) Landlord at Sungai Merah offered a shoplot at RM2,000 rental a month with 2 months rental deposit and 2 months utility deposit of RM500 a month. Rental period is for 5 years, subject to renewal upon expiry and revision of terms upon renewal. Rental was to be paid at the end of each month. Other terms and conditions followed common standards. After some deliberation, Mr Tan decided on taking up the Sungei Merah offer. He informed the landlord to ask the lawyer to do the rental agreement, and they agreed to share out the legal fee equally. Signed the Rental Agreement. The rental took effect from 10/9/2020 and rental payment shall fall on the 9 day of each following month. Legal fee cost RM300 and this was shared equally between the tenant and landlord. Mr Tan paid the 2 months rental deposit and 2 months utility deposit to the landlord. He used his own personal online banking facility to pay. He also paid his share of the legal fee to the lawyer using cheque. He did some inspections on the shop premise. Decide on layout of shop, what to repair and rearrange and other touch-ups. 9/9/2021 10/9/2021 Bought petrol for RM120 in cash for the van. 11/9/2021 Minor touch-ups on maintenance like small repairs to locks & shutter, repaint grilles, lightings, etc. costing RM2,000. These were paid in cash. 12/9/2021 Sunday 13/9/2021 He put up equipment like split air-con units to the shop. He bought cash register, calculators, computers, printer, CCTV system, burglary alarm system, etc. costing RM 12,000 He paid a total of RM3,000 in cheques to the various suppliers, and the balance of RM9,000 was granted credit deals as follows: Air Bliss (air-con units) RM2,000 FulleQuip (office equipment) RM4,000 Eltronic Security (CCTV & alarm) RM3,000 General cleaning & cearing up the place - engage cleaning service & pay RM300 in 14/9/2021 cash 15/9/2021 He furnished the shop with furniture, fixed counter and fixtures, put up display shelves, racks, etc. This cost RM6,000. He engaged Canterprise, a supplier-cum- contractor to do this. Part payment of RM3,000 was made in cheque and the balance was on credit 16/9/2021 17/9/2021 Mr Tan discussed with his uncle about his business plan. His uncle ran a chain of retail stores called Uni-Store. He requested his unde to grant him credit terms on purchases made from Uni-Store. His uncle agreed. He bought an initial stock of his inventory (goods) from his uncle's retail store for RM5,000 on credit Stock up stationery (sale invoices booklets, receipt books, cash book, papers, cash register rolls, pens, printer ink, etc.) & other admin items. These cost RM500 and were paid in cash. Purchased more inventory items from various other suppliers. RM3,000 were spent on these and they were fully settled in cheque. Bought cleaning and maintenance items like pails, brooms, rubbish baskets, plastic bags dispensers, hand-wash liquids, detergents, tissue papers, toilet rolls, etc. costing RM400. They were paid in cash. 18/9/2021 19/9/2021 20/9/2021 Sunday Continue working on arrangement of things in the shop. Prepared for operation: Put goods up on shelves & display racks. Set up the computer, payment counter, cash register system, etc. Bought & set up health care checking items like QR code, register, temperature scanning instrument, & hand sanitisers. These cost RM200 cash. 21/9/2021 Started business. Mr Tan was assisted by his wife, Ms Carrie Ong in running the business's daily operation. Cash receipts from the day's sales was RM250. Purchased petrol of RM 100 in cash for the van. 22/9/2021 23/9/2021 24/9/2021 Sunday Business operated for half a day in the moming only. Cash receipts from the day's sales was RM420. Business operation continued as usual. Cash receipts from the day's sales was RM560. Bought fire & burglary insurance to cover goods and other assets. Paid insurance premium of RM1,200 using cheque. It covers a period of one year starting from 24/9/2021. Business operation continued as usual. Cash receipts from the day's sales was RM590. Sold goods to Kedai Runcit Kpg Bandong for RM2,000. A part payment of RM 200 was received in cash and the balance was to be paid progressively later. Business operation continued as usual. Cash receipts from the day's sales was RM760. Banked in RM10,000 cash into the bank account through ATM. Sold goods of RM2,600 on credit to UCTS Co-op. 25/9/2021 26/9/2021 27/9/2021 Sunday Opened for half a day-in the morning only Cash receipts from the day's sales was RM390. Business operation continued as usual. Cash receipts from the day's sales was RM700. Bought inventory from Ta Kiong for RM5,000 paying RM 1,200 cash as down payment and the balance on credit. Issued cheques payments to trade creditors as follows: Air Bliss RM2,000 Fulle Quip RM2,000 Eltronic Security RM2,000 Business operation continued as usual. Cash receipts from the day's sales was RM630. 28/9/2021 Sold goods for RM4,000 to Pasai Grocer. RM500 cash was received as down payment and the balance was on credit 29/9/2021 30/9/2021 Business operation continued as usual. Cash receipts from the day's sales was RM750. Purchased petrol for RM 100 in cash for the van. Received cheque of RM800 from Kedai Runcit Kpg Bandong in part payment of outstanding account Business operation continued as usual. Cash receipts from the day's sales was RM680. Sold goods to Mr Johnny Wong (Mr Tan's friend) for RM2,800 on credit. Ms Carrie Ong (Mrs Tan) took some groceries of RM1,000 from the shop as her family personal donations to their relatives who were in need of assistance in kinds during the COVID-19 pandemic. Additional information: 1) Closing stocks (ending inventory) count on 30/9/2021 was RM2,500. 2) Payment of monthly instalment of principal and interest is not calculated using amortization method but based on a uniform spread of principal and interest over the loan period. 3) The firm's depreciation policy is to use straight line method of depreciation to depreciate all its fixed assets. Where depreciation is apportioned according to number of months' usage, no depreciation is provided if usage in the month is below 20 days. 4) The van is expected to last in the business for 5 years. 5) The economic useful lives of the equipment is estimated to be for 5 years. 6) The economic useful lives of the furniture and fixtures is estimated to be for 8 years. 7) The rental and utility deposits paid to the landlord from Mr Tan's personal banking facility represents the firm's owing to Mr Tan (in his personal capacity). Mr Tan decided to convert this as his capital contribution to the business. 8) Usage of electricity, water and telephone over the period is estimated at RM400. 9) Over the period, Ms Carrie Ong (Mrs Tan) took RM1,700 of the fim's cash for her family expenses